In this issue, we would like to introduce KDDI, a major integrated telecommunications company and one of the four major Japanese mobile phone carriers.

This article calculates the exchange rate at "$0.0069/yen" (145 yen/$).

The sales and other figures used in this article are current as of the time of writing. The figures may have changed significantly depending on your viewing period.

Table of Contents(目次)

| Founding of a company | 1984 |

| Stock exchange listings | [Japan] Tokyo |

| Securities Code | 9433 |

| Yahoo Finance | KDDI Corporation (9433.T) |

| Fiscal year-end | March 31 |

| Dividend Payment Shareholder Fixed Date | In principle, dividends are paid twice a year (interim and year-end), with March 31 and September 30 as the fixed dates for dividend-paying shareholders. |

| Number of shares per unit | 100 shares |

Company Profile

KDDI is a cell phone and fiber optic network company and one of the four major cell phone carriers.

It has three major business segments: "Personal (84%)," "Business (16%)," and "Other (0%)," with 84% of revenues coming from the personal segment.

Personal Segment

In the personal segment, the main sources of revenue are communication charges for cell phones and monthly charges for fiber optic lines. KDDI aims to retain customers and increase the unit price per customer by linking its telecommunication services with other life design services such as commerce, finance, energy, entertainment, and education. In its overseas business, KDDI is also actively engaged in business for individual customers, particularly in Myanmar, Mongolia, and other Asian countries, by leveraging its business expertise cultivated in Japan.

Business Segment

In the Business Segment, KDDI provides a wide range of corporate customers in Japan and overseas with various solutions, including smartphones and other devices, networks, and cloud computing, as well as data center services under the "TELEHOUSE" brand. Furthermore, KDDI is creating new value through DX with its customers by providing one-stop solutions that contribute to developing and expanding customers' businesses globally by utilizing technologies such as 5G and IoT and collaborating with partner companies.

Rivals

Among telecommunication service companies, the following three companies are compared to KDDI

- NTT (9432) (Nippon Telegraph and Telephone Corporation)

- SoftBank Corp. (9434)

- Rakuten Group, Inc. (4755)

Among telecommunication service companies, NTT is No. 1, and KDDI is No. 2 in terms of market capitalization. Although telecommunication companies are trying their best to attract customers by offering inexpensive telecommunication plans, all Japanese people already have cell phones, and the flow of customers has been slowing down. Therefore, rather than increasing the number of customers, each company is trying to increase the price per customer and retain customers by offering other ancillary services.

NTT

The webmaster feels that NTT and KDDI have similar business styles, with the main focus on telecommunication services and commerce and financial services to serve the customers of those services.

SoftBank

SoftBank is dedicated to telecommunication services, but it is also a member of the "SoftBank Group," which includes Yahoo Japan, a media and e-commerce company, and PayPay, an electronic payment service provider, to retain customers.

Rakuten

Rakuten was an IT company that provided an e-commerce platform like Amazon, but in 2018, it established "Rakuten Mobile" and entered the cell phone service market in earnest in 2020. Rakuten's cell phone business is currently struggling with a series of losses.

About Corporate Performance

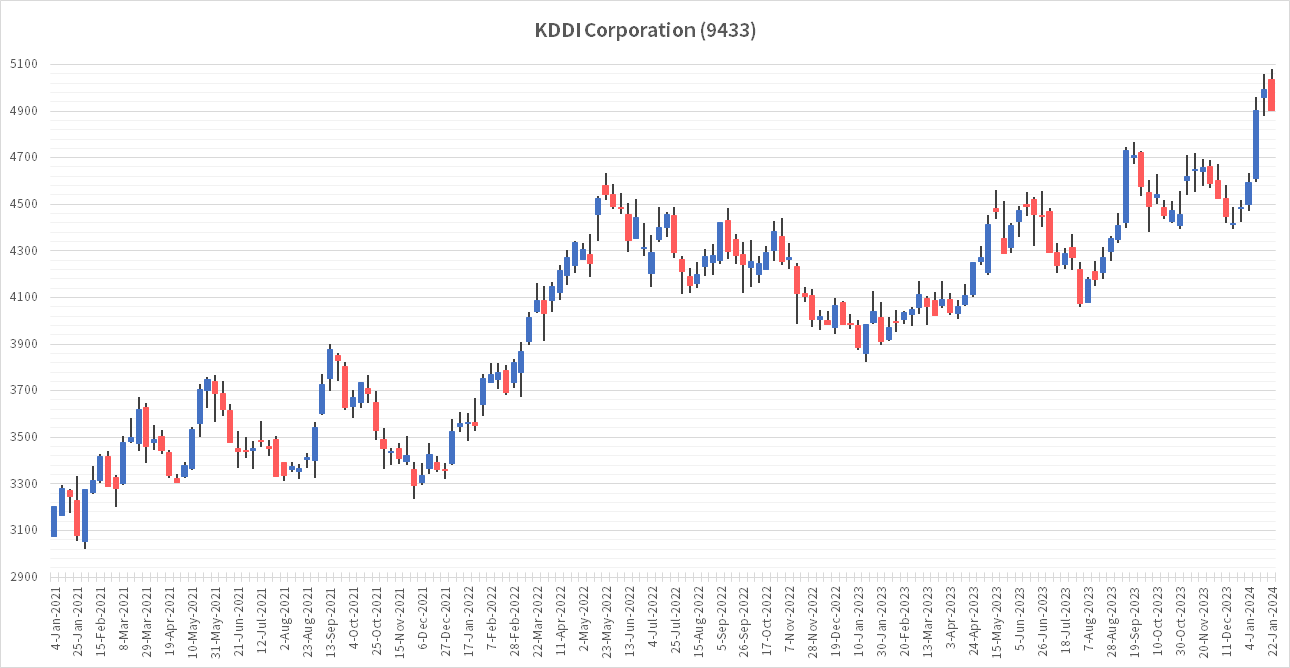

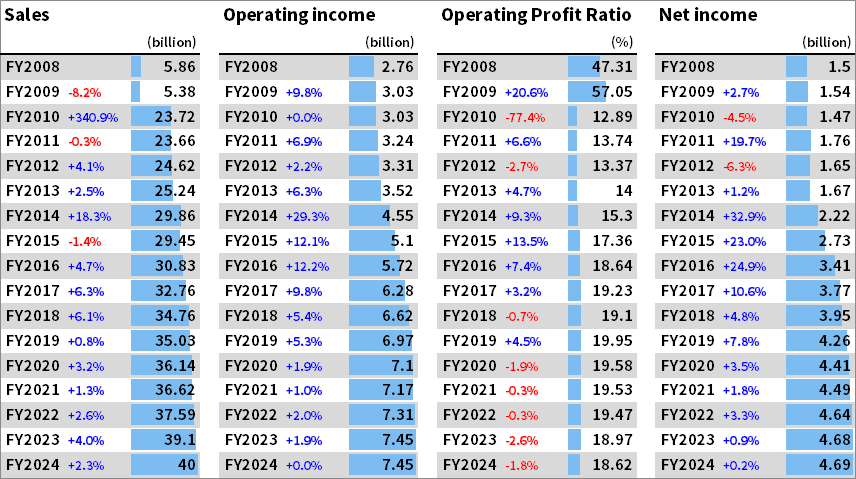

(The image attached below is a webmaster's re-display of the information on https://irbank.net/E04425/results, converted to dollar amounts. * FY2024 is a forecast.)

Sales, Operating income, Operating Profit Ratio, Net income

KDDI's sales, operating income, and net income have gradually increased over the past 10 years without a year-on-year decline. As a large company, KDDI does not have outstanding growth rates, but it has grown gradually by developing services other than cell phones and getting customers to use them.

The operating profit margin has been stable at 18-19% recently. Cell phone services are highly profitable if there is no customer outflow after installing base stations.

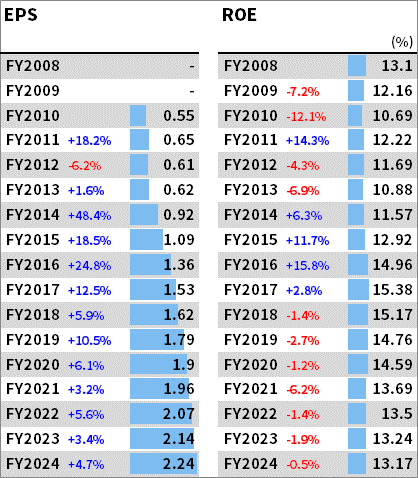

EPS, ROE

EPS is rising slowly but surely. As we will explain later, KDDI is also aggressively buying back its own shares, so EPS growth can be expected to continue.

ROE is around 13%. Personally, I would like to see KDDI aim for a higher figure, and I have high expectations for the company.

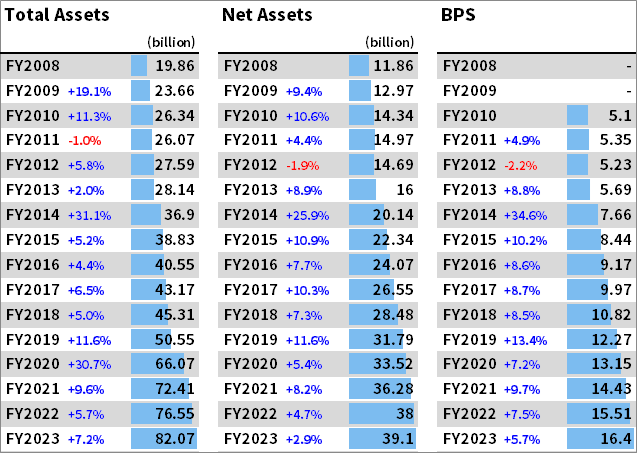

Total Assets, Net Assets, BPS

Net worth and BPS are rising steadily, and total assets are also increasing. BPS has been increasing by more than 5% in recent years and, in some years, by as much as 8-9%. This is due to the company's stable annual profits and share buybacks, which have increased net assets per share.

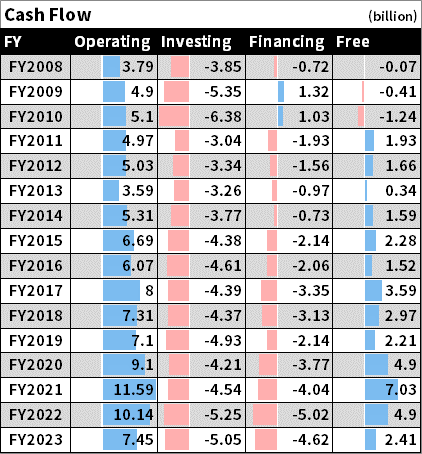

Cash Flow

As for cash flow, there will be no problem at all. There is no concern about cash depletion.

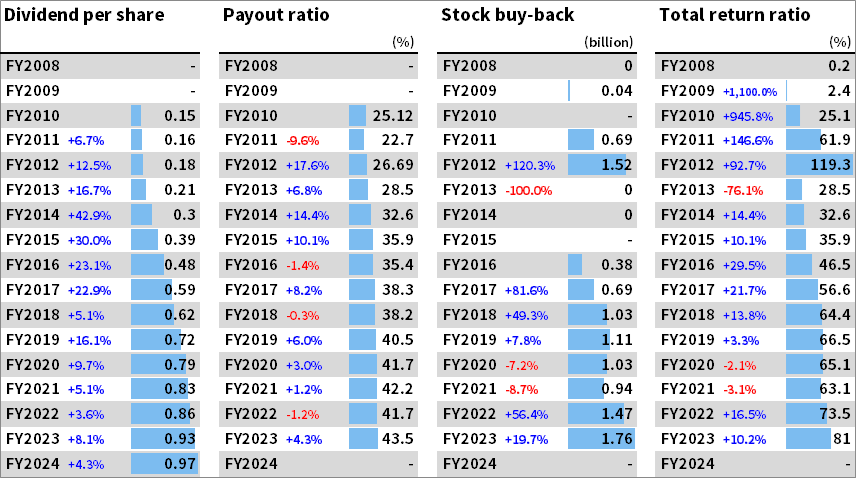

Dividends have been increased every year, albeit gradually. The dividend payout ratio is approximately 40%. This shows that the company pays dividends within a reasonable range. The company has bought back its own shares every year for the past eight years. The total return ratio was 81% in FY2023. We can probably expect a shareholder return of about 80% in FY2024 through dividends and share buybacks.

General Review

KDDI is a large company, and while it is not expected to have a significant growth rate, it was found to be a company that generates stable profits while providing a high rate of return to shareholders.

Should I hold the stock or not?

The webmaster owns shares of KDDI and assumes a long-term investment. I do not expect the stock price to rise explosively, but I purchased the stock to receive a steady income gain. If you are going to buy KDDI stock, I recommend investing when the PER and other indices are low.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.