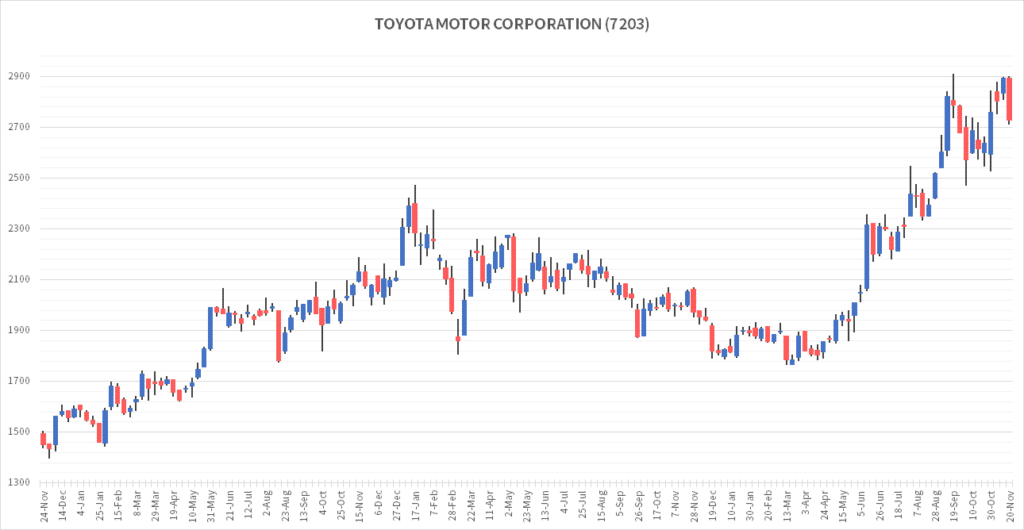

Let us introduce some of Japan's leading automakers. TOYOTA is also the company with the highest market capitalization among Japanese listed companies. I want to explain this company from a Japanese perspective.

This article calculates the exchange rate at "$0.0067/yen" (150 yen/$).

The sales and other figures used in this article are current as of the time of writing. The figures may have changed significantly depending on your viewing period.

Table of Contents(目次)

| Founding of a company | 1937 |

| Stock exchange listings | [Japan] Tokyo, Nagoya / [Overseas] New York, London |

| Securities Code | 7203 (Japan) / TM (NYSE) / TYT (LSE) |

| Yahoo Finance | Toyota Motor Corporation (7203.T) |

| Total Number of Shares Issued and Outstanding | Common stock 16,314,987,460 shares |

| Number of Shareholders | 989,548 shareholders |

| Fiscal year-end | March 31 |

| Dividend Payment Shareholder Fixed Date | March 31 (When interim dividends are paid, the shareholder fixed date for interim dividend payment is September 30.) |

| Number of shares per unit | 100 shares |

Company Profile

TOYOTA is an automobile manufacturer so well known worldwide that there is probably not a person who has not heard of the name "TOYOTA."

TOYOTA is the world's leading manufacturer of four-wheeled vehicles, with global sales reaching a record high of 11.38 million units. Recently, profits in Japanese yen terms have been increasing due to the effects of the weak yen (strong dollar). Operating and net income are expected to reach new highs, with net income approaching 4 trillion yen (approx. $26.6 billion). As a global automaker, we need to consider the number of cars sold and the impact of currency exchange rates.

TOYOTA, from a Japanese point of view

The share of TOYOTA cars in Japan is about 31%, with the Lexus brand accounting for about 1.2%. This means that approximately one in three cars is a TOYOTA vehicle. The TOYOTA brand is highly trusted in Japan. It does not mean that there are no car troubles or recalls, but there are sales dealers all over Japan, so there is a sense of security that if there is any trouble, they will take care of the car maintenance immediately.

Can't TOYOTA get more market share? In Japan, there is a special standard called "kei car." A kei car is a compact car that is smaller and lighter than a regular car and meets the standards. They are popular because of their low price and high fuel efficiency. Since TOYOTA does not produce mini cars, it cannot capture their demand. However, a subsidiary of TOYOTA is an automobile company called DAIHATSU, which makes "kei car." DAIHATSU has about 13% share of the Japanese market. TOYOTA and DAIHATSU together have about 45% of the Japanese market. Therefore, half of all Japanese car owners own a TOYOTA vehicle.

All-solid-state battery

Previous battery concerns

TOYOTA has been said to be reluctant to embrace electric vehicles. There were several reasons for this, with TOYOTA expressing concerns such as "If we rush to popularize electric cars under the current electricity situation, there will be a problem of being unable to supply electricity in time.

Electric cars have many problems, but I (the webmaster) could not buy an electric car because of the "battery" problem. Batteries, such as regular lithium-ion batteries, contain liquid. Liquid, as we all know, freezes when it gets cold. Lithium-ion batteries are designed not to freeze even when the temperature drops below freezing, but performance is still significantly reduced. I am sure you have all experienced a sudden drop in your smartphone's battery life after being outdoors for a long time during the cold winter months.

TOYOTA has announced

In June 2023, TOYOTA announced a new all-solid-state battery technology. In October, TOYOTA announced it would begin practical application and mass production of all-solid-state batteries around 2027. The next-generation all-solid-state battery will have a cruising range of over 1,000 km, approximately double the current range, and require less than 10 minutes (10%->80%) for quick recharging. In addition, since they are "all solid," they have the advantage of being resistant to cold weather. If this mass production and technological innovation go as planned, we may see more TOYOTA electric vehicles on the streets in five years.

About Corporate Performance

TOYOTA's financial performance has been strong: sales and profits fell in FY2021 due to COVID-19 but steadily rose. Also, ROE is around 12%, which is not bad. Considering the funds for investment in building a system to increase the production of all-solid-state batteries and electric vehicles in the future, a certain amount of retained earnings will be necessary. Incidentally, TOYOTA has no debt in the automotive sector. For accounting purposes, interest-bearing debt is affected by the loans customers take out when dealers sell them cars. Many automakers record finance receivables, especially in North America, because it is essential to be able to make loans to sell automobiles. In other words, the liabilities of TOYOTA's "finance business" appear in the accounting. Thus, TOYOTA, which is basically debt-free and profitable, is stable among automakers.

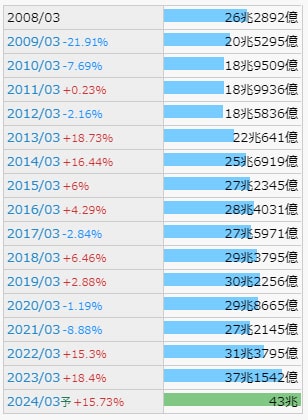

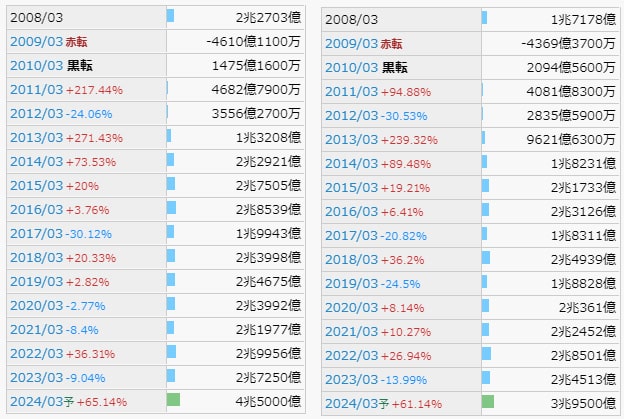

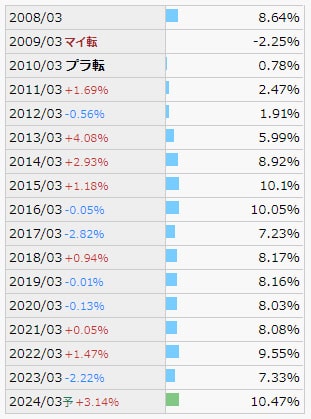

(The image attached below is taken from https://irbank.net/E02144/results)

Sales

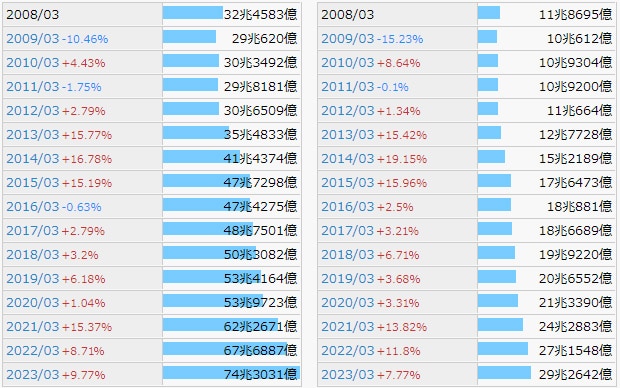

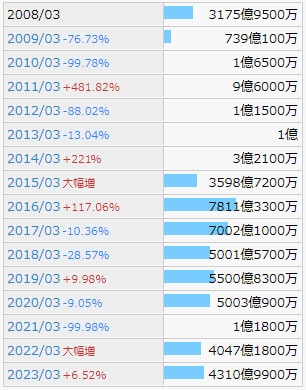

Sales are expected to be about 43 trillion yen (about $286.7 billion) in FY2024, and while there is a temporary drop in sales due in part to COVID-19, sales have increased continuously since FY2022, thanks in part to the weaker yen.

Profit

Operating and net income are increasing, especially for FY2024, projected to be about 4 trillion yen (about $26.7 billion). This is a significant increase from the 2 trillion yen range (approximately $13.3 billion to $20 billion) until the last fiscal year.

Operating Profit Ratio

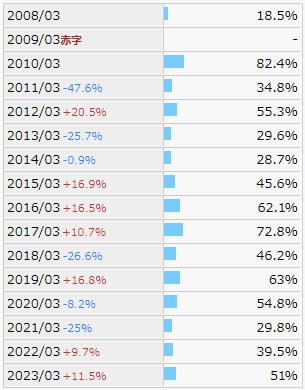

The rate has generally been around 8-10% in recent years. These figures for the manufacturing sector are not considered bad.

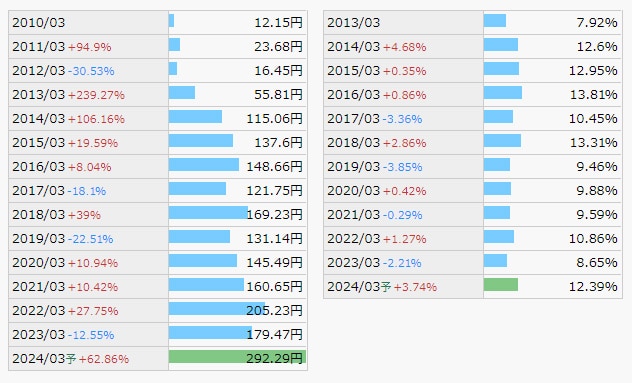

EPS, ROE

EPS is steadily increasing over the long term. Aggressive share buy-backs are also a factor in the rise in EPS. ROE is usually around 10% to 13%. The company avoids inferior figures by returning profits to shareholders through dividends and share buy-backs.

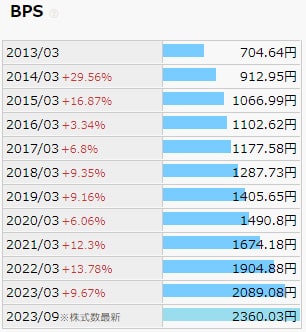

Total Assets, Net Assets, BPS

We see a steady increase in total assets, net assets, and BPS.

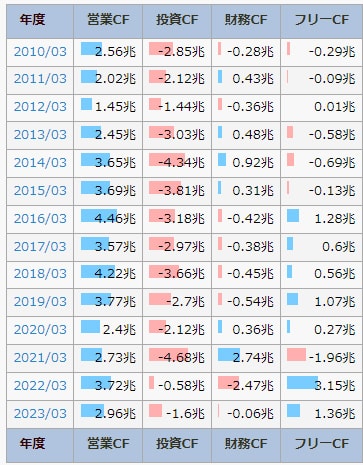

Cash Flow

CF from operating activities is always positive, indicating that the company has cash. As for free cash flow, there are some negative areas in the years when we have made a lot of investments, but we believe we are in good shape.

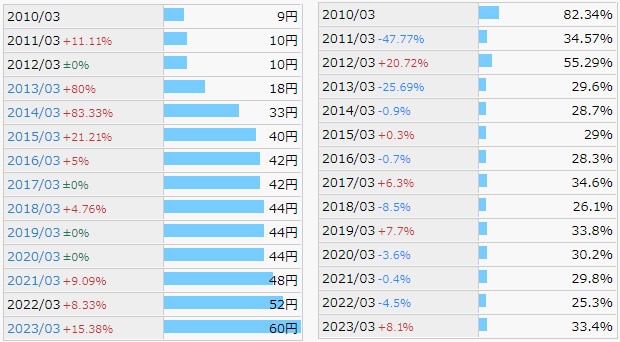

As for the dividend, we can confirm that it has been steadily increasing. The dividend payout ratio is about 33%, within a reasonable range. The company has also been flexibly buying back its shares; in 2022 and 2023, it bought back more than 400 billion yen (US$2.6 billion).

The total return ratio, including dividends and share buy-backs, was 51% for the fiscal year ended March 31, 2023. In past years, the company has used approximately 30-50% of its earnings to return profits to shareholders.

General Review

Being a large company, TOYOTA's earnings have been steadily increasing, although not as explosively as those of startups. Especially recently, it has been doing well due to the yen depreciation. The company has proactively returned profits to shareholders, paid dividends, and bought back its shares yearly. I am confident that the company will continue to provide proactive and flexible shareholder returns in line with market conditions.

Should I hold the stock or not?

I own TOYOTA stock. This is a long-term investment for more than 10 years, and I do not buy or sell in the short term.

TOYOTA is trying to enter the EV market. Until now, European automakers have promoted electric vehicles because they have been unable to fill the gap in engine (internal combustion engine) technology. However, the battery, the critical component of electric cars, is still weak in cold climates and has a short cruising range. If TOYOTA were to enter the EV market with a "next-generation all-solid-state battery," what would happen to its market share? I expect TOYOTA to gain a large share of the EV market.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.