![April 2024 Result [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2024/05/eyecatch_092.webp)

Summary of investment and asset management performance for April 2024.

This article calculates the exchange rate at "$0.0067/yen" (150 yen/$).

The sales and other figures used in this article are current as of the time of writing. Depending on your viewing period, the figures may have changed significantly.

Table of Contents(目次)

April 2024 Result

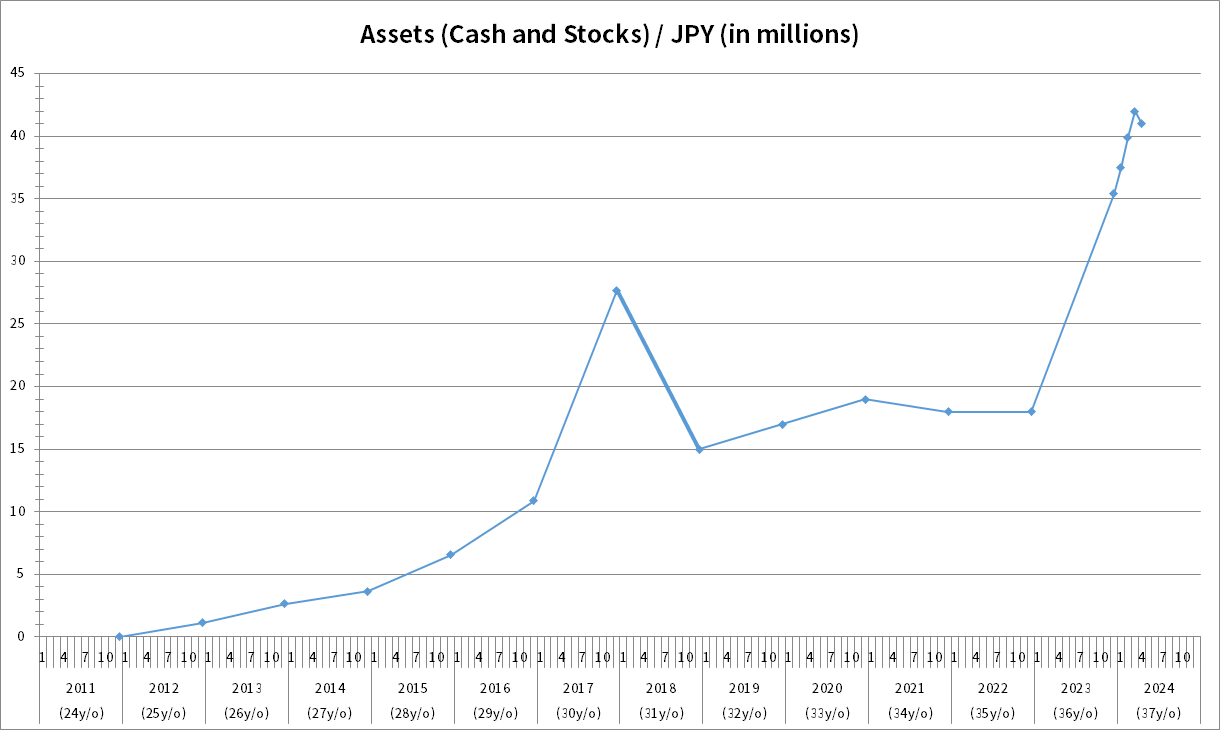

The chart below shows the transition of my assets. The rightmost point is the amount of assets at the end of April 2024, which is 41 million yen (about $0.27 million). At the end of March 2024, my assets were 42 million yen(about $0.28 million), which means a change of -2.38%.

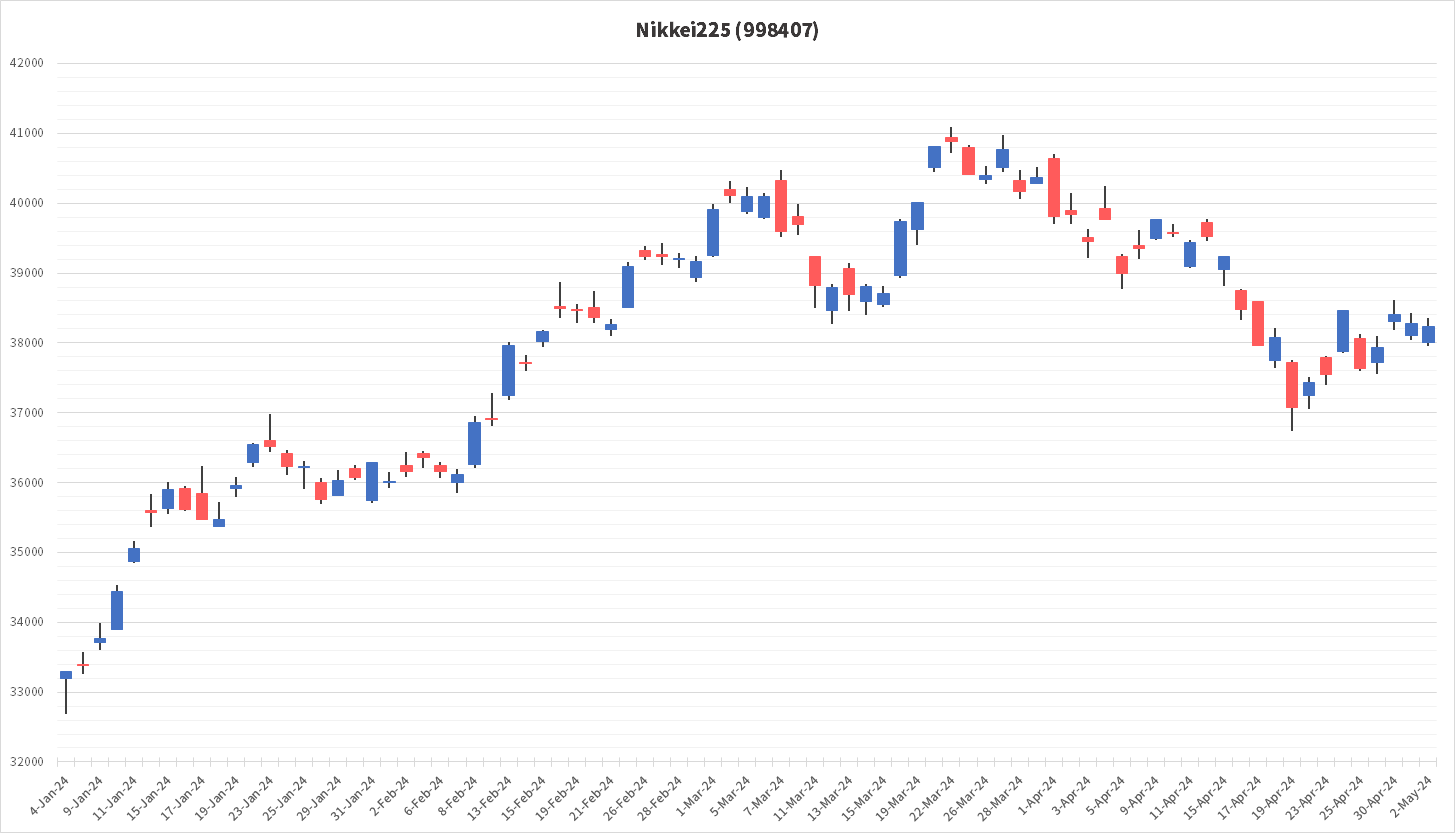

The Nikkei 225 is trending slightly lower.

The Nikkei 225 has continued to be soft, a change from the days through March. This is because there was a lot of news running around; for example, there was news about Israel's relations with Iran, and the scenario of a rate cut on US Treasuries went awry because of the strong US economic indicators. The media likes to look for reasons why stock prices are falling, but in many cases, it is pointless to be swayed by such observations.

A stock price that rises in the short term may eventually fall. This same phenomenon occurs even in the stock prices of companies performing well. So, the uptrend will not change unless there is a reason, such as a deterioration in the overall performance of Japanese companies.

There may have been a move to liquidate the position.

The announcement of FY2024 results is forthcoming for companies with fiscal years ending in March. In Japan, many companies close their books in March, and around mid-April, companies begin to announce their FY2024 financial results. In particular, many companies will announce their FY2024 financial results between May 7 and 15. Each company's FY2025 earnings forecast is also released during this earnings announcement.

Among my stock holdings, JPX(Japan Exchange Group, Inc. (8697.T)) and JIA(Japan Investment Adviser Co., Ltd. (7172.T)), companies with a March fiscal year end, announced their financial results on Tuesday, April 30. (I will post more on these companies' financial results after I have examined their contents.) After May 7, the financial results of my holdings will be announced one after another.

Therefore, many institutional investors and individuals are likely to liquidate their stock positions in preparation for the volatility in stock prices during earnings announcements in May. This may be the reason why the Nikkei 225 was soft in April.

Finally

The webmaster's assets have decreased compared to the end of March, but this is not pessimistic. Instead, the companies that announced earnings in April performed well, and we look forward to the future.

Temporary declines in stock prices are expected, so we should not be happy or sad. There has been no change in the webmaster's policy. I scrutinize the companies' performance results and future forecasts and hold the stocks of companies whose performance will grow with a long-term perspective.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.

![FPG announced an upward revision to its financial results. [22/03/2024]](https://financial-textbook.com/wp-content/uploads/2024/03/eyecatch_069-150x150.webp)