Summary of investment and asset results for 2025.

This article uses an exchange rate of "$0.00637/yen" (157 yen/$).

The sales figures and other data used in this article are current as of the time of writing. Depending on when you read this, the figures may have changed significantly.

Table of Contents(目次)

2025 Final Results

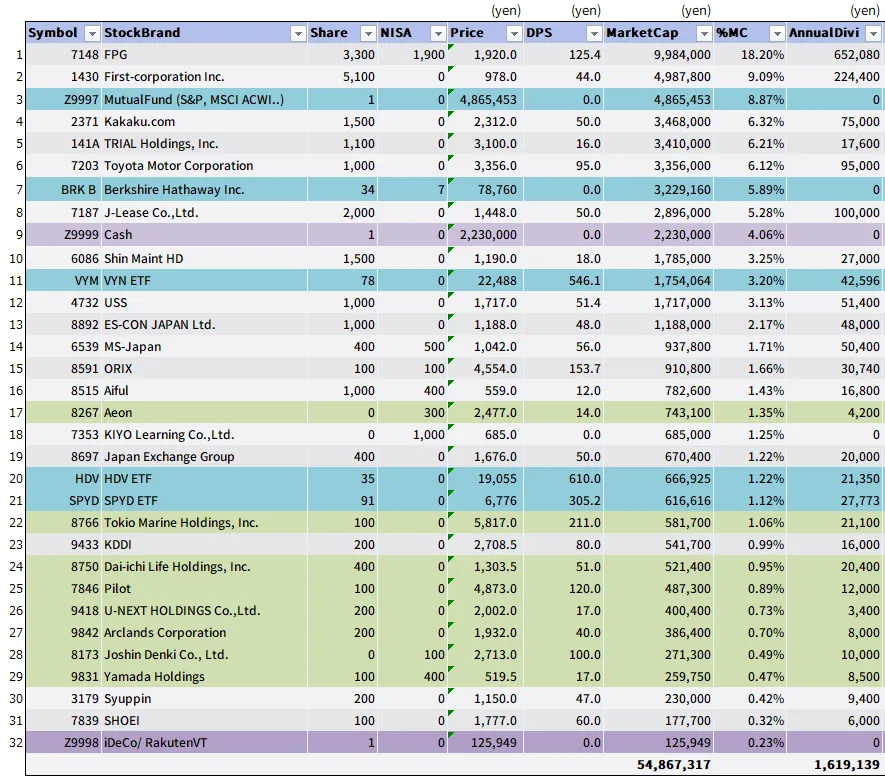

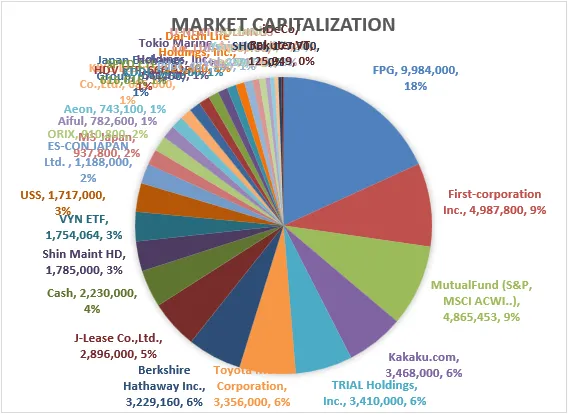

The webmaster’s stock investment performance for 2025 was +9,179,877 yen (20.12%) compared to the previous year. My total assets ultimately reached 54.86M yen ($349.47K).

Portfolio Breakdown

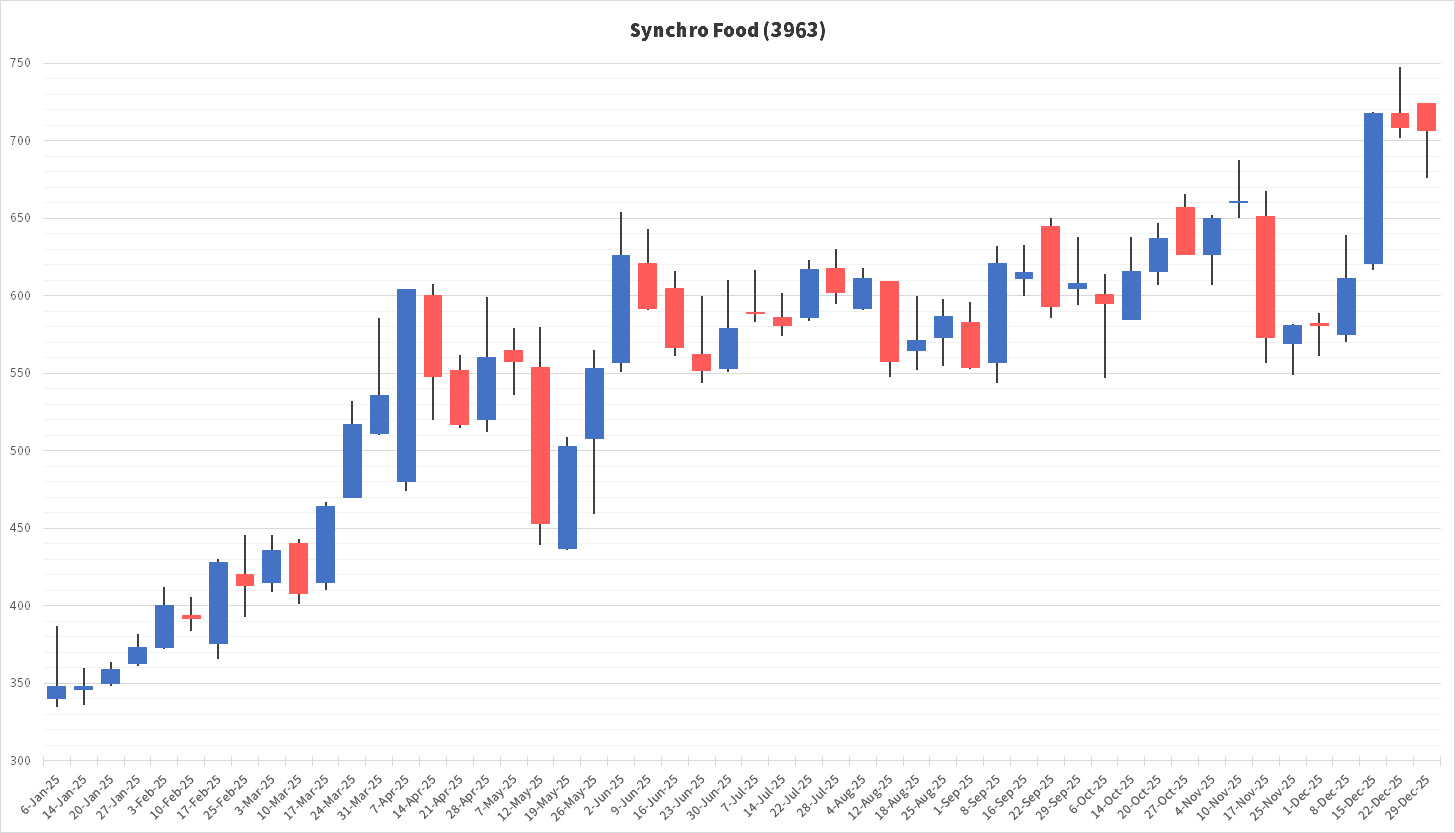

My asset breakdown is shown below. I sold all of my shares in Synchro Food, which had been my core holding, and used the proceeds to purchase other stocks. The timing may not have been perfect, but I fully liquidated the position within December to prepare for entering 2026 with a new portfolio composition.

For an explanation of each column in the asset table, please refer to the article “June 2025 Results [Asset Trends Disclosure]”.

Synchro Food had been my core holding, but I decided to sell all of my shares. The reasons are as follows.

- Signs of weakness have begun to appear in what had previously been strong business performance.

- The founder, who was a major shareholder, sold a significant portion of his shares.

- The founder became chairman without executive authority.

I invest in companies where the founder, as a major shareholder, firmly steers the business and steadily grows it. However, when those conditions collapse, I have no choice but to sell.

In my view, the situation at Synchro Food ultimately stemmed from the founder’s pride.

The Japanese stock market is divided into three segments—Prime, Standard, and Growth—based on criteria such as market capitalization. Large-cap companies like Toyota Motor Corporation are listed on the Prime market, but Synchro Food failed to meet the requirements, including market capitalization, needed to remain in the Prime market. The company attempted to increase its scale through M&A, but these efforts failed. As a result, it was unable to grow sales or profits, and the stock price declined.

At that point, moving to the Standard market should have been an option, but the founder’s excessive pride proved to be a fatal flaw. Despite needing to raise the stock price to stay in the Prime market, the company inexplicably carried out capital increases. When the stock price fell, it then engaged in share buybacks, continuing a series of contradictory actions. Ultimately, the founder sold a large portion of his shares and lost control. I had grown thoroughly tired of these misguided decisions and had been considering when to exit.

The only silver lining for me was that from 2025 onward, asset management firms such as “Asset Value Investors Limited” and “LIM Advisors Limited” purchased large amounts of Synchro Food shares, pushing the stock price higher. Compared with the lows of 2024, the price recovered to a more reasonable level, but with the current PER exceeding 40x, I felt that continuing to hold the stock carried significant risk. As a result, I sold all of my shares in December.

Time Series of Year-over-Year Changes in Assets

The table below shows my historical investment performance. The “Change (%)/History” column indicates the year-over-year asset growth rate, while “Compounding Yields Since 2012” represents the compounded return (%) achieved since 2012. Because this record begins from a period when my assets were relatively small, contributions from salary savings had a significant impact, especially in the early years, resulting in larger percentage figures.

| End of | Assets (Yen / Dollar) | Change (%) / History | Compounding Yields Since 2012 |

|---|---|---|---|

| 2011 | 0yen / $0 | ||

| 2012 | 1.15M yen / $8.2K | At this stage, I had little capital and minimal investment gains, so I saved what I could and used those savings to purchase shares. | |

| 2013 | 2.64M yen / $18.8K | +130% | +130% |

| 2014 | 3.67M yen / $26.2K | +39% | +78% |

| 2015 | 6.55M yen / $46.7K | +78% | +78% |

| 2016 | 10.91M yen / $77.9K | +66% | +75% |

| 2017 | 27.68M yen / $197.7K | +153% | +89% |

| 2018 | 15M yen / $107.1K | -45% | +53% |

| 2019 | 17M yen / $121.4K | +13% | +47% |

| 2020 | 19M yen / $135.7K | +11% The stock market declined due to COVID-19, severely impacting the restaurant and airline industries related to my holdings. This sluggishness continued through 2023. | +42% |

| 2021 | 18M yen / $128.5K | -5% | +36% |

| 2022 | 18M yen / $128.5K | +0% | +32% |

| 2023 | 35.4M yen / $252.8K | +96% Japan’s economy had stagnated due to COVID-19, but following the May revision, economic activity returned to normal. The stocks I purchased between 2020 and 2022 rose sharply, resulting in a remarkable +96.7% increase in my asset value. | +36% |

| 2024 | 45.6M yen / $291.0K | 29.06% | +36% |

| 2025 | 54.86M yen / $349.47K | 20.1% | +35% |

Compounding Yields / Since 2016

Once assets exceed 10 million yen (approximately $63,700), fluctuations in stock prices can outweigh the impact of new savings. For this reason, I have summarized the compounded return (%) since the end of 2016, when my assets first surpassed 10 million yen.

As of the end of 2025, the compounded return stands at +19.7%. This figure includes savings from my salary. In other words, it reflects a combination of capital investment through stocks and labor income. While it is not a pure stock investment return, it can still be considered a solid result.

| End of | Assets (Yen / Dollar) | Compounding Yields Since 2016 |

|---|---|---|

| 2016 | 10.91M yen / $77.9K | - |

| 2017 | 27.68M yen / $197.7K | +153% |

| 2018 | 15M yen / $107.1K | +17% |

| 2019 | 17M yen / $121.4K | +16% |

| 2020 | 19M yen / $135.7K | +15% |

| 2021 | 18M yen / $128.5K | +10% |

| 2022 | 18M yen / $128.5K | +8% |

| 2023 | 35.4M yen / $252.8K | +18.3% |

| 2024 | 45.6M yen / $291.0K | +19.6% |

| 2025 | 54.86M yen / $349.47K | +19.7% |

Comparison with the Nikkei 225

The Nikkei 225 gained +10,445 yen in 2025 (+26.18%).

My performance for the year was 20.12%. As a result, my investment performance in 2025 underperformed the Nikkei Stock Average. One contributing factor was that the share price of FPG, my core holding, did not rise significantly over the past year.

However, rather than focusing solely on single-year results, I place the greatest emphasis on long-term performance and aim to outperform the index over the long run.

In Closing

There was a great deal of positive news for Japan in 2025, but the most significant was the inauguration of the Sanae Takaichi administration. The birth of Japan’s first female prime minister is truly welcome news. The Takaichi administration aims to stimulate the economy and boost consumption through proactive fiscal policy that encourages investment. While this increases the amount of money circulating in the economy, it also means that the value of cash is diluted.

In other words, as a weaker yen drives higher prices and inflation, those who hold assets only in cash will find their lives becoming more difficult. On the other hand, people who hold inflation-resistant assets such as stocks may be able to hedge against inflation while increasing their wealth.

Will these policies prove beneficial? The future is impossible to predict, but at the very least, in an aging society with a declining birthrate like Japan, support for the elderly will place an enormous burden on the system. For that reason, I believe we are reaching a point where we must tolerate a certain level of inflation, even if it involves some pain. However, rather than simply accepting that pain, we should counter inflation by also benefiting from gains through stock investing.

I feel extremely fortunate to have learned about stock investing more than a decade ago and to have been able to build a certain level of assets by now. To combat inflation, I still need to continue increasing my asset base. However, I believe that by carefully selecting and holding high-quality stocks, it will one day be possible to reach the milestone of 100 million yen. (Although, due to inflation eroding future value, it may be necessary to aim for 200 million yen instead 😂.)

Going forward, I will continue to steadily purchase stocks using a portion of my salary and share that information here. With that in mind, I appreciate your continued support of the Japanese stock market and this site in 2026 as well.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.

![June 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/06/eyecatch_126-150x150.webp)

![2024 Final Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/01/2024_results-150x150.png)