![May 2024 Result [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2024/06/eyecatch_094.webp)

Summary of investment and asset management performance for May 2024.

This article calculates the exchange rate at "$0.0067/yen" (150 yen/$).

The sales and other figures used in this article are current as of the time of writing. Depending on your viewing period, the figures may have changed significantly.

Table of Contents(目次)

May 2024 Result

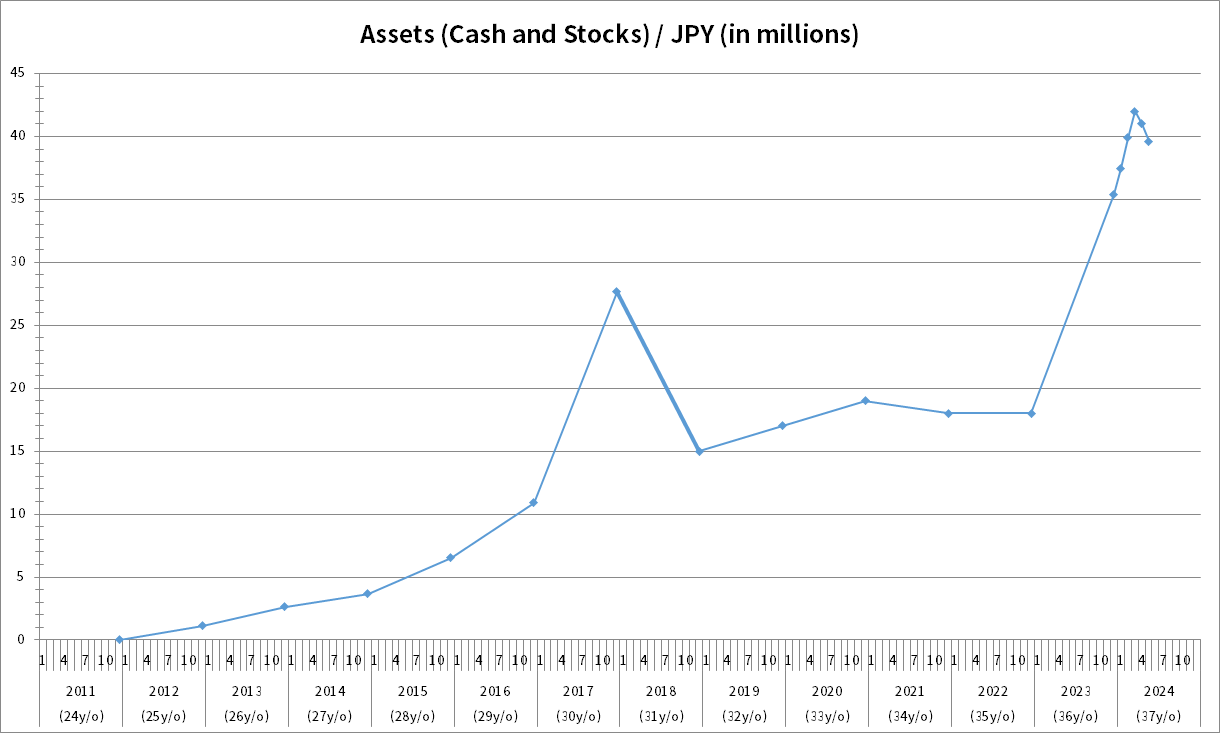

The chart below shows the change in my assets. The rightmost point on the chart is the amount of assets at the end of May 2024, which is 39.6 million yen (about $0.26 million). The month-over-month change in assets was -3.41%.

Sell in May

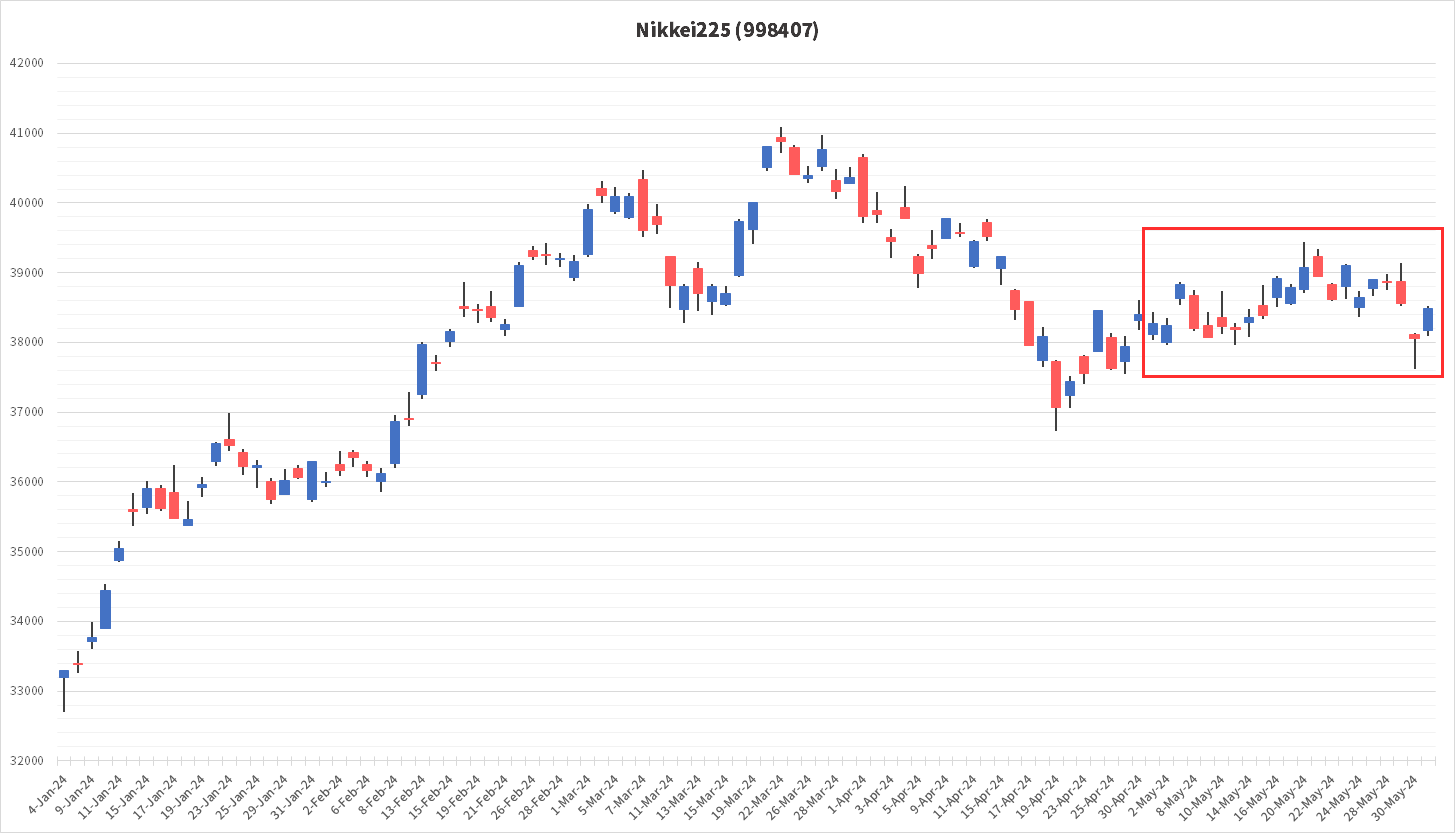

Do you know the phrase "Sell in May"? It is an anomaly in the stock market that stock prices tend to fall in May. How did the Nikkei 225 perform in May of this year?

In May of this year, the Nikkei 225 ended the month without a significant drop in stock prices. In the first half of May, there were occasions when stock prices rose. However, the stock price seemed to fall in the second half of the month.

May is the month when many Japanese companies announce their FY2024 results.

Most Japanese companies set their fiscal year end in March. As a result, there were stocks whose share prices changed dramatically in response to the results of corporate earnings reports. I want to give my impression of the overall financial results, leaving individual issues for further commentary in the future.

Many exporting firms have improved their performance and are expected to continue to do well in FY2025. This is due to the weaker yen, which had a significant impact and was a tailwind for exporters, with TOYOTA Motor Corporation hitting record profits.

Outside of export-oriented companies, the food and beverage and tourism industries are also doing well. In Japan, the effects of COVID-19 dragged on longer than in other countries, and normal economic activities were finally able to take place in May 2023. Before May 2023, there had been restrictions on activities, such as limited hours of operation for restaurants and bars and restrictions on foreign tourists coming to Japan. Still, with the removal of these restrictions, the city has finally regained its liveliness. Another factor behind the strong performance may be the large increase in foreign tourists due to the yen depreciation.

How undervalued is the Nikkei 225?

The latest PER of the Nikkei 225 is 16.52. This figure is about the standard value, neither too high nor too low. From this point on, the Nikkei 225's rise will depend on how well the first-quarter results for FY2025 shake out. Of course, there is a possibility that stock prices will rise ahead of the index, but I have a feeling that the stock prices of blue-chip companies that are performing well will rise due to expectations rather than the index as a whole.

Finally

Some of the webmaster's stocks saw their share prices drop in May, but I consider that temporary. The FY2024 financial results of my stock holding were not bad and gave me hope that earnings will improve, so I will continue to hold on to the stock without selling it. Although market participants seem to be feeling happy or sad, such as the speculation of an interest rate hike in Japan, the webmaster plans to continue to hold the stock for the long term. In addition, if there are stocks whose share prices are falling now, I would like to buy new stocks depending on the conditions, so I will continue to monitor the market closely.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.

![April 2024 Result [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2024/05/eyecatch_092-150x150.webp)