Japan Exchange Group, Inc. ("JPX") is a Japanese holding company that owns the Tokyo Stock Exchange. The Tokyo Stock Exchange has a 99% share of the annual trading value of stocks in Japan. In this article, we will delve deeper into this company.

This article calculates the exchange rate at "$0.0067/yen" (150 yen/$).

The sales and other figures used in this article are current as of the time of writing. The figures may have changed significantly depending on your viewing period.

Table of Contents(目次)

| Founding of a company | 2013 Created through the business merger of Tokyo Stock Exchange Group and Osaka Stock Exchange in January 2013 |

| Stock exchange listings | [Japan] Tokyo |

| Securities Code | 8697 |

| Yahoo Finance | Japan Exchange Group, Inc. (8697.T) |

| Total Number of Shares Issued and Outstanding | 528,578,441 |

| Fiscal year-end | March 31 |

| Dividend Payment Shareholder Fixed Date | March 31 (When interim dividends are paid, the shareholder fixed date for interim dividend payment is September 30.) |

| Number of shares per unit | 100 shares |

Company Profile

JPX was created in January 2013 through the business merger of the Tokyo Stock Exchange Group and the Osaka Securities Exchange. Although JPX was established in 2013, its subsidiary, Tokyo Stock Exchange, Inc., has been in business as a securities exchange since 1878.

Four Japanese stock exchanges handle equities: Tokyo, Nagoya, Sapporo, and Fukuoka. (Osaka was positioned as an exchange specializing in market derivatives after its merger with JPX.) The share of these exchanges in terms of trading value is as follows

| Exchange | Share (%) |

|---|---|

| Tokyo | 99.97% |

| Nagoya | 0.016% |

| Sapporo | 0.0047% |

| Fukuoka | 0.0036% |

The Tokyo Stock Exchange has by far the largest market share. Although some blue-chip companies are listed on other stock exchanges, most well-known companies are listed on the Tokyo Stock Exchange.

About Corporate Performance

JPX's revenue pillars fall into the following five major categories.

| Transaction-related revenues | Related to cash and financial derivatives transactions | 39.7% |

| Clearing-related revenues | Businesses aimed at facilitating the smooth implementation of clearing and settlement | 21.4% |

| Listing-related revenues | "Annual listing fee", etc. | 9.7% |

| Information-related revenues | Provision of stock price information, etc. | 20.4% |

| Others | arrownet usage fees, etc. | 8.9% |

In addition to commissions from stock trading, there are other revenue pillars, such as "Clearing-related revenues" and "Information-related revenues," which each account for about 20% of the total, providing a well-balanced revenue stream.

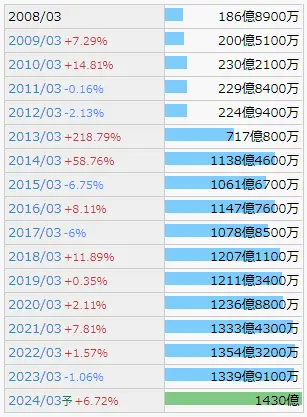

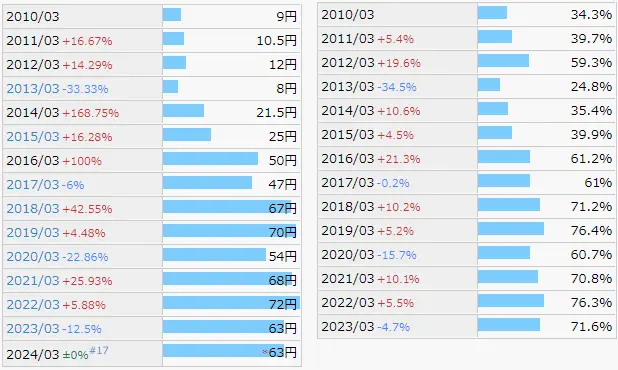

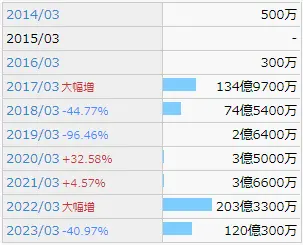

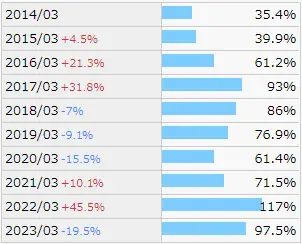

(The image attached below is taken from https://irbank.net/E03814/results)

Sales

The sharp rise in sales in FY2013 and FY2014 is due to the business merger with Osaka Securities Exchange Co. Looking at the last ten years, sales have gradually increased from 100 billion yen ($666 million) and are scheduled to reach 143 billion yen ($933 million) in FY2024. We see a steady increase in sales.

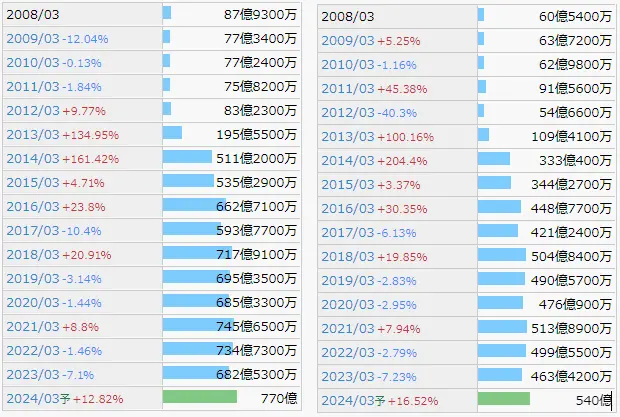

Profit

We can confirm that operating and net income are strong and expected to reach record highs in FY2024.

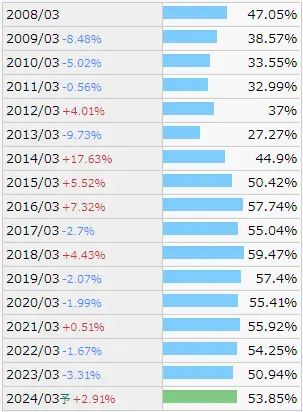

Operating Profit Ratio

The operating margin is an astounding 50%+. In good years, it has been 59.47%, and the forecast for FY2024 is 53.85%. The strength of JPX is that, unlike in the past, equities and derivatives products are now electronic. Although computer maintenance costs are high, there are virtually no labor costs once structured. Moreover, JPX has a monopoly on Japanese equities and derivatives trading, so when they want to sell (trade) a product, the counterparty comes to them without any sales effort from us. In other words, unlike other firms, JPX requires almost no sales staff, thus reducing fixed costs.

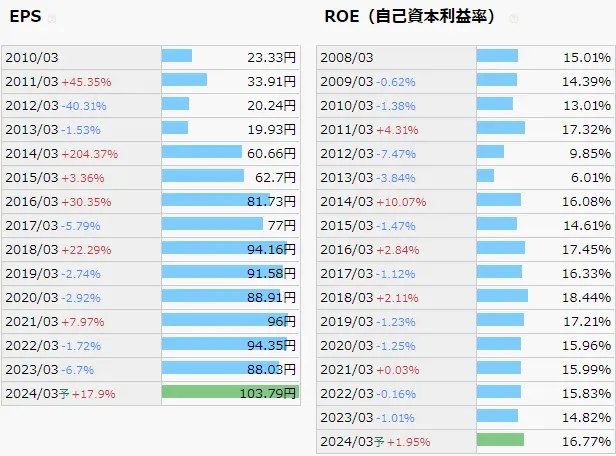

EPS, ROE

EPS is projected to be at an all-time high in FY2024, although it is zigzagging a bit; ROE has been around 15-17% over the last ten years and is projected to be 16.77% in FY2024. Numerically, this is not a problem and would be in the excellent category.

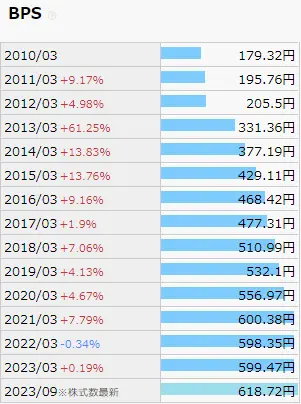

Total Assets, Net Assets, BPS

Net assets have not changed much, but total assets have risen sharply. In other words, "liabilities" have increased. However, this debt is not a bad thing. This is because "assets and liabilities underwritten by the Japan Securities Clearing Corporation," a subsidiary of JPX, as a clearing organization, and "clearing participant deposits" received from clearing participants as collateral are recorded in both accounts. Therefore, please be assured that JPX is not in debt due to poor management. JPX's interest-bearing debt is ¥52.4 billion ($349 million), which is enough to repay the debt with one year's net income.

We see BPS increasing steadily.

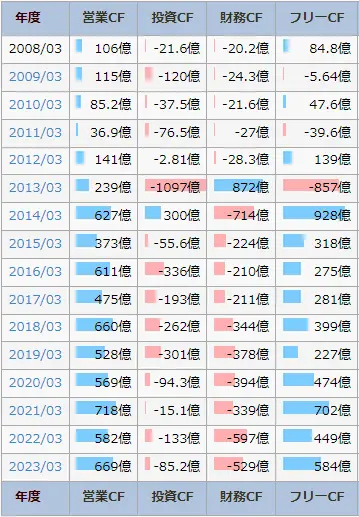

Cash Flow

There would be nothing bad in cash flow. Operating cash flow is always positive; the increase in investment CF in 2013 is probably due to the costs of the management integration.

JPX has been trying to return as much as possible, with a dividend payout ratio of at least 60% since FY 2016. As a result, its dividends have varied depending on its net income; for FY2024, the company is forecasting 63 yen per share for a payout ratio of 71.6%. The company is also active in share buybacks, and the total return ratio, including dividends and share buybacks, has been 60-117% over the past eight years, confirming that a large portion of profits are used to return profits to shareholders.

General Review

JPX is a company that has been able to generate high-profit margins because of its dominance in the Japanese securities and derivatives markets, and will be stable in the future. It also strongly intends to return those profits to shareholders and will continue to benefit from dividends and share buybacks in the future.

Should I hold the stock or not?

I own shares of JPX and plan to hold them for the long term.

First of all, the reason is that this company will not go under (except when Japan ceases to be capitalist…). Since the company has a monopoly on stock trading and its operating margin is over 50%, I do not think this company can go under except in the event of a natural disaster of considerable magnitude. Therefore, I believe this stock can be held with peace of mind even ten years from now. However, I have to admit that I do not know whether the company's performance will steadily rise or zigzag from year to year. This is because JPX's commission income will depend on the stock's trading value. However, since we have other revenue pillars besides stocks and derivatives trading, I do not think our earnings will deteriorate significantly.

The second reason is that JPX is proactive in returning profits to shareholders: it generates stable profits and uses most of those profits for dividends and share buybacks. Therefore, I believe that JPX can generate stable income gains and aim for capital gains when EPS rises due to share buybacks. However, unlike startups, profits are not exploding, so we must think over 10 years or more.

These are my reasons for owning shares of JPX.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.