I want to introduce Kakaku.com, which I have incorporated into my portfolio for a long time.

This article calculates the exchange rate at "$0.0069/yen" (145 yen/$).

The sales and other figures used in this article are current as of the time of writing. Depending on your viewing period, the figures may have changed significantly.

Table of Contents(目次)

| Founding of a company | 1997 |

| Stock exchange listings | [Japan] Tokyo |

| Securities Code | 2371 |

| Yahoo Finance | Kakaku.com (2371) |

| Fiscal year-end | March 31 |

| Dividend Payment Shareholder Fixed Date | March 31 (When interim dividends are paid, the shareholder fixed date for interim dividend payment is September 30.) |

| Number of shares per unit | 100 shares |

Company Profile

Kakaku.com is an Internet media business. The company's main revenue source is advertising fees paid to media outlets. The top-selling media outlets are "Kakaku.com (meaning Price.com)," "Tabelog (meaning Eating Log)," and "Kyujin Box (meaning Job Box)."

Kakaku.com (価格.com/ meaning Price.com)

"Kakaku.com" was the first product of Kakaku.com, Inc. The site was launched in May 1997 by Mitsuaki Makino with the concept of "providing price information via the Internet.

Kakaku.com is a purchasing support site for various products, including durable goods, consumer goods, and services. In addition to price comparisons, the site offers a variety of information, including reviews, word-of-mouth reviews, and trends.

The site is used by 40.29 million people per month (325.8 million PV).

When we all try to buy consumer electronics and other products on e-commerce sites, we want to buy at the cheapest price. Especially in the case of home appliances, the specifications are the same, so the only difference is the price. Especially in Japan, there are so many small e-commerce sites that it is difficult to find out where the lowest price is. Kakaku.com, however, is very convenient because it aggregates price information from all over Japan. Even Amazon, for example, posts information about its products on Kakaku.com, even if it has to pay a fee. That is how influential this site is.

Tabelog (食べログ/ meaning Eating Log)

The site provides information on restaurants nationwide and allows users to select restaurants from a ranking system based on word-of-mouth reviews and other information that is scored accordingly.

The main source of revenue comes from paid customer attraction services, which increase the site's exposure and enable customers to make restaurant reservations online. Tabelog has established itself as a restaurant information site, and restaurants are willing to pay to increase their exposure on Tabelog.

It has 95 million monthly users. (2,071.21 million PV)

Kyujin Box (求人ボックス/ meaning Job Box)

Kyujin Box, launched in 2015, is a service that allows job seekers to search job listings from job sites and employers in one place; like Google, it gathers jobs from all over the web and displays them all at once, making it easy for job seekers to look up jobs without going to each media or site.

The revenue source is commissions based on the number of clicks to job sites and employers that post jobs on their listing ad spaces.

The number of monthly users is 7.59 million. (101.96 million PV)

About Corporate Performance

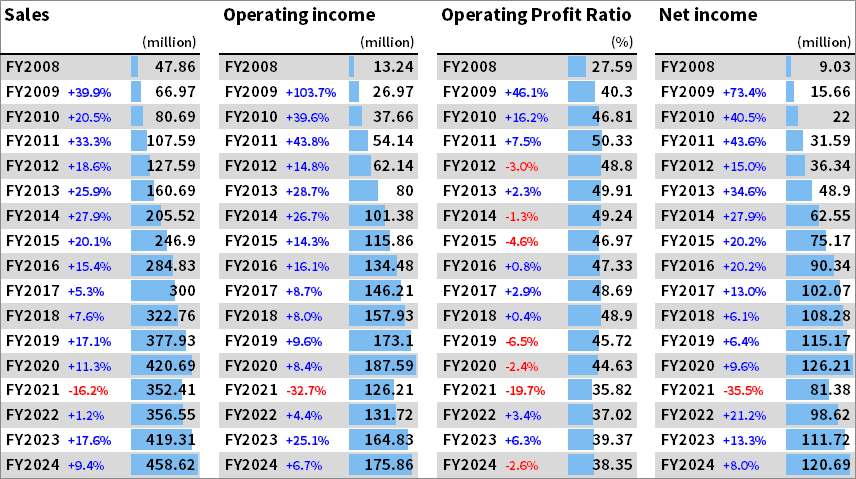

(The image attached below is a webmaster's re-display of the information on https://irbank.net/E05350/results, converted to dollar amounts. * FY2024 is a forecast.)

Sales, Operating income, Operating Profit Ratio, Net income

Sales, operating income, and net income were temporarily down from FY2021 to FY2023 but are steadily rising. Tabelog, operated by Kakaku.com, is a restaurant service, so it was greatly affected by COVID-19, which restricted people's activities. For this reason, its performance in FY2021 was poor.

However, even with the impact of COVID-19, we are not in the red. This is due to the high operating margin, over 40% until FY2020! The company's efficiency in attracting customers to its sites, good monetization, and scalability through IT are its attractions, and it is well-positioned to operate in the black even in difficult times.

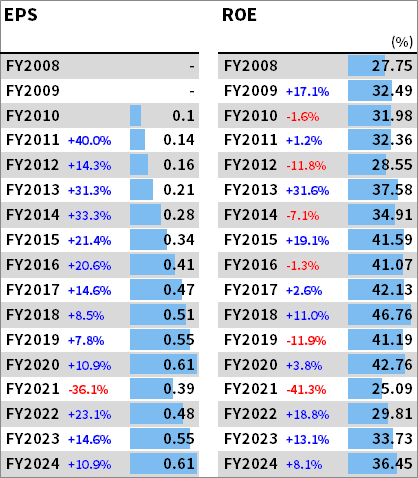

EPS, ROE

EPS also shows a similar graph to sales; it dropped significantly in FY2021 but is expected to recover to the same level as FY2020 in FY2024. Kakaku.com, Inc. has been aggressively buying back its shares, which will also positively impact EPS.

ROE was over 41% until FY2020! In FY2021, it dropped to 25% but is projected to be around 36% in FY2024. Since Kakaku.com, Inc. is aggressive in returning profits to shareholders, a recovery to the 40% level can be expected in the future.

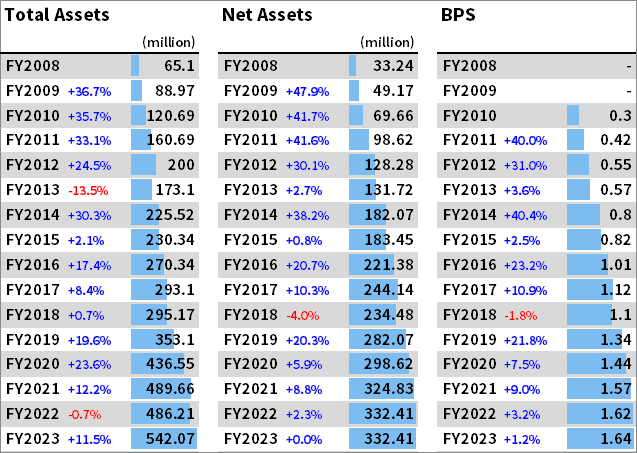

Total Assets, Net Assets, BPS

Total assets, net worth, and BPS are rising nicely. The company has minimal debt, which can be repaid with one year's net income. Since the amount to be repaid is small, retained earnings will remain an asset. The retained earnings are used to return profits to shareholders and build a stronger financial position.

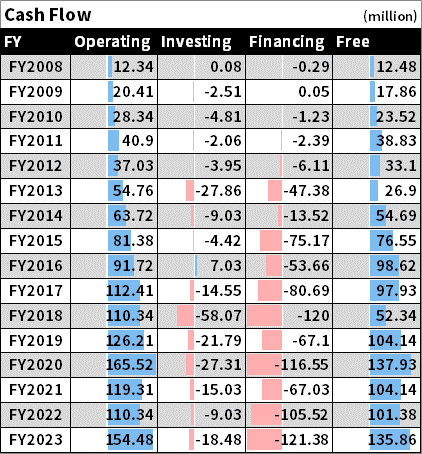

Cash Flow

Looking at the cash flow graph, there does not appear to be any particular area of concern. IT companies do not require huge investments; they can do the job with a PC and an engineer. Therefore, little money flows out, and operating and free cash flow are consistently positive.

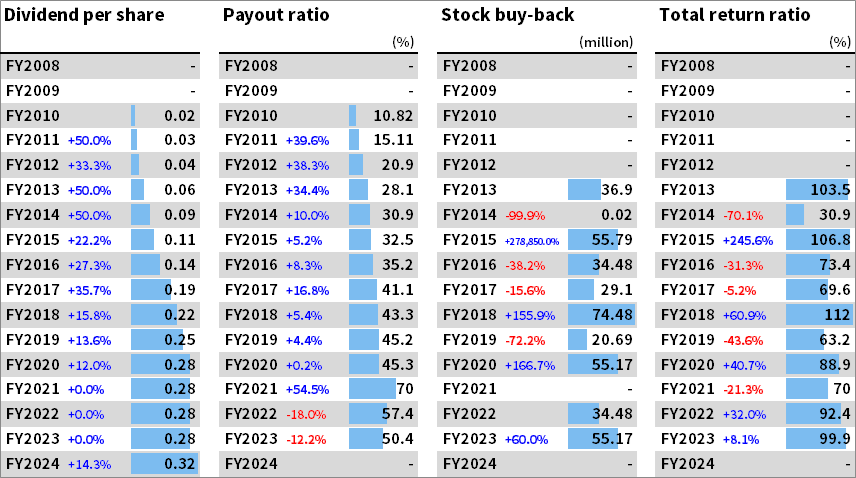

Dividends were flat from FY2020 to FY2023 but have increased slightly overall. For FY2024, the company plans to increase the dividend. The dividend payout ratio is generally 40-50%.

Next, I would like to review the company's share buybacks, which the company has done every year.

The amount of share buybacks varies from year to year. Still, the company has been returning profits to shareholders so that the total return ratio, including dividends and share buybacks, is close to 100%.

The company can return so much to shareholders largely because it is highly profitable, with a profit margin of about 40%, so it can continue its business without using its cash and other assets. While returning so much to shareholders, revenues and profits are also growing. That is why they can keep their ROE values high!

General Review

Kakaku.com, Inc. is very attractive because of its profitability and management's willingness to return profits to shareholders. Although there are other web services similar to the company's, many of the company's services are in the lead. Because it is the leader, e-commerce sites and restaurant owners are willing to pay to advertise the company's service. In other words, other businesses will lose customers if consumers are unaware of the company through Kakaku.com and Tabelog. Once this good cycle is established, the company will have the right to determine pricing. In other words, it will be able to charge higher advertising costs than others. That is the company's strength.

Should I hold the stock or not?

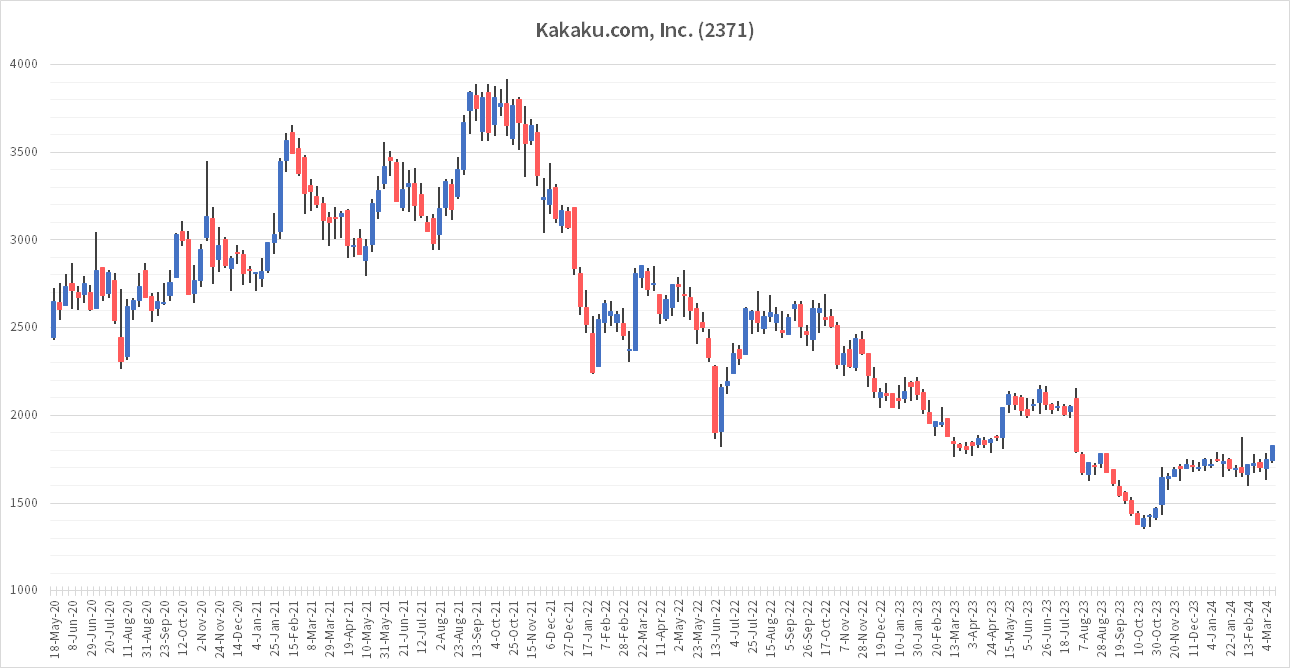

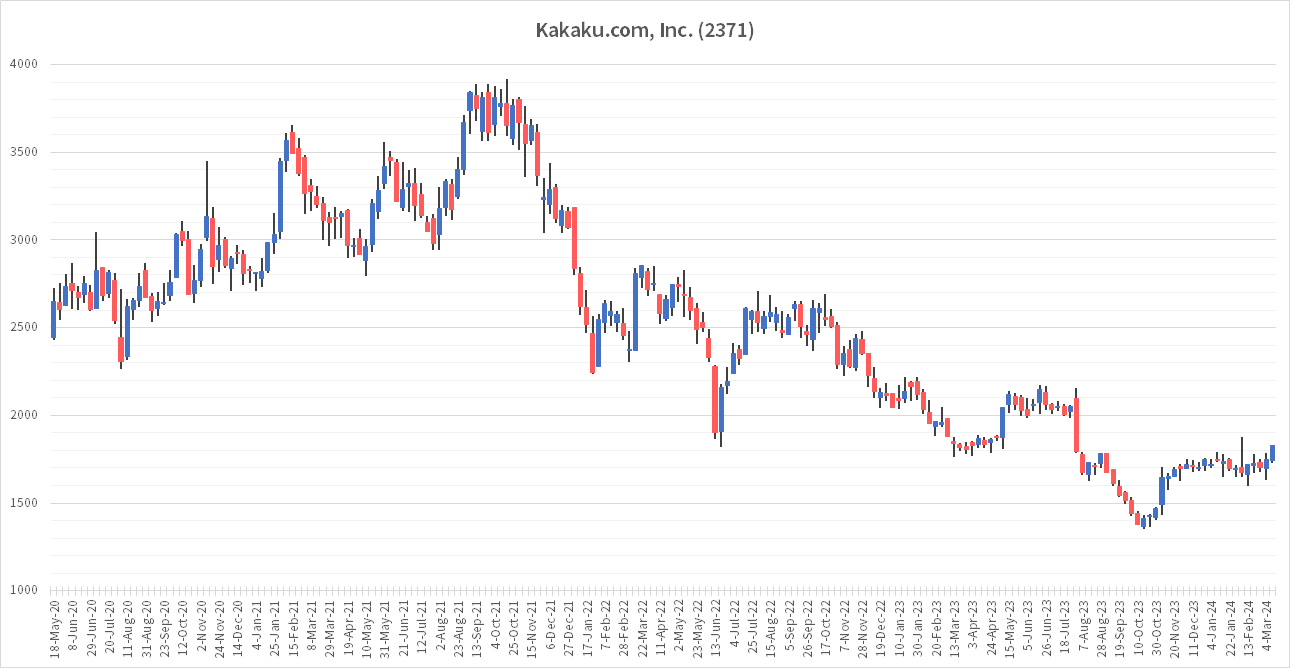

The webmaster owns stock in this company. It is the fourth-largest investment in my portfolio. I would buy more company shares if I could, but the PER is always high, over 20x.

In addition, the stock price has been falling recently. This is because the PER has dropped from 40x to the 20x PER level. Thus, even for a company with very good performance, when the stock price reaches the level of PER of 40 times or more, the stock price will drop. Therefore, it is very important to purchase at an appropriate share price.

I want to keep a close watch on future stock prices and performance and buy at the appropriate time.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.