![August 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/08/eyecatch_193.webp)

Summary of investment and asset management performance for August 2025.

This article calculates the exchange rate at "$0.00690/yen" (145 yen/$).

The sales and other figures used in this article are current as of the time of writing. Depending on your viewing period, the figures may have changed significantly.

Table of Contents(目次)

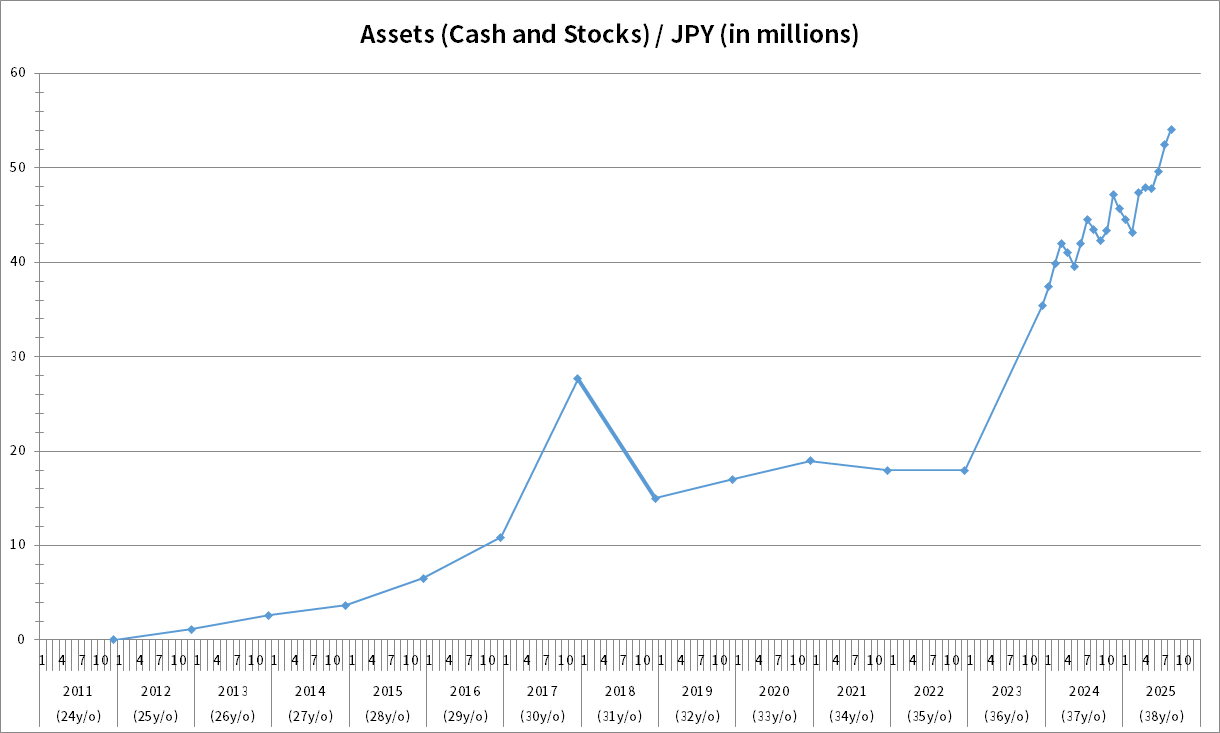

August 2025 Investment Results and Asset Growth

The chart below shows the change in my assets. The rightmost point indicates my assets at the end of August 2025, which totaled 54.12 million yen (approximately $0.373 million).

The month-over-month change in assets was +3.16%.

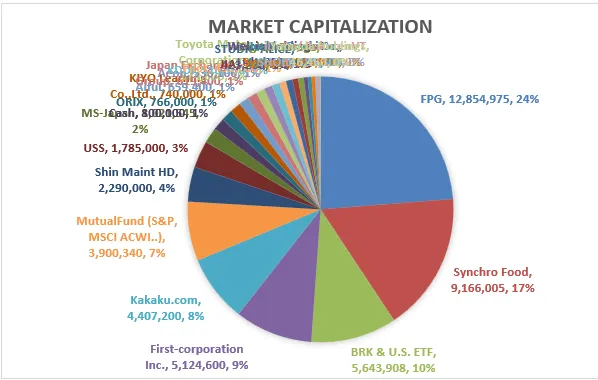

My August 2025 Asset Allocation (Portfolio Breakdown)

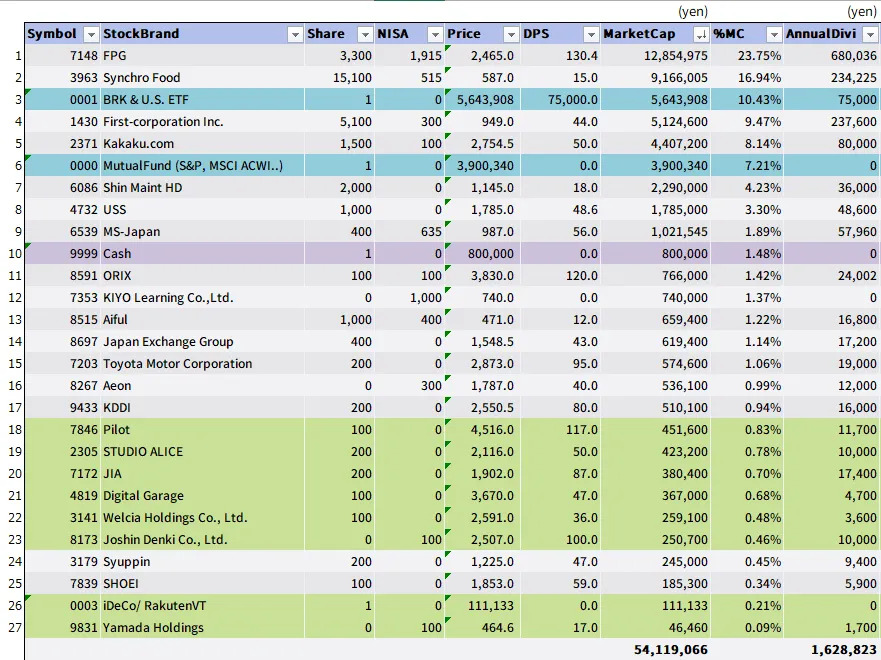

As of the start of August, I owned the following assets, and their composition remained unchanged throughout the month.

- Cash

- Cash equities (Japanese Stocks/U.S. Stocks)

- U.S. ETFs

- Mutual Funds

The stocks and mutual funds purchased this month are as follows:

- Berkshire Hathaway Inc. (BRK-B): 1 share purchased on the spot

- S&P 500-linked investment trust: 50,000 yen

- ACWI-linked investment trust: 50,000 yen

The stocks and investment trusts purchased this time are part of a plan to make regular monthly purchases. Therefore, there were no unplanned stock purchases.

Cash increased due to dividends from the following companies, in addition to salary.

The current total assets are 54,119,066 yen as shown in the asset statement.

For the meaning of each column in the asset table, please refer to the article “June 2025 Results [Asset Trends Disclosure].”

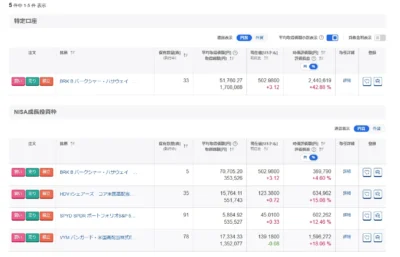

High-Dividend U.S. ETFs I Hold (HDV, SPYD, VYM)

U.S. Stocks

This time, I'll explain the U.S. ETFs I own. My U.S. ETFs are included in the market value of the “BRK & U.S. ETF” row in the asset statement I publish. This row also includes the value of my U.S. stocks (BRK-B). The reason for this presentation is that my brokerage categorizes them all under “U.S. Stocks.” I decided that categorizing my asset statement the same way would reduce my daily management costs.

Fundamentally, I have no intention of trading individual U.S. stocks except for “BRK-B”. As a Japanese person whose native language is not English, it takes me considerable time to thoroughly verify each company's performance. Moreover, since I don't live locally, I cannot actually experience the products and services each company offers before making an investment. Therefore, I choose to invest using mutual funds and ETFs, which enable me to diversify my holdings broadly across numerous American companies.

The U.S. ETFs I Hold

The figure below shows a list of my U.S. Stocks. It may be a bit difficult to read, as some Japanese is included, but each ticker symbol appears at the beginning of the stock name.

The ETFs I currently hold are as follows:

Some of you may already be familiar with these names. These ETFs invest in high-dividend U.S. stocks. The purchase ratio I use is HDV:SPYD:VYM = 1:1:2. I bought a bit more of VYM because I believe it also has good growth potential.

The reason I buy ETFs that invest in high-dividend stocks is that Japan has an account called NISA, which allows you to receive dividends and capital gains tax-free. By combining ETFs with relatively high dividends to build my portfolio, my aim is to efficiently generate income gains. (Strictly speaking, the amount is credited after a 10% tax is withheld in the U.S.)

From the perspective of capital efficiency and performance, it might be better to choose an S&P 500 index mutual fund. However, when I consider how to manage my investments after retiring from work, I believe it’s better to have a balanced mix of both capital gains and income gains, rather than relying solely on capital gains.

I intend to continue investing in high-dividend U.S. ETFs.

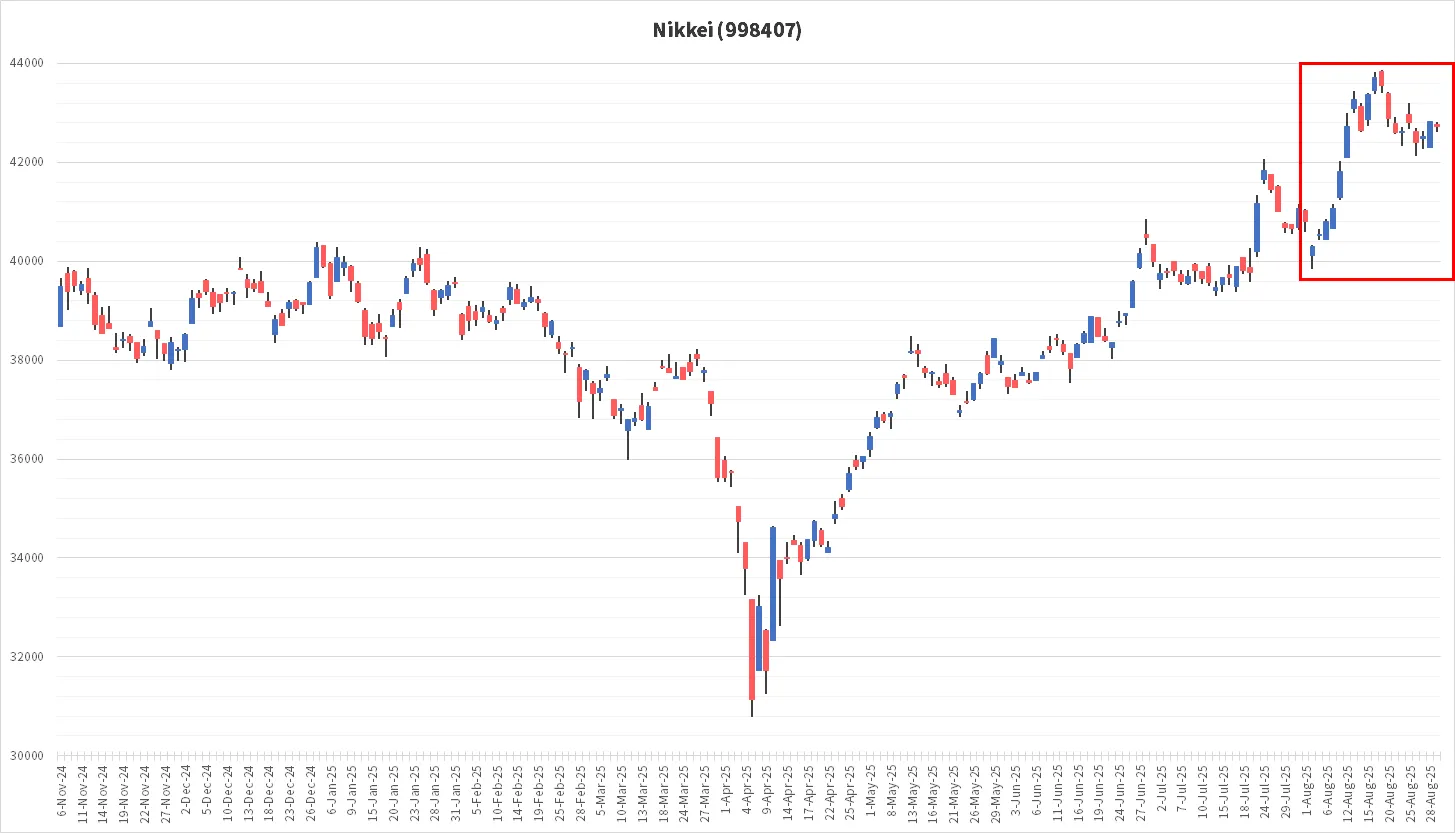

Nikkei 225 Hits All-Time High: Impact on My Portfolio

The Nikkei 225 surged significantly, setting a new all-time high.

While my holdings have also risen, their gains feel smaller compared to the Nikkei 225. The reason is that the Nikkei 225 is structured to be more influenced by stocks with high per-share prices, rather than being a market capitalization-weighted average. Therefore, it's common for only a few stocks to rise, while the share prices of major Japanese companies like TOYOTA Motor Corporation don't necessarily follow suit.

Still, the Nikkei 225's rise can be seen as reflecting broader optimism about Japan's overall stock market performance, which I certainly hope for. That said, I'd be delighted if the stocks I hold also saw significant price increases.

Finally

In July, my assets surpassed 50 million yen, and in August, I continued to set new personal records.

August saw earnings announcements from Japanese companies. While some reported solid results, others lowered their full-year forecasts. Particularly, many companies seemed to revise their performance downward in anticipation of uncertainty surrounding tariffs with the United States.

Among the companies I hold, some reported lackluster earnings, yet their stock prices surprisingly didn't drop much. While future movements remain uncertain, I intend to continue my buy-and-hold strategy.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.

![June 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/06/eyecatch_126-150x150.webp)

![July 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/07/eyecatch_153-150x150.webp)

![May 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/05/eyecatch_125-150x150.webp)

![January-April 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/05/eyecatch_124-150x150.webp)

![2024 Final Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/01/2024_results-150x150.png)