Summary of investment and asset management performance for September 2025.

* Since the data could not be finalized by the end of September, this report reflects figures as of the market close on October 3.

This report uses an exchange rate of $0.00690/¥ (equivalent to ¥145/$).

The sales and other figures shown are current as of the time of writing. Depending on when you read this, the numbers may have changed significantly.

Table of Contents(目次)

September 2025 Investment Results and Asset Growth

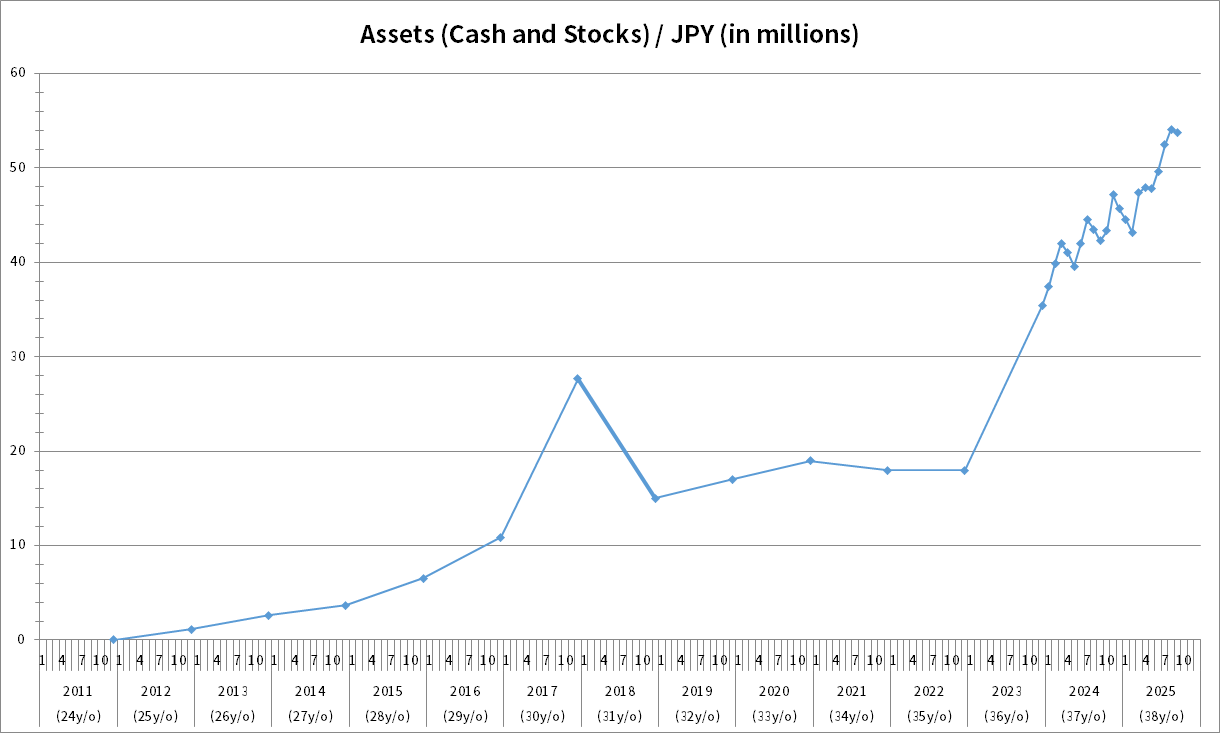

The chart below illustrates the change in my total assets. The rightmost point represents my assets at the end of August 2025, which totaled ¥53.71 million (approximately $0.37 million).

The month-over-month change in assets was -0.75%.

My September 2025 Asset Allocation (Portfolio Breakdown)

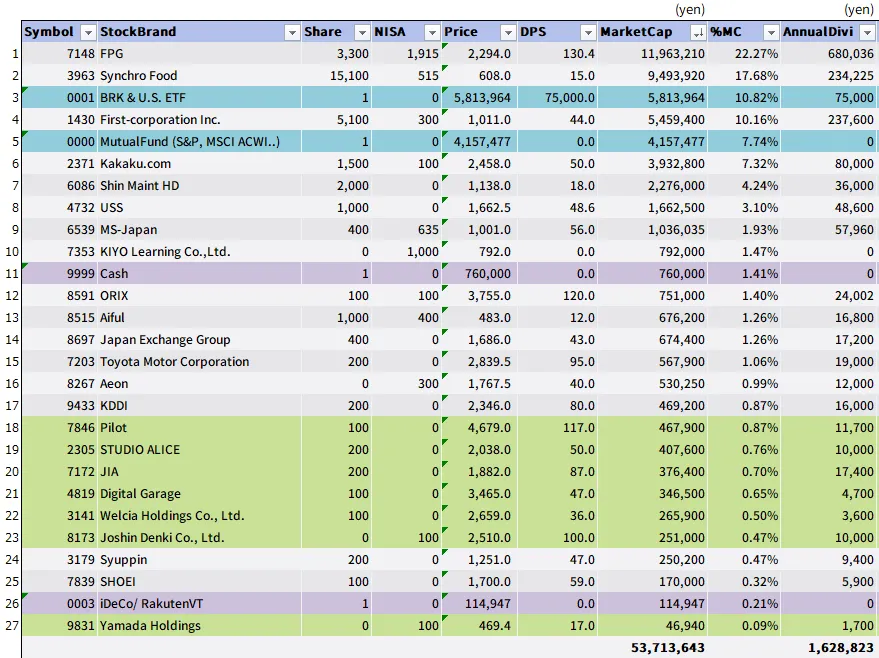

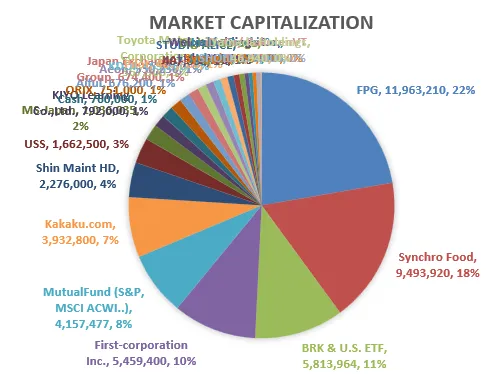

At the start of September, I held the following asset classes, and their composition remained unchanged throughout the month:

This month, I made the following purchases:

- Berkshire Hathaway Inc. (BRK-B): 1 share (spot buy)

- S&P 500–linked investment trust: ¥50,000

- ACWI-linked investment trust: ¥50,000

These purchases are part of a regular monthly investment plan, so there were no additional or unplanned trades this month.

As shown in the asset summary, my total assets currently amount to ¥53,713,643.

For an explanation of each column in the asset table, please refer to the article “June 2025 Results [Asset Trends Disclosure]”.

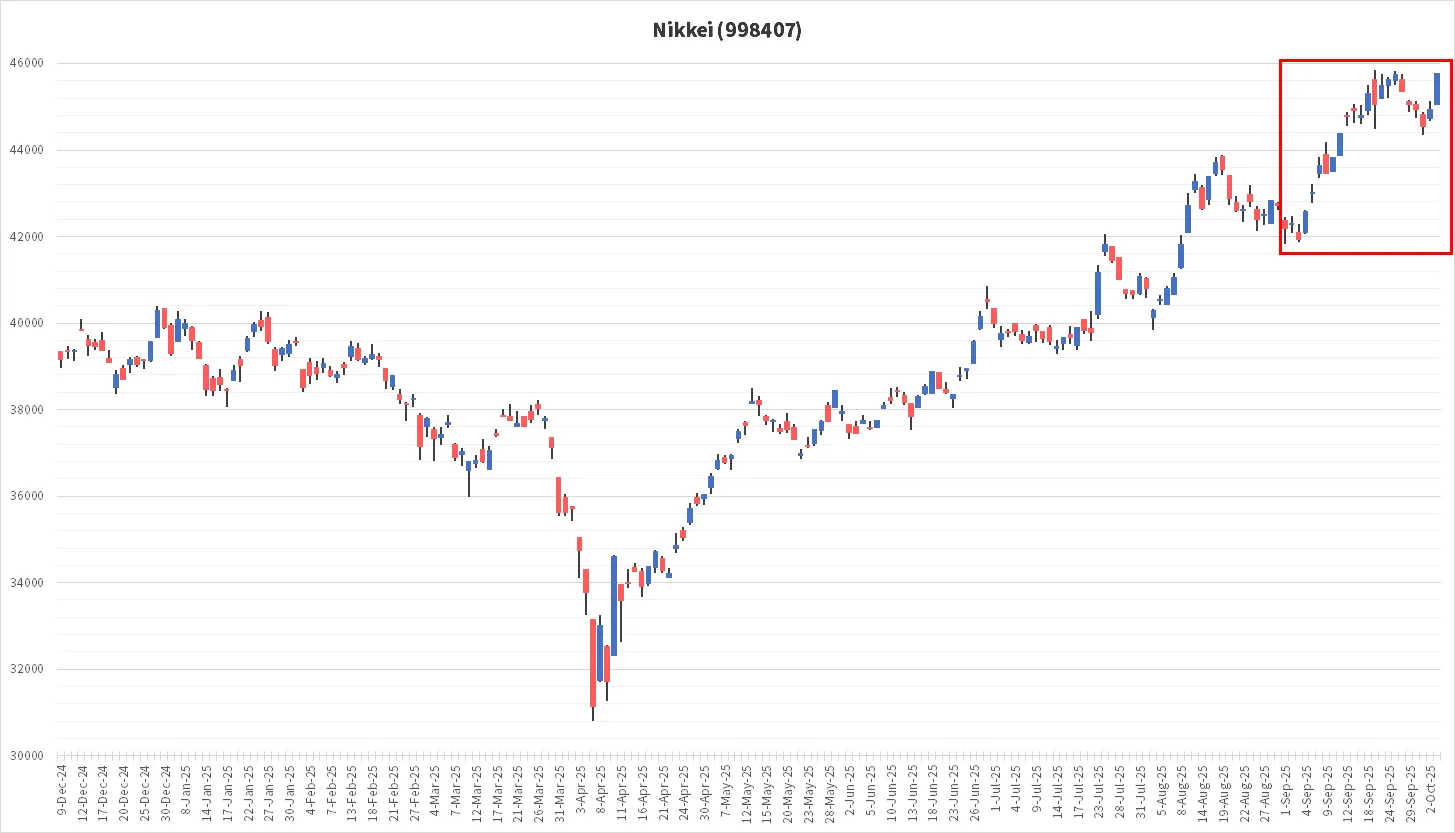

Nikkei 225 Hits an All-Time High: Impact on My Portfolio

The Nikkei 225 surged in September, reaching a record high.

Although my holdings also increased in value, the growth was modest compared to the Nikkei 225. This is because the index is more heavily influenced by high-priced stocks rather than being weighted by market capitalization. As a result, even when a few select stocks rally, the share prices of major companies—like Toyota Motor Corporation—don’t necessarily follow suit.

Among Japanese investors, the Nikkei 225 is often called a “flawed index.” For instance, stocks with smaller market caps can exert far greater influence than much larger companies. Here’s an example comparing Advantest Corporation (6857.T) and Toyota Motor Corporation (7203.T):

- Advantest Corporation (6857.T)

- Market Capitalization: ¥12 trillion

- Weight in Nikkei 225: 9.23%

- Toyota Motor Corporation (7203.T)

- Market Capitalization: ¥44 trillion

- Weight in Nikkei 225: 1.04%

Despite Toyota’s market cap being 3.6 times larger, its weight in the Nikkei 225 is just one-ninth that of Advantest. This explains why certain individual stocks don’t necessarily rise when the Nikkei 225 does.

For more details, see the Contribution List for All Nikkei Average Constituent Stocks (Japanese site, but Google Translate works well).

Even if this divergence between the Nikkei Average and individual stocks continues, I plan to stay patient and hold my selected positions for the long term.

Japan Is Back

“Japan is Back” is a phrase used by Sanae Takaichi during the Liberal Democratic Party’s leadership election. After becoming the party leader (and effectively Japan’s next prime minister), she declared her intent to speak confidently on the global stage, including at the United Nations.

On Saturday, October 4, Japan’s Liberal Democratic Party held its leadership election, and Sanae Takaichi was chosen as the new leader. As the ruling party head, she is highly likely to become Japan’s first female prime minister. She has previously held several key government posts, including during former Prime Minister Shinzo Abe’s administration:

- Minister for Economic Security

- Minister of Internal Affairs and Communications

- Minister of State for Science and Technology Policy, Space Policy, and Intellectual Property Strategy

- Chairperson, Policy Research Council, Liberal Democratic Party

- Chairperson, House of Representatives Steering Committee

- Vice Minister of Economy, Trade and Industry

Her conservative views could help strengthen Japan’s economy and refine immigration policies. She has also expressed willingness to engage with President Trump, raising expectations for stronger Japan–U.S. relations.

Over the long term, I’m optimistic about the Japanese market. While short-term corrections are inevitable, improving economic fundamentals and corporate performance could push the Nikkei beyond ¥50,000 someday. (The current level is ¥46,080.)

Although Japan appears to have avoided the worst effects of left-leaning economic mismanagement, the ruling party still includes lawmakers with a broad range of ideologies. I intend to keep a close eye on future developments.

Closing Thoughts

Japan’s political landscape is entering a period of major change. As seen globally, immigration-related unrest is also emerging domestically, creating growing social tension. The Japanese people may not resort to violence, but they express their will through democratic elections. If the new administration can reassess misguided policies of the past, there is reason to be cautiously hopeful about Japan’s future direction.

Having worked with talented individuals from the U.S., France, and China, I value the contributions of skilled professionals. However, I also believe Japan must address issues surrounding unskilled immigration and public safety through proper screening and governance. This isn’t about excluding foreigners—it’s about fostering mutual respect and shared contribution to Japan’s future stability.

After all, a stable society and economy are essential foundations for building wealth.

![June 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/06/eyecatch_126-150x150.webp)

![August 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/08/eyecatch_193-150x150.webp)

![July 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/07/eyecatch_153-150x150.webp)

![May 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/05/eyecatch_125-150x150.webp)

![January-April 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/05/eyecatch_124-150x150.webp)