![November 2024 Result [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2024/12/eyecatch_123.webp)

Summary of investment and asset management performance for November 2024.

This article calculates the exchange rate at "$0.00690/yen" (145 yen/$).

The sales and other figures used in this article are current as of the time of writing. Depending on your viewing period, the figures may have changed significantly.

Table of Contents(目次)

November 2024 Result

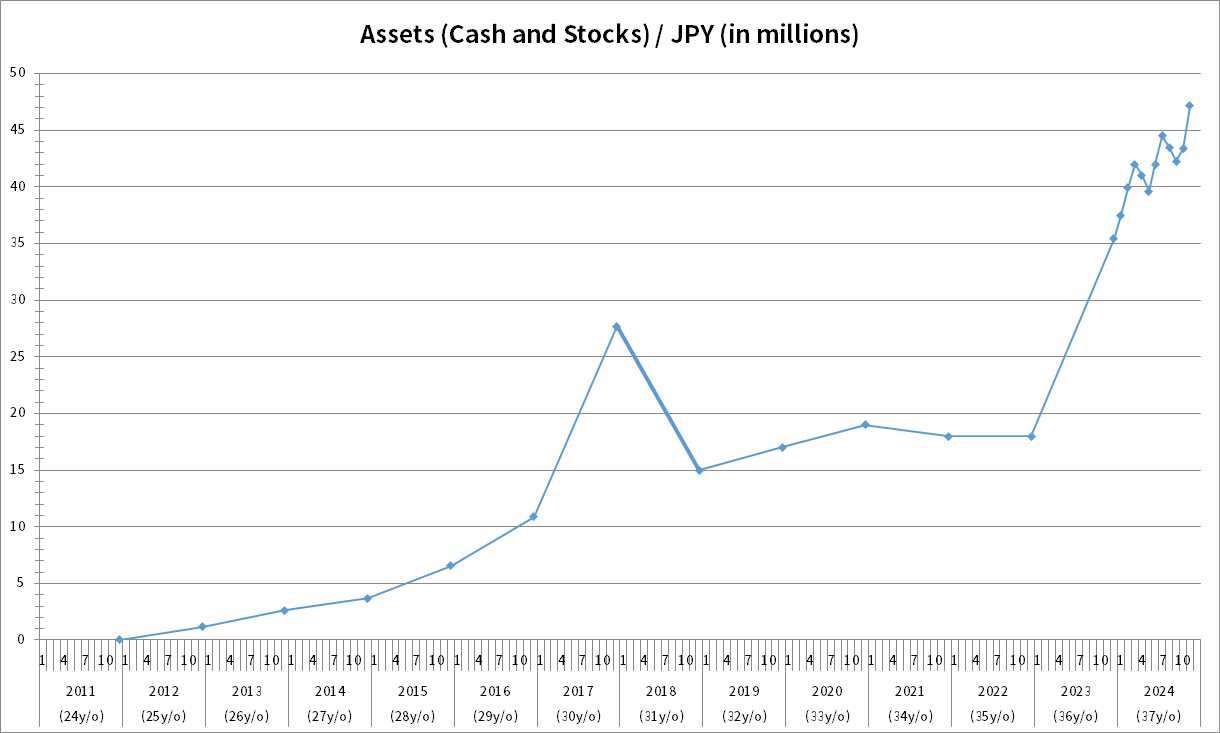

The chart below shows the change in my assets. The rightmost point shows my assets at the end of November 2024, which were 47.14 million yen (about $0.325 million).

The month-over-month change in assets was 8.72%.

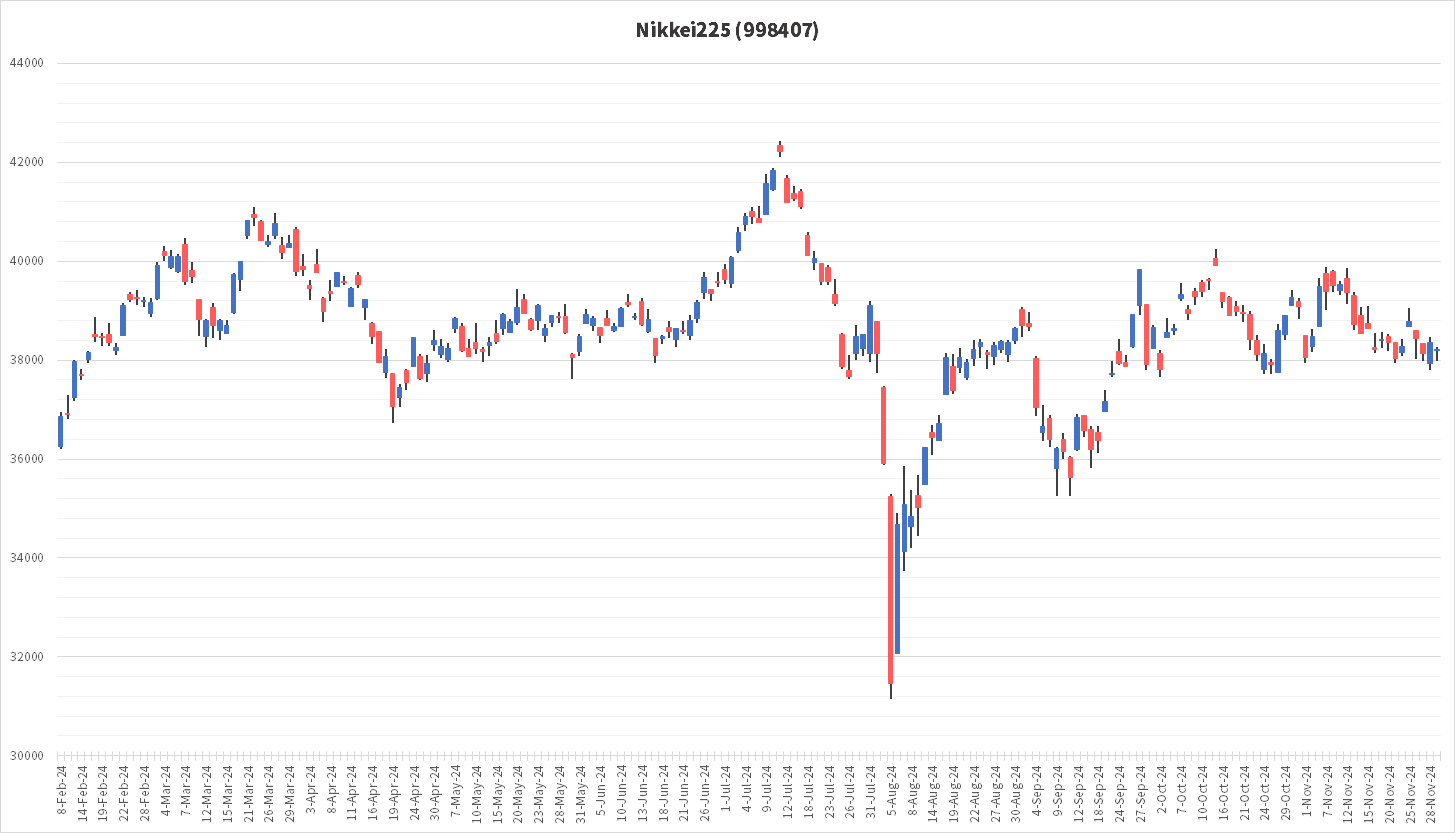

The Nikkei 225 continues to move sideways.

The Nikkei 225 has remained almost unchanged. The Diet is currently in session following the recent House of Representatives election, but I think the reason for this is that there has been no discussion or indication of direction regarding economic measures. Also, I think the reason for the Nikkei 225 remaining unchanged is that it is unclear how the current cabinet will deal with the Trump administration.

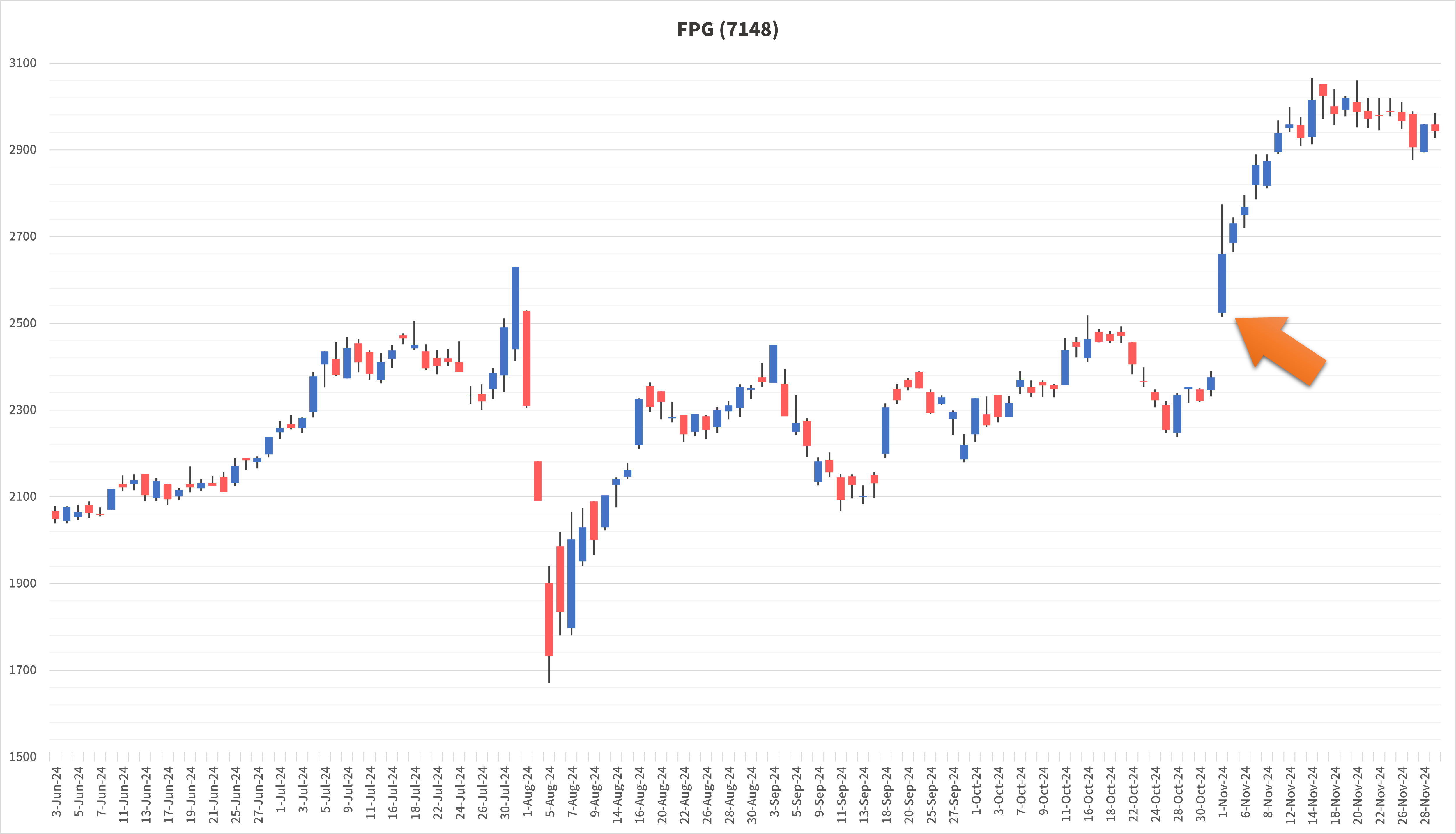

The Nikkei 225 stock price remained flat, but some of my holdings were doing well. One example is FPG (7148), whose share price jumped significantly on November 1st due to the strong financial results announced at the end of October.

As of December 16th, the date of writing this article, FPG accounts for 32% of my portfolio, making it one of my major holdings. This company has recently sold small-lot domestic real estate products, targeting wealthy individuals and earning commissions. It is also expected to post record profits this year, and I hope the stock price will continue to rise for some time.

Finally

Unfortunately, I've been posting fewer articles on this site recently and have been slow to update my portfolio progress reports. I know that you all come to read my articles, so I'm sorry for causing you any concern. My day job has been keeping me busy, and I haven't had much time to spare.

However, thanks to this, I've had less opportunity to check stock prices and more time to relax. In the case of long-term investment, I can only watch the stock prices fall without being able to do anything about it. (As you all know, long-term investors rarely buy and sell stocks.) By not looking at the stock prices, I don't get carried away by rises in value, but I have the advantage of escaping the anxiety of falls in value.

For now, it looks like my main job will remain busy. Even if you all come to this site, many new articles may not exist. Once my main job has settled, I will try to increase the number of articles.

Until then, please continue to support this site. Thank you.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.