![2023 Final Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2023/12/eyecatch_028.webp)

Summary of investment and asset results for 2023.

This article calculates the exchange rate at "$0.0071/yen" (140 yen/$).

The sales and other figures used in this article are current as of the time of writing. The figures may have changed significantly depending on your viewing period.

Table of Contents(目次)

2023 Final Results

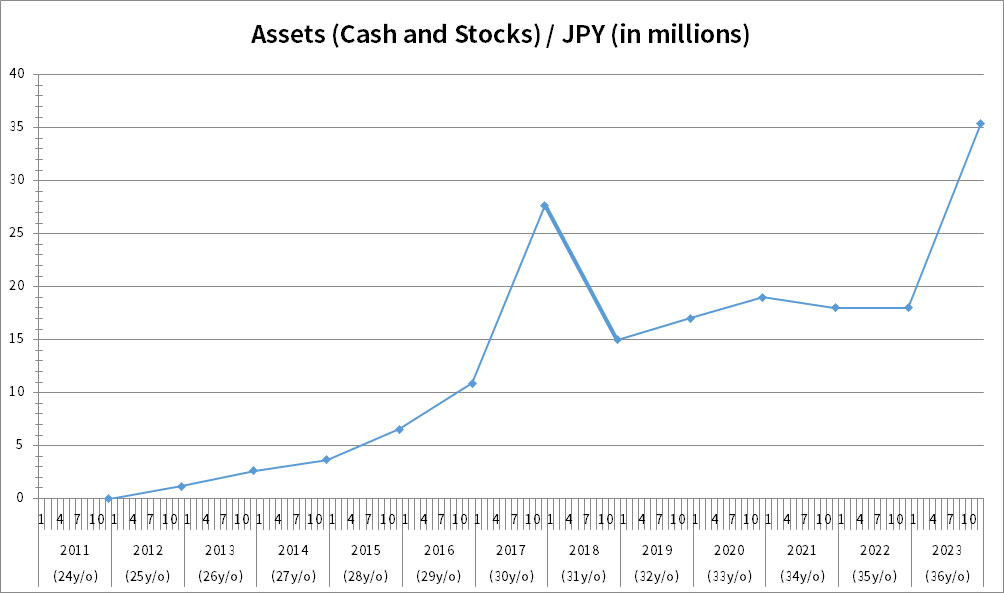

The results of my equity management in 2023 were excellent. My assets increased by a whopping +96% over the previous year. This includes some deposits from my paycheck, but mostly due to rising stock prices.

Two of my holdings that have had particularly strong gains are Synchro Food and FPG. These two stocks will be presented in a later issue analysis.

In the end, my assets came to 35.4M yen ($252.8K).

Time series of year-over-year changes in assets

This is my table of asset management performance to date. Performance in 2021 and 2022 was lackluster, although my salary was also deposited. However, the stocks I had bought when stock prices were lackluster increased significantly in 2023.

| End of | Assets (Yen / Dollar) | Change (%) / History |

|---|---|---|

| 2011 | 0yen / $0 | |

| 2012 | 1.15M yen / $8.2K | Initially, I had little money and little profit from my investments, so I saved what I could and used that to purchase shares. |

| 2013 | 2.64M yen / $18.8K | +130% |

| 2014 | 3.67M yen / $26.2K | +39% |

| 2015 | 6.55M yen / $46.7K | +78% |

| 2016 | 10.91M yen / $77.9K | +66% |

| 2017 | 27.68M yen / $197.7K | +153% |

| 2018 | 15M yen / $107.1K | -45% |

| 2019 | 17M yen / $121.4K | +13% |

| 2020 | 19M yen / $135.7K | +11% Stock market decline due to COVID-19. The restaurant and airline industries, which are related to my holdings, were hit. Sluggishness continues through 2023. |

| 2021 | 18M yen / $128.5K | -5% |

| 2022 | 18M yen / $128.5K | +0% |

| 2023 | 35.4M yen / $252.8K | +96% Japan's economy had been in the doldrums due to COVID-19, but with the May revision, things have returned to their normal routine. The price of the stocks I had purchased in 2020-2022 will rise significantly, with the value of my assets rising a whopping +96.7%. |

Compounding Yields/ Since 2012

The table below shows the compounded yields on asset growth since 2012. This includes the impact of deposits (stock purchases) from my payroll. So, especially when my assets are small, the yield appears large due to the impact of the deposit amount.

At the end of 2023, the compounded yield is +36%.

We can see from this that it is important, especially in the early stages of investing, to transfer as much of one's salary as possible into equities.

| End of | Assets (Yen / Dollar) | Compounding Yields Since 2012 |

|---|---|---|

| 2011 | 0yen / $0 | - |

| 2012 | 1.15M yen / $8.2K | - Compounding from 2012, the yield looks large because of the large impact of the deposits from my paycheck. |

| 2013 | 2.64M yen / $18.8K | +130% |

| 2014 | 3.67M yen / $26.2K | +78% |

| 2015 | 6.55M yen / $46.7K | +78% |

| 2016 | 10.91M yen / $77.9K | +75% |

| 2017 | 27.68M yen / $197.7K | +89% |

| 2018 | 15M yen / $107.1K | +53% |

| 2019 | 17M yen / $121.4K | +47% |

| 2020 | 19M yen / $135.7K | +42% |

| 2021 | 18M yen / $128.5K | +36% |

| 2022 | 18M yen / $128.5K | +32% |

| 2023 | 35.4M yen / $252.8K | +36% |

Compounding Yields/ Since 2016

Once assets exceed 10 million yen ($71,000), the impact of stock prices is greater than the impact of deposits. For this reason, I have tabulated the results of the compounded yield since the end of 2016, when my assets first exceeded 10 million yen.

At the end of 2023, the yield is +18%. This is not pure stock performance, as it includes deposits from my salary, but it may be considered a good result.

| End of | Assets (Yen / Dollar) | Compounding Yields Since 2016 |

|---|---|---|

| 2016 | 10.91M yen / $77.9K | - When assets exceed 10 million yen ($71,000), the impact of stock prices is greater than the impact of deposits. |

| 2017 | 27.68M yen / $197.7K | +153% |

| 2018 | 15M yen / $107.1K | +17% |

| 2019 | 17M yen / $121.4K | +16% |

| 2020 | 19M yen / $135.7K | +15% |

| 2021 | 18M yen / $128.5K | +10% |

| 2022 | 18M yen / $128.5K | +8% |

| 2023 | 35.4M yen / $252.8K | +18% |

Finally

I have continued to hold my stocks in the belief that once the effects of COVID-19 are gone and the economy normalizes, my holdings will increase in profit. As a result, I have seen excellent gains in 2023. I will continue to invest aggressively when I come across great stocks through my analysis of stocks on this website and on the assumption that I will hold them for the long term.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.