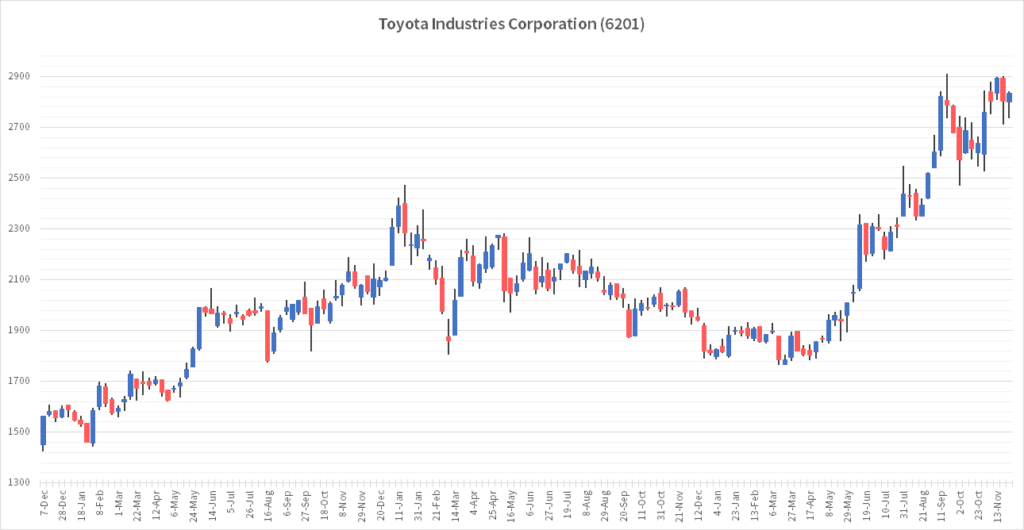

I want to introduce TOYOTA Industries Corporation, the head family of the TOYOTA Group.

This article calculates the exchange rate at "$0.0067/yen" (150 yen/$).

The sales and other figures used in this article are current as of the time of writing. The figures may have changed significantly depending on your viewing period.

Table of Contents(目次)

| Founding of a company | 1926 |

| Stock exchange listings | [Japan] Tokyo, Nagoya |

| Securities Code | 6201 |

| Yahoo Finance | Toyota Industries Corporation (6201.T) |

| Total Number of Shares Issued and Outstanding | 325,840,640 |

| Number of Shareholders | 18,934 |

| Fiscal year-end | March 31 |

| Dividend Payment Shareholder Fixed Date | March 31 (When interim dividends are paid, the shareholder fixed date for interim dividend payment is September 30.) |

| Number of shares per unit | 100 shares |

Company Profile

Many people in the general public may not know about this company. However, some people involved in the logistics and textile industries may know of it. Toyota Industries Corporation manufactures and sells textile machinery, industrial vehicles, automobiles, and automotive parts. The company manufactures and sells industrial vehicles, which include forklifts and other logistics and transportation equipment. Among the products it manufactures and sells, Toyota Industries has the world's largest market share for forklifts, compressors for car air conditioners, and air jet looms.

History

Established in 1926 to manufacture the G-type automatic loom invented by Sakichi Toyoda1, the company established an automobile division2 in 1933 to manufacture automobiles. The company then launched the Toyoda Model G1 truck and popular passenger cars and in 1937, established the current TOYOTA MOTOR CORPORATION.

About Corporate Performance

Many auto parts companies and companies in the TOYOTA group were born from Toyota Industries Corporation. Therefore, this company holds many shares in TOYOTA-affiliated companies, the most representative of which are listed below.

| Stock holdings | Number of shares held (million) | Stock valuation (in U.S. dollars, million) | Projected dividends (in U.S. dollars, million) |

|---|---|---|---|

| TOYOTA MOTOR CORPORATION (7203) | 1,192.3 | 22,519 | 556.4 |

| DENSO Corporation (6902) | 277.4 | 4,315 | 96.1 |

| Toyota Tsusho Corporation(8015) | 39.3 | 2,160 | 65.5 |

| Aisin Corporation(7259) | 20.7 | 761 | 23.4 |

| Aichi Steel Corporation (5482) | 1.3 | 31 | 0.7 |

| Total dividends: 111,340 |

The table above shows that the company earns many dividends from its stock holdings alone. (Dividend income is much higher because we also own shares outside this table.) This dividend income supports the management of the company. However, listed companies in Japan have recently begun " improving management efficiency," particularly in ROE and other indicators. (Until a few years ago, this was not considered an issue, but this is changing.) To this end, Toyota Industries Corporation is liquidating its asset holdings, most recently announcing on November 29, 2023, that it will sell a portion of its stake in DENSO Corporation. It will be interesting to see how shareholder value changes due to asset sales.

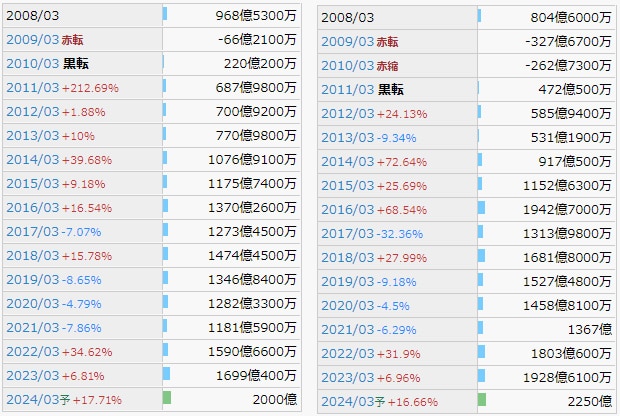

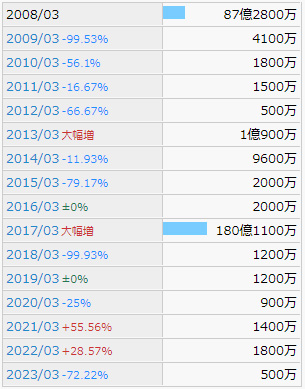

(The image attached below is taken from https://irbank.net/E02144/results)

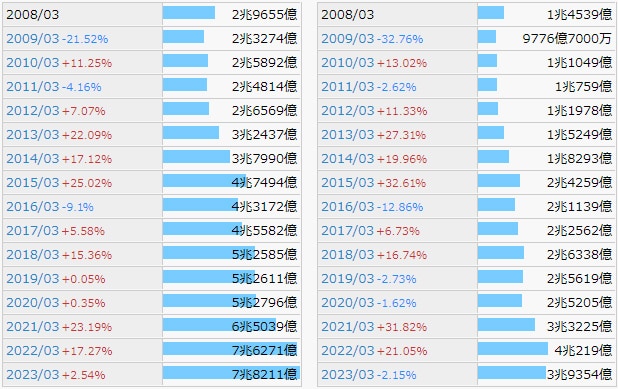

Sales

Looking at past sales trends, the impact of COVID-19 appears to have been minimal; for FY2024, the company expects a record 3.6 trillion yen (about $24,000 million), thanks in part to the weaker yen.

Profit

Operating income and net income were negative in FY2009, when the impact of the Lehman Shock remained, and net income was negative in FY2010. However, other than that, we are operating in the black. And, as with sales, we plan to achieve record profits in FY2024.

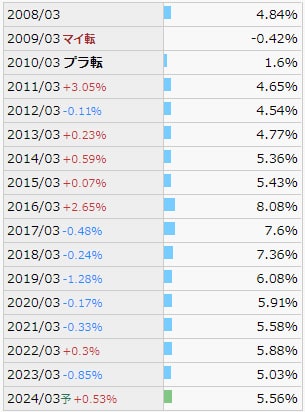

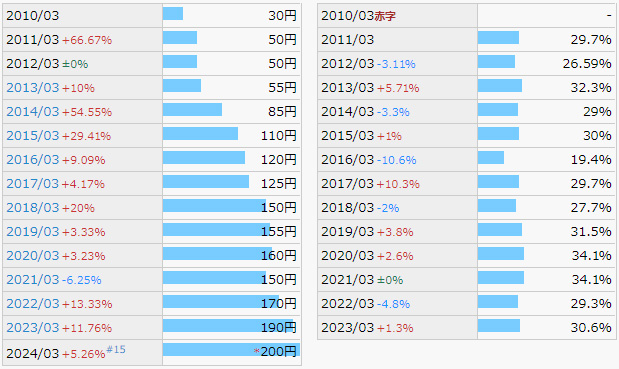

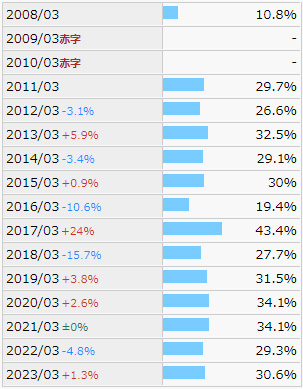

Operating Profit Ratio

As for the operating margin, it has recently been in the 5% range. I find this figure a bit unsatisfactory; operating profit margins were around 6-8% before COVID-19 became popular, and I would like to see them return to at least this level.

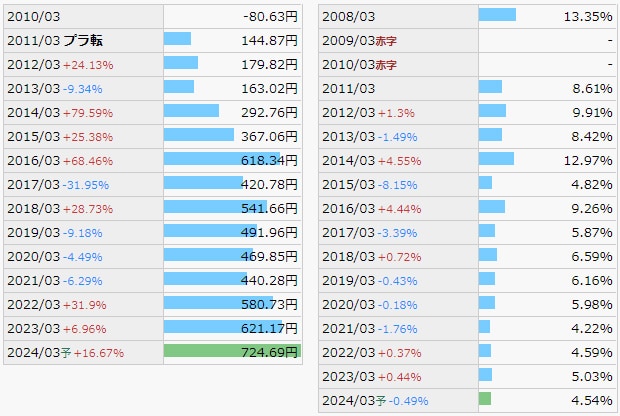

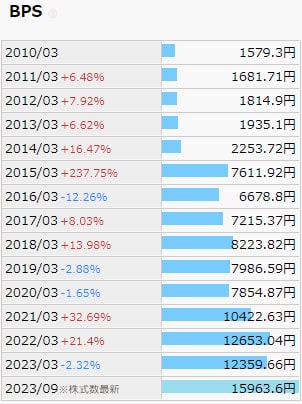

EPS, ROE

As for EPS, it is going up in order, so there should be no problem.

I think the ROE is low. As mentioned, Toyota Industries Corporation holds many shares in TOYOTA Group companies. As a result, the denominator in the ROE formula is larger, resulting in a lower figure. In particular, the recent rise in the stock market, including that of Toyota Motor Corporation, has worsened the ROE figures. However, with the recent announcement of the sale of DENSO's shares, I believe it will improve.

ROE (%) = (Net income) / (Shareholders' equity) x 100

Total Assets, Net Assets, BPS

All values are rising steadily. The values may drop in the future as the company liquidates its holdings, but a temporary drop would be acceptable if it leads to an improvement in ROE and other values.

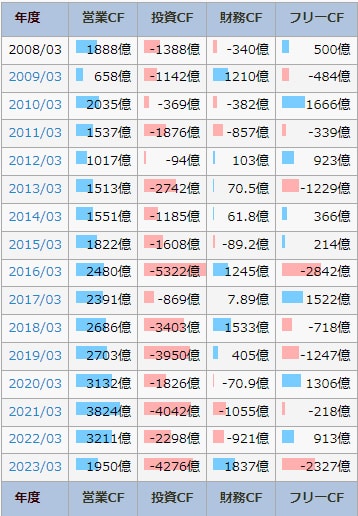

Cash Flow

Operating CF is always positive. Free CF has been moving between surpluses and deficits due to the size of CF's investment CF, the company's finances are sound, and this should not be a problem.

Dividends have risen steadily and are expected to be the highest ever paid. The dividend payout ratio is about 30%, within a reasonable range. The total return ratio is around 30%, almost the same as the dividend payout ratio, as there are almost no share buybacks. We want to see the company return more profit to shareholders, but it may be unavoidable if it prepares for future capital investment.

General Review

I would like to see improved earnings and stronger shareholder returns going forward. There is room for improvement in the current situation, but we are moving toward improvement, so let's hope for the best.

Should I hold the stock or not?

My investment style, like Warren Buffett, is to invest in companies in "industries I understand". Therefore, it is difficult for me to invest in companies with a high percentage of industrial vehicle sales, which I am not familiar with. However, Toyota Industries Corporation is moving to improve shareholder returns, so it may be a candidate for a long-term holding.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.

- Sakichi Toyoda is the great-grandfather of Akio Toyoda (former president of Toyota Motor Corporation). ↩︎

- Yoichi Kawagoe, the founder of Daido Metal Industries, was the first General Manager of the Automotive Division. ↩︎