In this issue, I want to introduce Synchro Food Co., Ltd., one of our webmaster's mainstay stocks.

This article calculates the exchange rate at "$0.0071/yen" (140 yen/$).

The sales and other figures used in this article are current as of the time of writing. The figures may have changed significantly depending on your viewing period.

Table of Contents(目次)

| Founding of a company | 2003 |

| Stock exchange listings | [Japan] Tokyo |

| Securities Code | 7203 |

| Yahoo Finance | Synchro Food Co., Ltd. (3963) |

| Fiscal year-end | March 31 |

| Dividend Payment Shareholder Fixed Date | March 31 (When interim dividends are paid, the shareholder fixed date for interim dividend payment is September 30.) |

| Number of shares per unit | 100 shares |

Company Profile

Synchro Food is a company that operates information websites for restaurants, including job opportunities, real estate, and foodstuff purchasing.

The company's main website is "飲食店.COM (Restaurant.COM)". The company's revenue stream comes from job posting fees and advertising on this site.

COVID-19 and the Long Silence

The company provides services to restaurants, so its performance similarly deteriorated when the industry collapsed after COVID-19 (2020). In Japan, COVID-19 was finally treated like the flu in May 2023. In other words, before that, restaurants had to close or shorten their business hours when the government called for self-restraint.

After May 2023, Japan's economic activity will return to pre-COVID-19 conditions as inbound travel from abroad resumes. The restaurant industry's management regulations will also be eliminated, and the revival of the restaurant industry will lead to Synchro Food's revival.

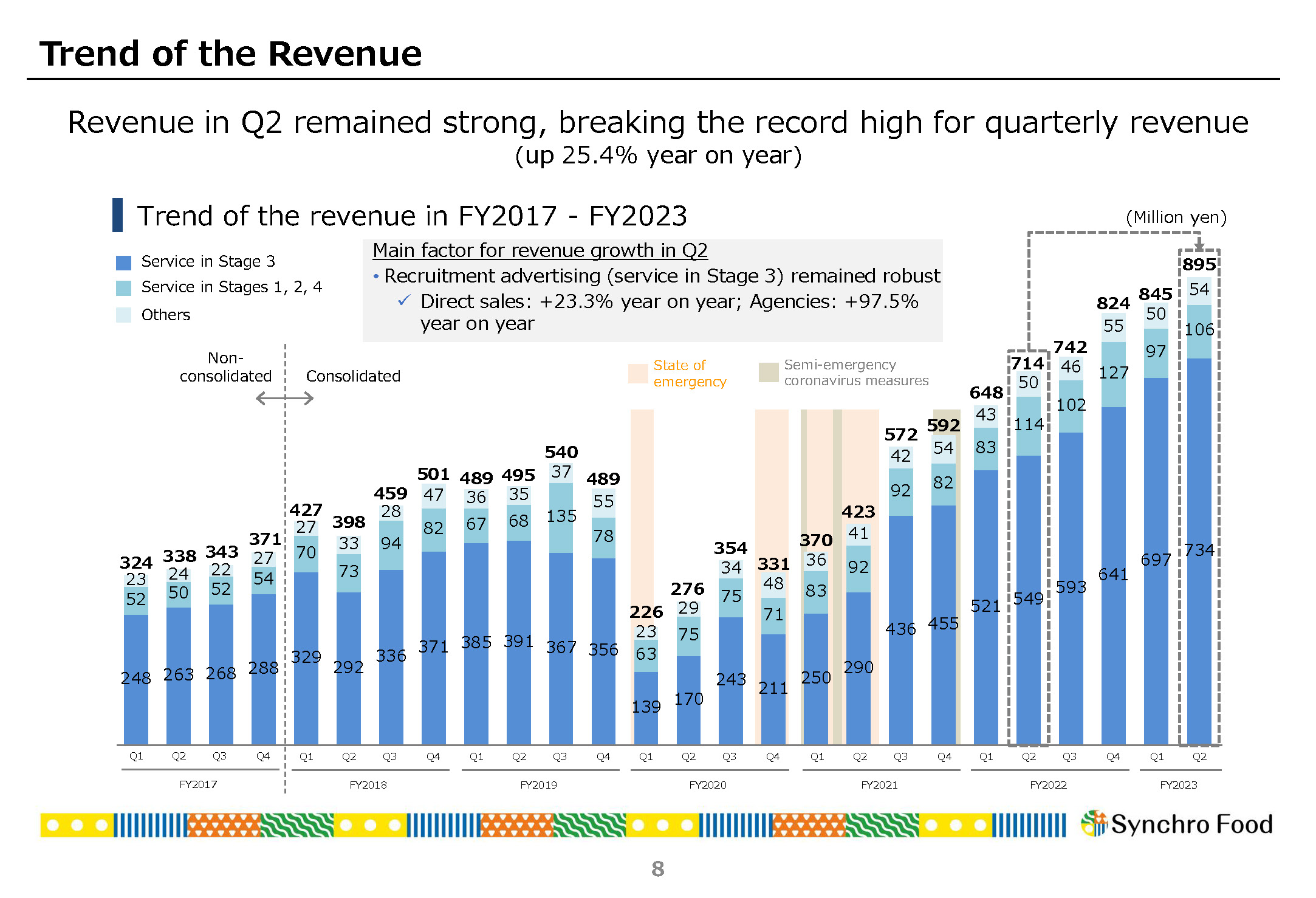

The chart below shows revenue trends; there was a period of time when revenues dropped significantly due to the impact of COVID-19. In 2020-2022, even as the impact of COVID-19 continued, the company was gradually recovering revenues. And this fiscal year, when the impact of COVID-19 has been removed, the company plans to mark a record high.

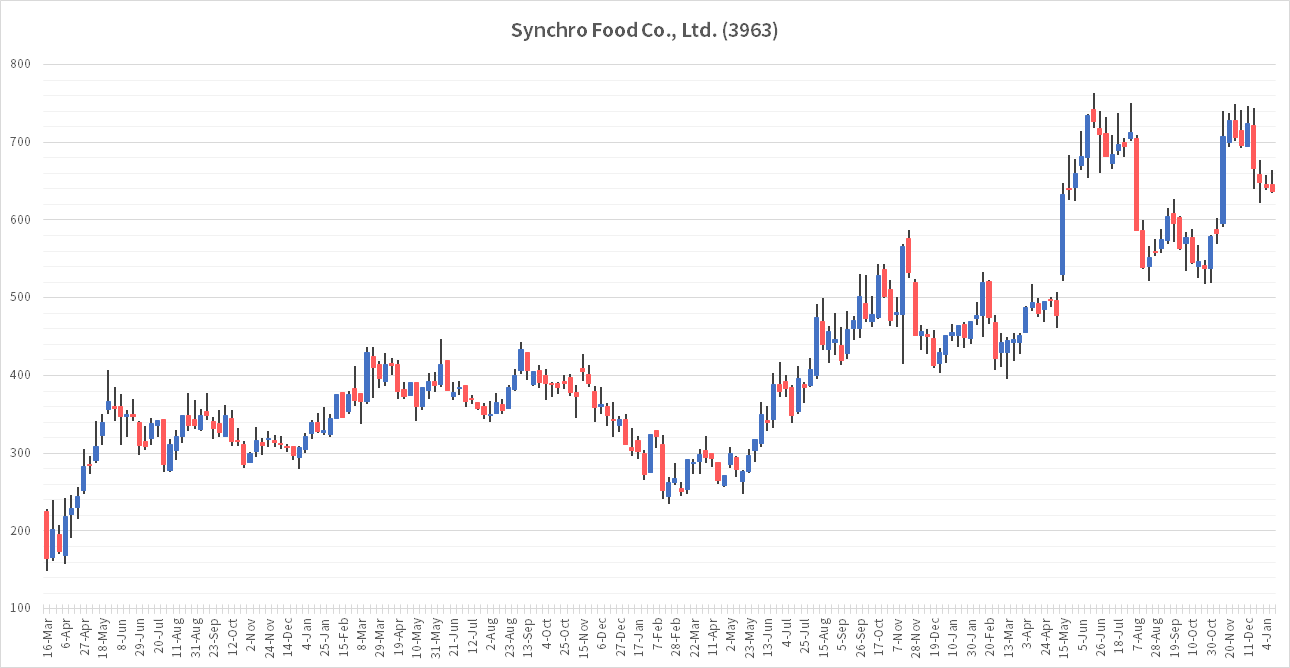

Stock prices rose sharply

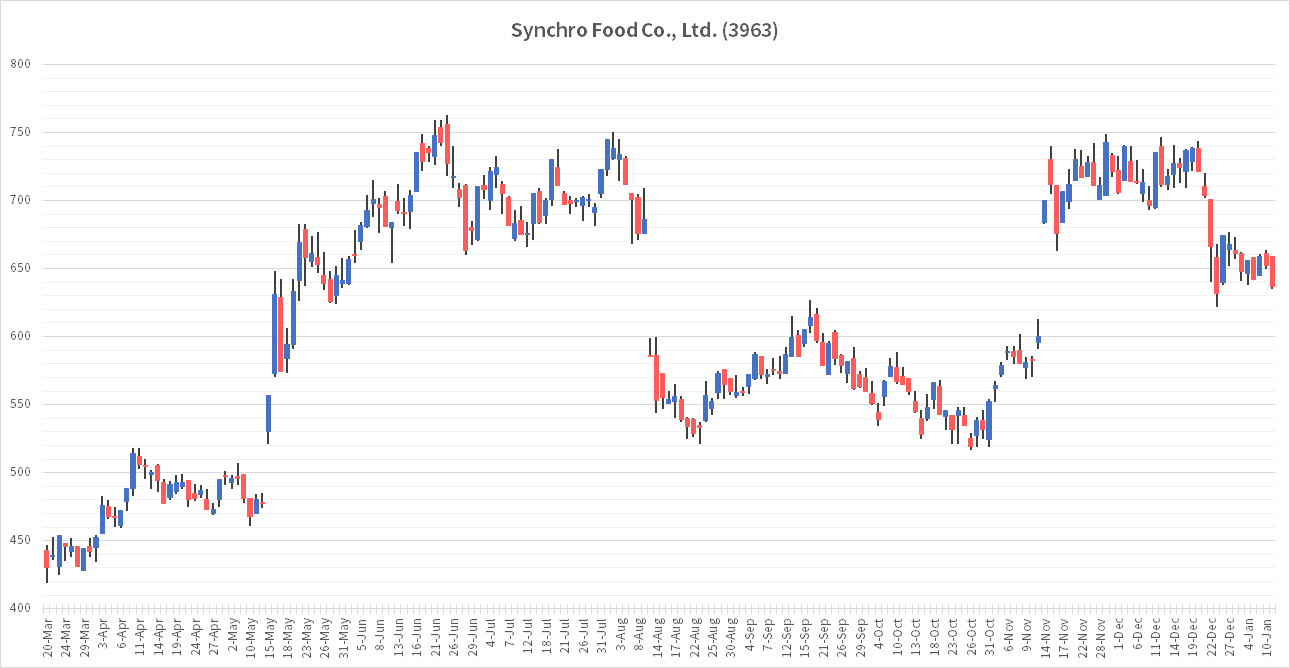

The chart above shows the stock price since January 2023; it would have gone up significantly in May 2023. It went up significantly because of good earnings announcements and with an eye on a resurgence in the restaurant industry when the Japanese economy returns to normal again.

There was a significant drop in the stock price in August 2023 due to the company's perceived low profitability. However, the company had given advance notice that it would need to spend money to hire more employees, which was an expected scenario.

The company's November earnings announcement showed increased profits, and the stock price rose again. The company also announced that it would pay dividends for the first time. The company had not previously paid a dividend due to business growth but decided to do so to emphasize shareholder returns.

About Corporate Performance

The performance of the company is basically on a steady rise. (Except for the impact of COVID-19…)

The company's business is to operate a platform related to food and beverage, and it operates its website efficiently with a small number of people and good profit margins. It does not require a large capital investment, and with a computer and talented people, the company can generate large profits with minimal investment.

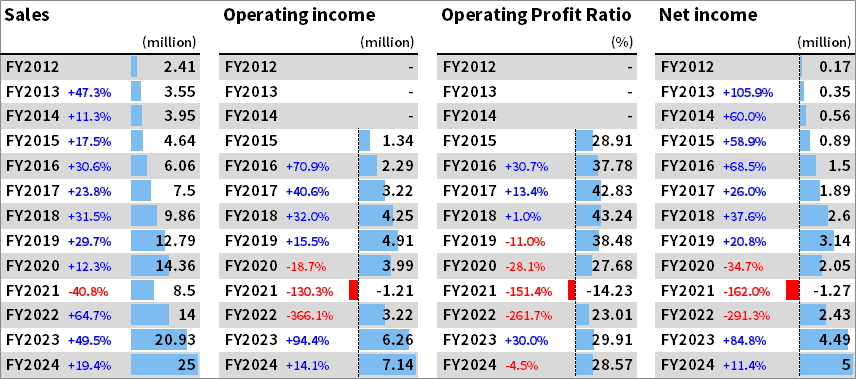

(The image attached below is a webmaster's re-display of the information on https://irbank.net/E32647/results, converted to dollar amounts. * FY2024 is a forecast.)

Sales, Operating income, Operating Profit Ratio, Net income

You can see that Synchro Food's performance has been steadily increasing except for FY2021 and FY2022. We know the temporary drop in revenues and profits is due to COVID-19. The company's management itself is fine. FY2024 is expected to be the company's highest profit year to date.

The operating profit margin is also excellent, at nearly 30%, maintained even as the company has grown. With an operating margin of 30% and steadily rising revenues and profits. This is a company with a promising future.

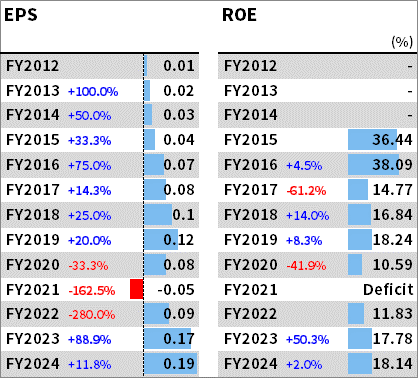

EPS, ROE

The EPS of this company is also rising steadily, as it should. It is growing without problems.

ROE is around 18% for FY2023 and FY2024. This is a good number. As discussed later, dividends will be paid from FY2024, so further shareholder returns can be expected while securing internal reserves. In addition, the company has set a medium- to long-term goal of increasing its ROE to 25%.

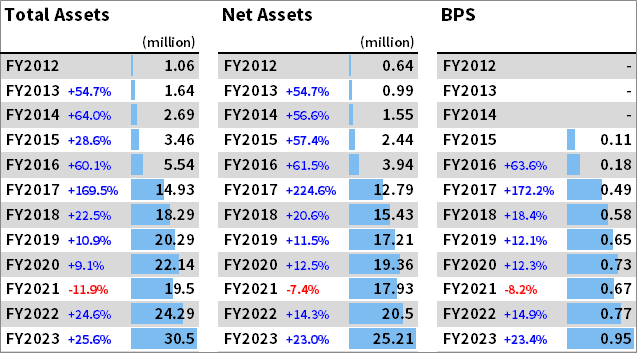

Total Assets, Net Assets, BPS

Total assets, net assets, and BPS are all rising steadily. This company does not require a large capital investment and only needs a PC to run its operations. It also has zero interest-bearing debt! So, the business is smooth sailing and has the strength to hold up even if restaurants are damaged in the future, as was the case when COVID-19 was popular.

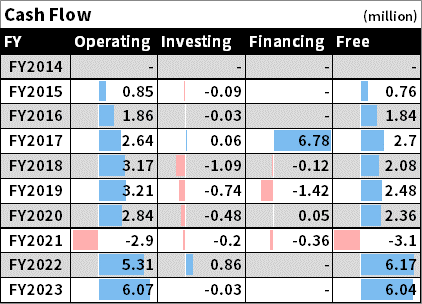

Cash Flow

Cash flow will not be a problem either; the operating cash flow deficit in FY2021 is due to COVID-19. Besides, the company has always been profitable, and there is no worry about cash depletion. Investment CF is low because, as mentioned earlier, this company can operate with a PC. If they hire more personnel, they can purchase more PCs for that amount.

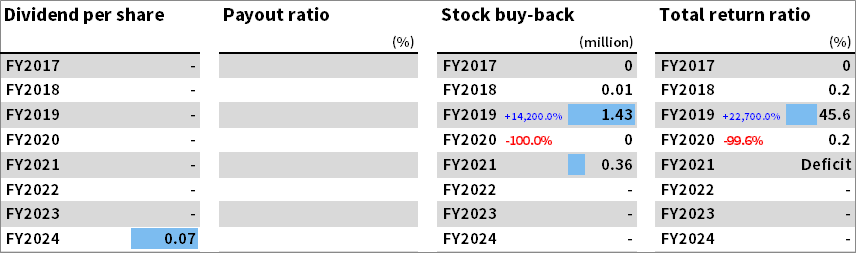

As for shareholder returns, the company plans to pay its first dividend in FY2024. The dividend payout ratio is planned to be 38.1%. It should be noted that the dividend will be 10 yen ($0.07) this time, but this consists of a "regular dividend of 5 yen" and a "commemorative dividend of 5 yen". This means that FY2025 may be less than 10 yen. However, since the company plans to raise EPS to 33 yen in its FY2025 earnings target, even if it were to pay a dividend of 10 yen in FY2025 as well, the dividend payout ratio would be about 33%, which is within a reasonable range. In any case, we look forward to future business expansion and shareholder returns.

General Review

The company's performance is expanding nicely, with no large capital expenditures or interest-bearing debt. The company has been very proactive in returning profits to shareholders, and we can expect more of the same in the future.

Should I hold the stock or not?

30% of my portfolio is in Synchro Food. While diversifying my stocks, I try to concentrate my investments on stocks growing particularly fast. I believe the company will continue to grow and plan to hold it for the long term unless an event occurs that would cause the company's business to deteriorate.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.

![2023 Final Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2023/12/eyecatch_028-150x150.webp)