![June 2024 Result [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2024/07/eyecatch_095.webp)

Summary of investment and asset management performance for June 2024.

This article calculates the exchange rate at "$0.00625/yen" (160 yen/$).

The sales and other figures used in this article are current as of the time of writing. Depending on your viewing period, the figures may have changed significantly.

Table of Contents(目次)

June 2024 Result

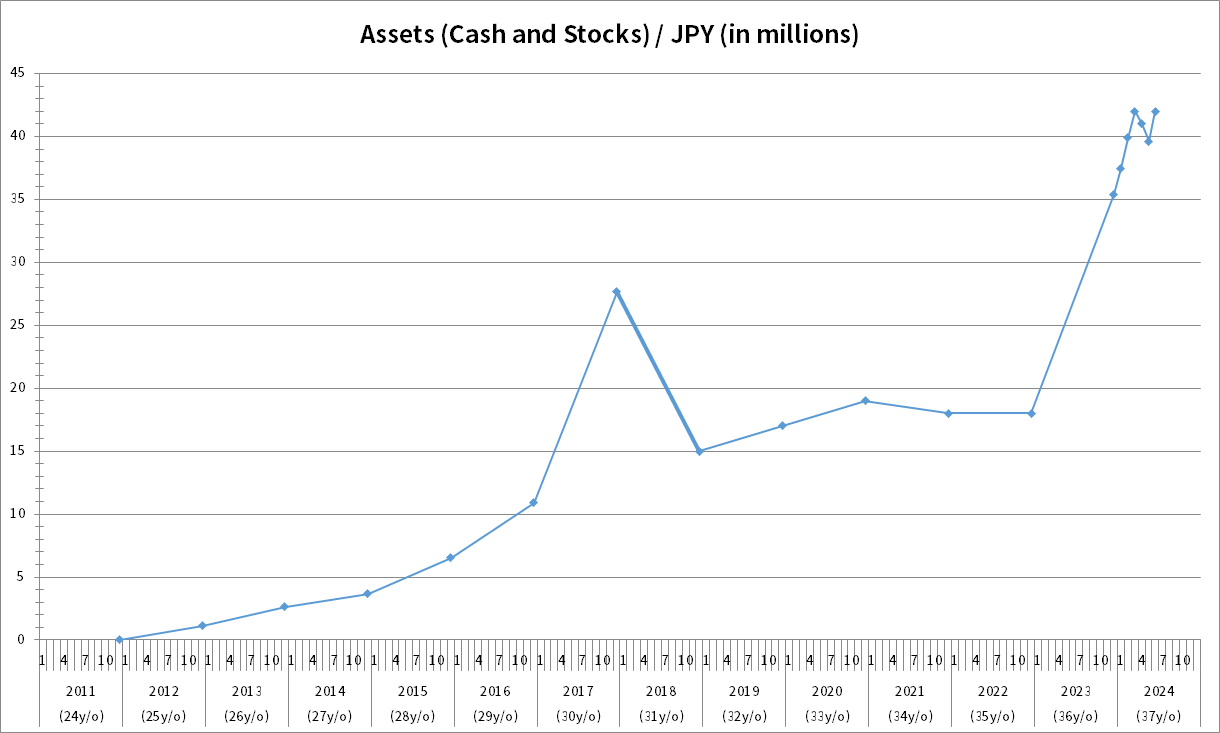

The chart below shows the change in my assets. The rightmost point on the chart is the amount of assets at the end of June 2024, which is 42 million yen (about $0.263 million). The month-over-month change in assets was +6.06%.

At the time of the last disclosure, the calculation was based on ¥150/$, but this time it is based on ¥160/$. While assets have increased in terms of Japanese yen, assets in dollar terms have changed little (OMG…).

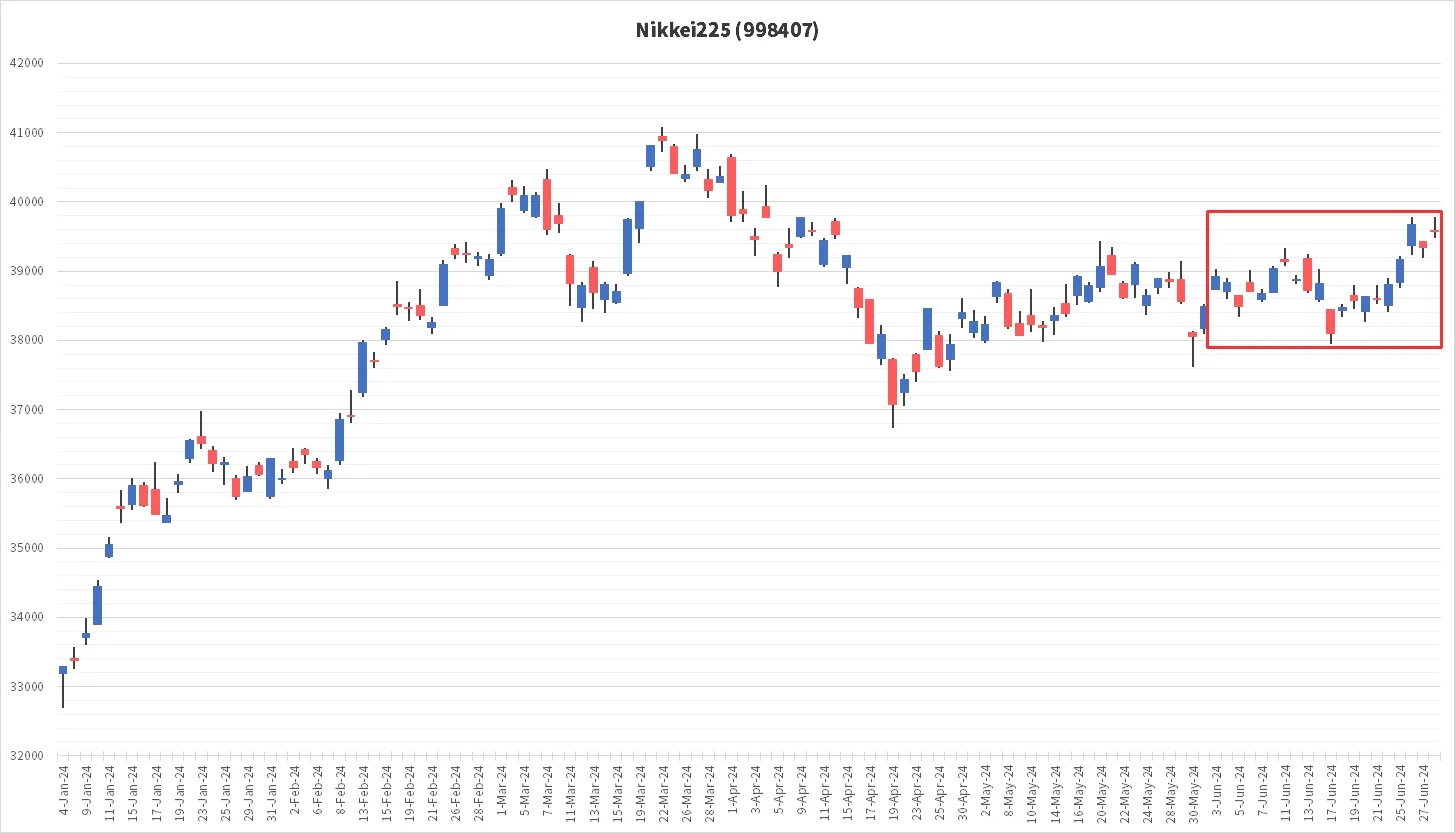

Stock prices rose toward the end of June.

In June, the Nikkei 225 remained mostly unchanged but showed an uptick at the end of the month.

As of this writing, the first week of July trading is over, and the momentum of the last stock market rally in June has continued through the first week of July. As a result, the valuation of my holdings is also at its highest as of July 7.

June is the month when most dividends are earned.

Most Japanese companies close their books at the end of March. Therefore, the dividend, based on the month of the fiscal year, comes in in June. The dividend received in June this year was 450,000 yen (about $2,866) after taxes.

Also, the bonus from the company I work for was 470,000 (about $2938) after tax.

My assets have increased largely due to the addition of stock dividends and a bonus from my company.

Finally

June was an uninteresting month, as there were no major incidents or accidents, but this is the kind of month you can expect if you are a long-term investor. July is the beginning of the second quarter for companies whose fiscal year ends in March, and companies will be compiling their first quarter (April-June) earnings releases. I hope that the revenues and profits of my holdings are good.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.

![May 2024 Result [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2024/06/eyecatch_094-150x150.webp)