![March 2024 Result [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2024/04/eyecatch_074.webp)

Summary of investment and asset management performance for March 2024.

This article calculates the exchange rate at "$0.0067/yen" (150 yen/$).

The sales and other figures used in this article are current as of the time of writing. Depending on your viewing period, the figures may have changed significantly.

Table of Contents(目次)

March 2024 Result

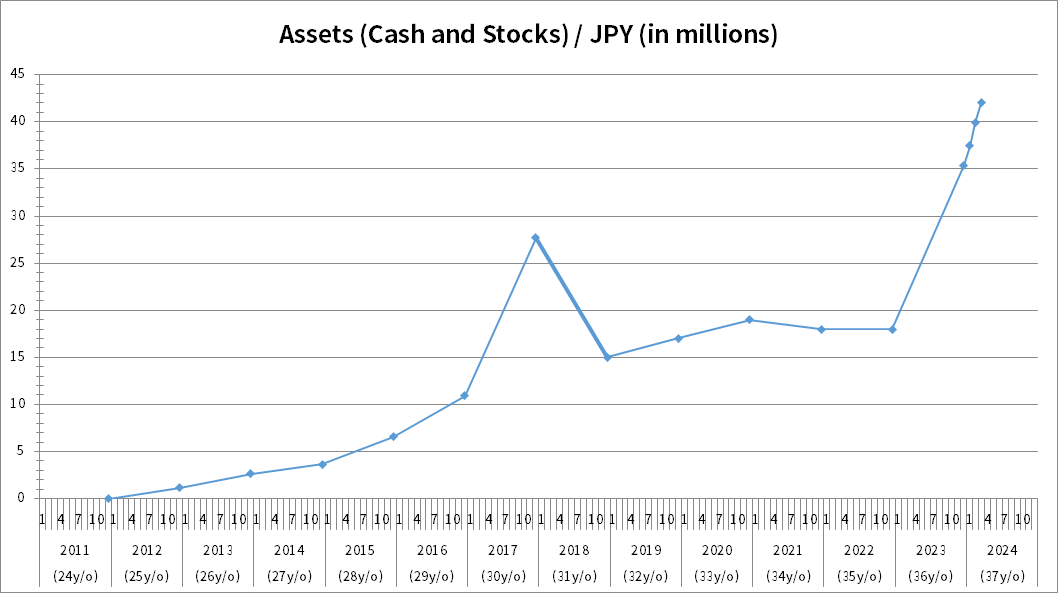

The chart below shows the transition of my assets.

The rightmost one is the amount of assets at the end of March 2024, which is 42 million yen (about $0.28 million). My assets at the end of February 2024 were ¥39.9 million (about $0.27 million), which means an increase of 5.26%.

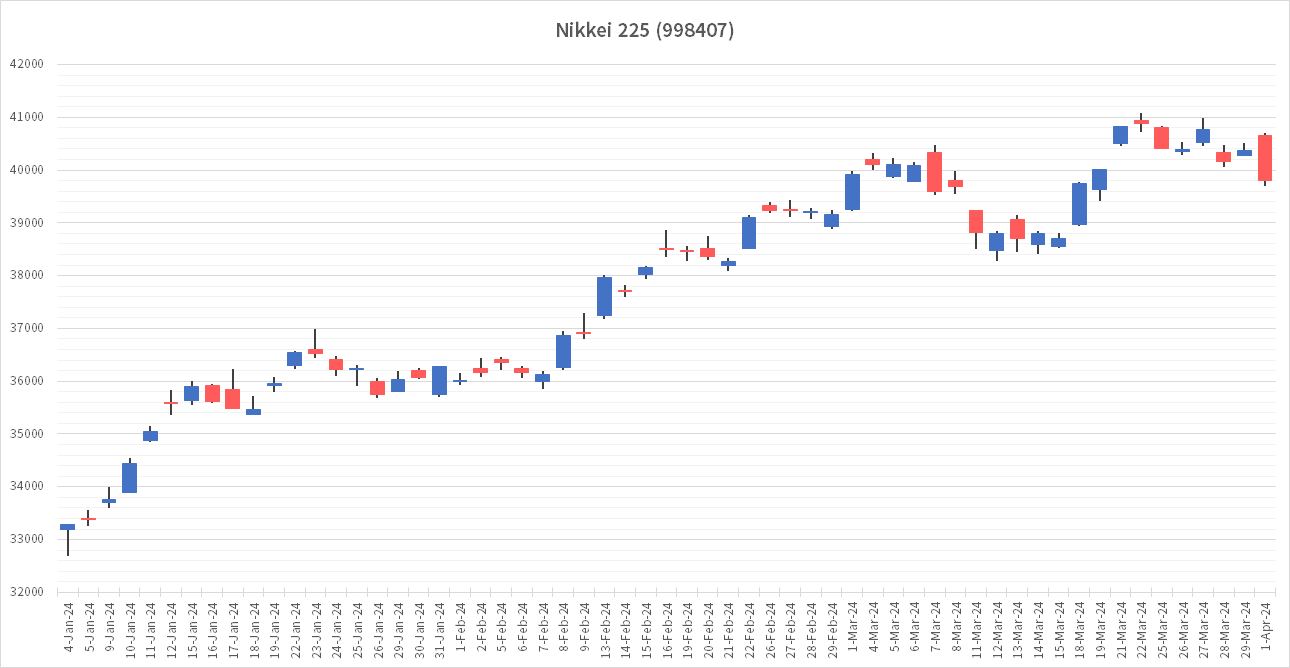

Nikkei 225 remains steady.

The Nikkei 225 continues to move higher. During March, there was a temporary drop in the stock price, but it immediately rallied and reached a new record high.

March is the closing month for many Japanese companies.

For many Japanese companies, March is the closing month of the fiscal year, so stock prices are based on expectations for the next fiscal year. Some companies have revised their FY2024 forecasts upward, and many of them are likely to continue to grow in FY2025.

For now, there is no sense of doom and gloom about the performance of Japanese stocks. Therefore, the webmaster believes that although there will be temporary situations where stock prices will plummet until news of the deterioration of the overall performance of Japanese equities is heard, stock prices will be on the right side of the curve.

Finally

The webmaster has no plans to sell his shares and intends to hold onto his holdings.

If the webmaster were to sell the stock, it would be when the stock price rises too high due to expectations. This is difficult to say, but a good rule of thumb is when the PER reaches 40x. However, if earnings are too strong, I may continue to hold the stock even if the PER is 40x, so it is difficult to say. The Japanese stock market is doing well, so PER is high overall. I must correctly judge whether this is a real demand or a bubble, but it is still difficult.

April marks the beginning of a new term for many Japanese companies. Let's hope for better performance in FY2025!

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.

![February 2024 Result [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2024/03/eyecatch_068-150x150.webp)

![January 2024 Result [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2024/01/eyecatch_055-150x150.webp)

![2023 Final Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2023/12/eyecatch_028-150x150.webp)