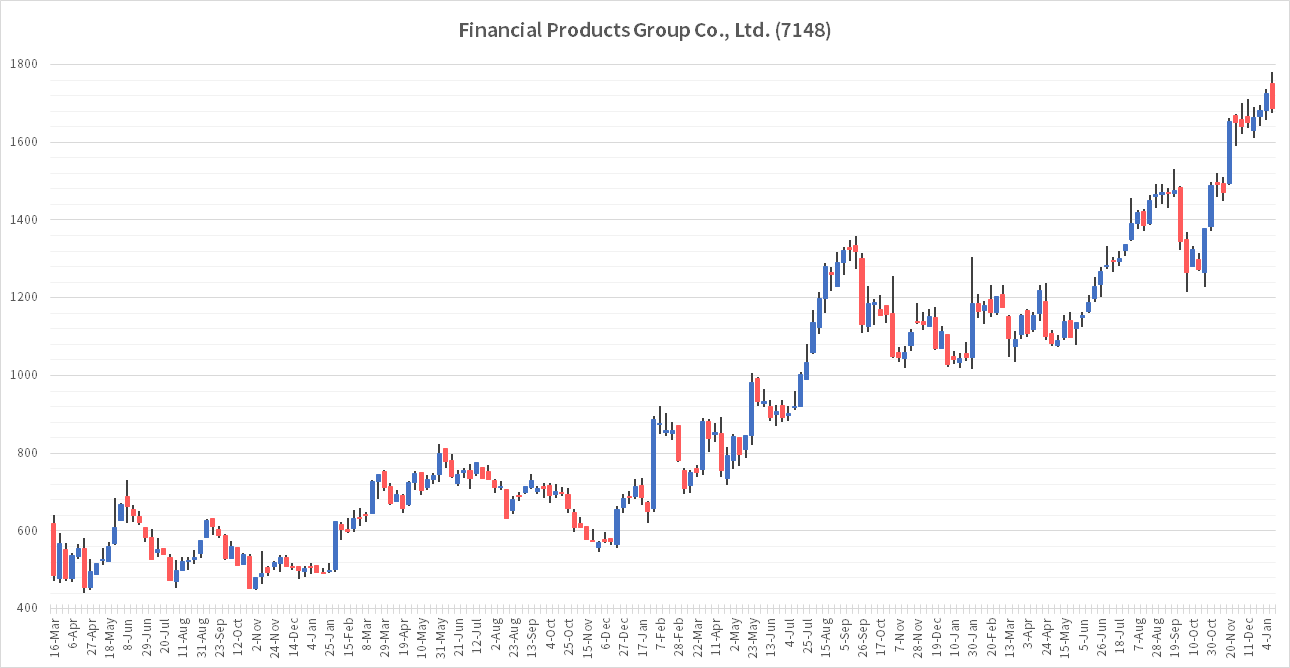

In this issue, I would like to introduce you to the Financial Products Group (FPG), the No. 2 among my main stocks.

This article calculates the exchange rate at "$0.0071/yen" (140 yen/$).

The sales and other figures used in this article are current as of the time of writing. The figures may have changed significantly depending on your viewing period.

Table of Contents(目次)

| Founding of a company | 2001 |

| Stock exchange listings | [Japan] Tokyo |

| Securities Code | 7148 |

| Yahoo Finance | Financial Products Group Co., Ltd. (7148.T) |

| Fiscal year-end | September 30 |

| Dividend Payment Shareholder Fixed Date | September 30 (When interim dividends are paid, the shareholder fixed date for interim dividend payment is March 31.) |

| Number of shares per unit | 100 shares |

Company Profile

Financial Products Group (FPG) is an independent financial services firm that provides solutions to small businesses and high-net-worth individuals, such as business owners, regarding financial strategies and asset succession. The company's revenue comes from fees for its services.

The company is known as a leader in "Japanese Operating Lease" for aircraft, ships, and marine transportation containers.

What is a Japanese Operating Lease?

The following video, published by FPG, will help you understand " Japanese Operating Lease".

By utilizing the "Japanese Operating Lease", SMEs can expect profit compression effects. Suppose the declining balance method is selected for the depreciation calculation of the subject leased assets. In that case, the profit and loss of the SPC (Special Purpose Company) tend to be red in the first half of the lease term and black in the second half of the lease term.

Clients can compress their profits by offsetting the profit from their core business and the loss from a silent partnership in proportion to their investment ratio. The effect of deferral of profits can be enjoyed. The deferred effect of taxable income also allows the company to increase its retained earnings.

Business Portfolio

| Business | Ratio | Remarks |

|---|---|---|

| Leasing Fund Business | 31.2% | Leasing fund business for aircraft, ships, and shipping containers. |

| Real Estate Fund Business | 67.3% | Real estate fund business in Japan and overseas. |

| Other Businesses | 1.5% | Insurance and M&A business, etc. |

FPG has grown through its leasing fund business for aircraft, ships, and shipping containers, in which it solicits investments from investors. In recent years, the company has established a second and third pillar, including providing domestic real estate small-lot products and overseas real estate investment products, driving its performance. Currently, the company is focusing on building a fourth pillar.

FPG's Strengths

FPG has established a strong sales network with over 6,700 accounting firms and over 150 financial institutions. Another advantage is that only a few companies handle Japanese-style operating leases.

Fewer competitors and higher barriers to entry mean that the company can avoid price competition, such as lower commissions. The company will continue to be a leading company handling Japanese-style operating leases. The company will maintain and gain a leading position in the field of leasing funds and domestic and international real estate funds.

About Corporate Performance

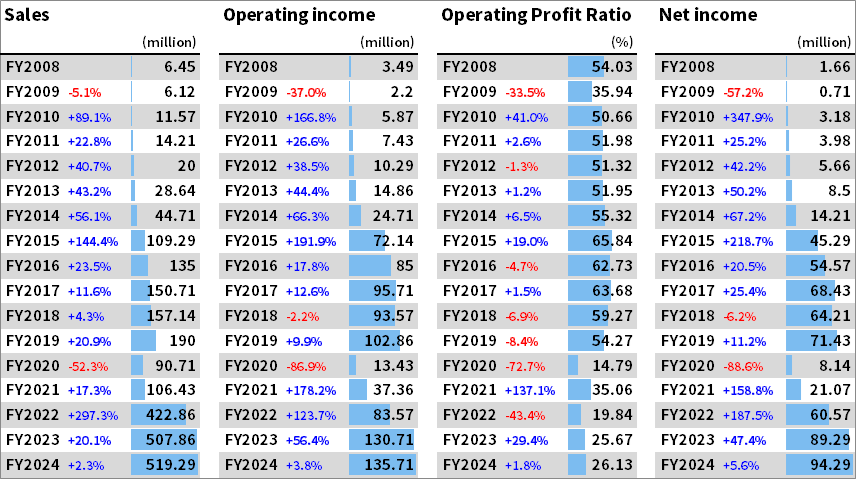

(The image attached below is a webmaster's re-display of the information on https://irbank.net/E24651/results, converted to dollar amounts. * FY2024 is a forecast.)

Sales, Operating income, Operating Profit Ratio, Net income

FPG's performance has been on the upswing; in FY2020 and FY2021, the aviation industry was severely damaged by COVID-19, which also affected the company's results. However, the company eventually landed in the black. In other words, the products are designed to endure even if there is a significant negative impact on business. Before COVID-19, the company's operating profit exceeded 50%. Due to this high profitability, the company did not lose money.

Since FY2020, operating income has fallen to the 20% level, which is likely due to the start of new businesses such as real estate funds. However, even if operating income drops, revenue has increased significantly (more than double compared to FY2019!) due to the new pillar of real estate funds in addition to the operating lease business, and operating income and net income have increased accordingly. ), and operating income and net income have increased accordingly.

Shareholder value will continue to increase as the company increases revenues and operates more efficiently.

EPS, ROE

EPS is increasing steadily, and we know the cause of the temporary decline, so it is not a problem.

ROE is around 30%. As will be discussed later, the company has declared a dividend payout ratio of 50%. This means that half of the company's profits are allocated to shareholder returns, resulting in a high ROE. This shows that the company is proactive in returning profits to shareholders.

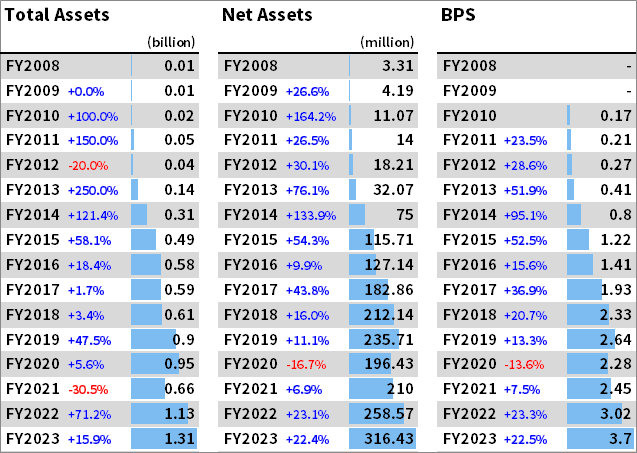

Total Assets, Net Assets, BPS

Total Assets, Net Assets, and BPS are all increasing steadily.

The company is also increasing its interest-bearing debt, which is necessary to structure investment products. Since the investment products are aircraft and real estate, such as buildings, the company needs to borrow a lot of money to finance the products. So please be assured that the company is not borrowing money because of its financial problems. If the company had a management problem, setting a high dividend payout ratio would be impossible.

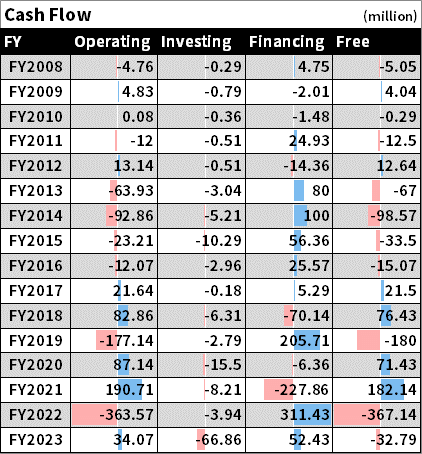

Cash Flow

Cash flow does not seem to be an issue either. However, some may be concerned about the deficit in operating CF. This is largely due to the impact of FPG's handling of expensive investment products.

To originate an investment product, the company first borrows funds from a bank to purchase the product. In other words, if the investment product is not sold in the same year, the result would be an increased financial FC and a negative operating CF.

Of course, in the next fiscal year, the investment product will be sold, and the associated commission will be the company's profit. Therefore, it can be said that the CF is not a problem for the management.

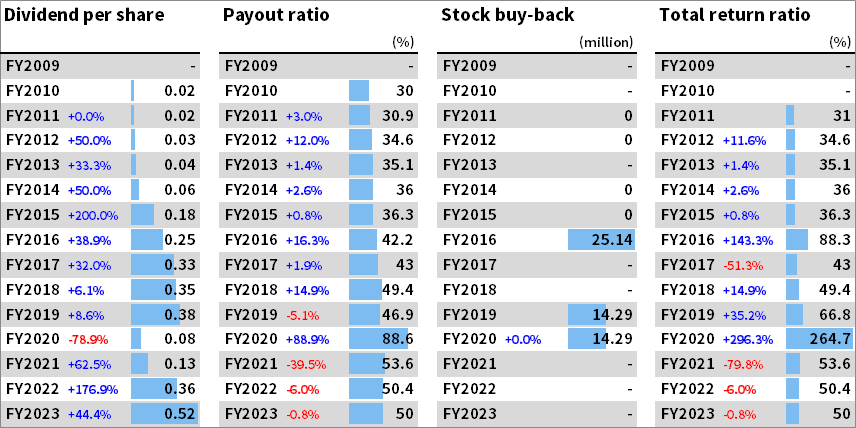

Dividends are performance-linked, and the dividend payout ratio of 50% has been announced.

So, in FY2020 and FY2021, when performance was temporarily poor, dividends were small. However, dividends have also increased along with the increase in net income. The dividend payout ratio of 50% is expected to be maintained in the future.

The company also conducts share buybacks but has not done so in the last three years. We hope that the company will aggressively buy back its shares, as its stock price is sometimes low compared to its track record.

The total return ratio is basically unlikely to fall below 50% since the dividend payout ratio is 50%.

General Review

It is fair to say that the company's performance has been very good. The company is also tough enough to remain profitable even when the airline industry has been severely damaged. Furthermore, the company is proactive in returning profits to shareholders. Since FY2020, the company has been focusing on real estate funds and has been enhancing its business portfolio.

The company will continue to grow in the future.

Should I hold the stock or not?

I have 25% of FPG stock in my portfolio and intend to continue to hold this stock for the long term.

However, I am cautious about whether to buy more. I try to concentrate my investments in companies that continue to grow, including share price appreciation. However, once I exceed 25% of my portfolio, I get a yellow light from a diversification perspective. Although I invest in concentrated stocks, I always consider diversification, which is the basis of stock investment.

However, since these are stocks that I can safely hold for the long term, I will continue to hold on to them without any thoughts of selling them!

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.

![2023 Final Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2023/12/eyecatch_028-150x150.webp)