![July 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/07/eyecatch_153.webp)

Summary of investment and asset management performance for July 2025.

This article calculates the exchange rate at "$0.00690/yen" (145 yen/$).

The sales and other figures used in this article are current as of the time of writing. Depending on your viewing period, the figures may have changed significantly.

Table of Contents(目次)

July 2025 Result

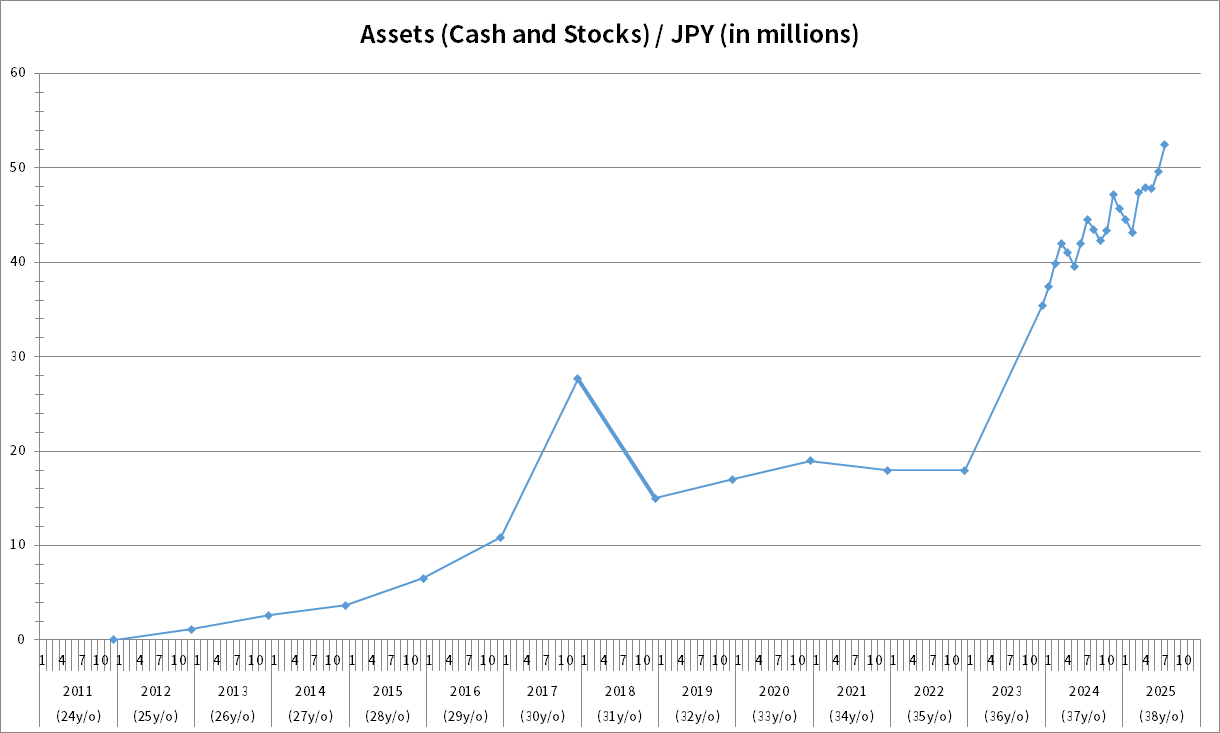

The chart below shows the change in my assets. The rightmost point indicates my assets at the end of July 2025, which totaled 52.46 million yen (approximately $0.362 million).

The month-over-month change in assets was +5.68%.

My asset allocation

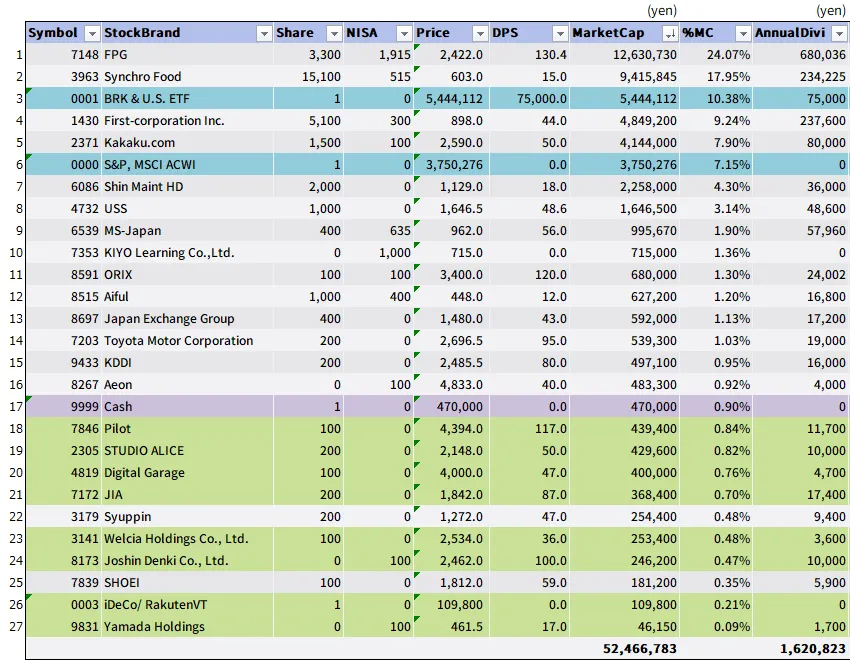

As for my assets, at the beginning of July, I owned the following assets.

- Cash

- Cash equities

- Shares held under margin accounts

Of the assets listed above, I sold all of my shares held through margin trading on July 11. The capital gains from this sale were almost zero. This is because interest on margin trading and other fees had to be paid, so after deducting those costs, there was almost no profit from the sale. However, I had already received income gains in the past, so the final profit was 605,000 yen.

In my previous post, my total assets did not reach 50 million yen because the value of my margin trading was negative. However, this time, I do not need to calculate the margin trading portion, so the market value shown in the table below is my current total asset value.

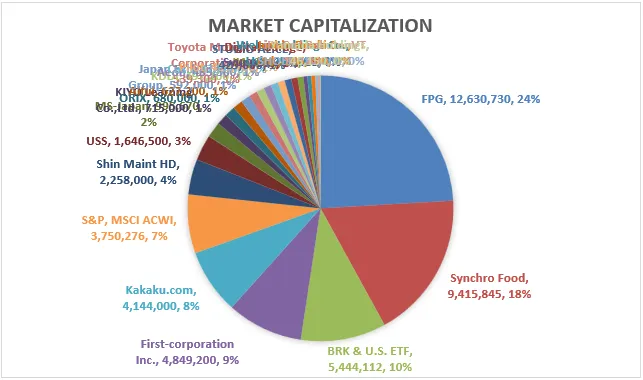

In other words, the total market value, including cash, is 52,466,783 yen.

For the meaning of each column in the asset table, please refer to the article “June 2025 Results [Asset Trends Disclosure].”

Stocks and mutual funds purchased in July

I use the automatic savings service offered by a securities company to purchase mutual funds every month. The products I purchase are mutual funds linked to the ‘S&P 500’ index and mutual funds linked to the ‘MSCI All Country World Index (ACWI)’. I invest 50,000 yen each month in each fund, totaling 100,000 yen per month. These are mutual funds that automatically reinvest dividends, so while I don't receive dividend payments, they efficiently manage my assets.

The row labeled “S&P, MSCI ACWI” in my asset statement represents the total value of the mutual funds I invest in on a monthly basis. Since I manage all my mutual funds in a single row, the ‘Share’ column is set to “1,” and I only track the total market value.

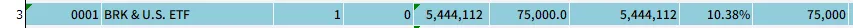

In addition, I am purchasing one share of Berkshire Hathaway Inc. (BRK-B) each month through spot purchases. Although the stock price has been sluggish recently, I believe it will rise in the future and plan to continue purchasing it every month.

The line labeled “BRK & U.S. ETF” in the asset statement includes the value of the shares I own of BRK-B. This line also includes assets from other U.S. ETFs.I manage them in a single row because the securities company's website displays market capitalization under the “U.S. Stocks” category, and checking each stock's market value individually would be time-consuming.

In my case, I only invest in three types of US stocks: BRK-B, ETFs, and mutual funds. I don't think it's necessary to manage the number of shares in detail, so I've summarized them in one line. Currently, I'm not experiencing any particular problems, so I plan to continue with this management method in the future.

In my next post, I will explain what “U.S. ETF” I am purchasing.

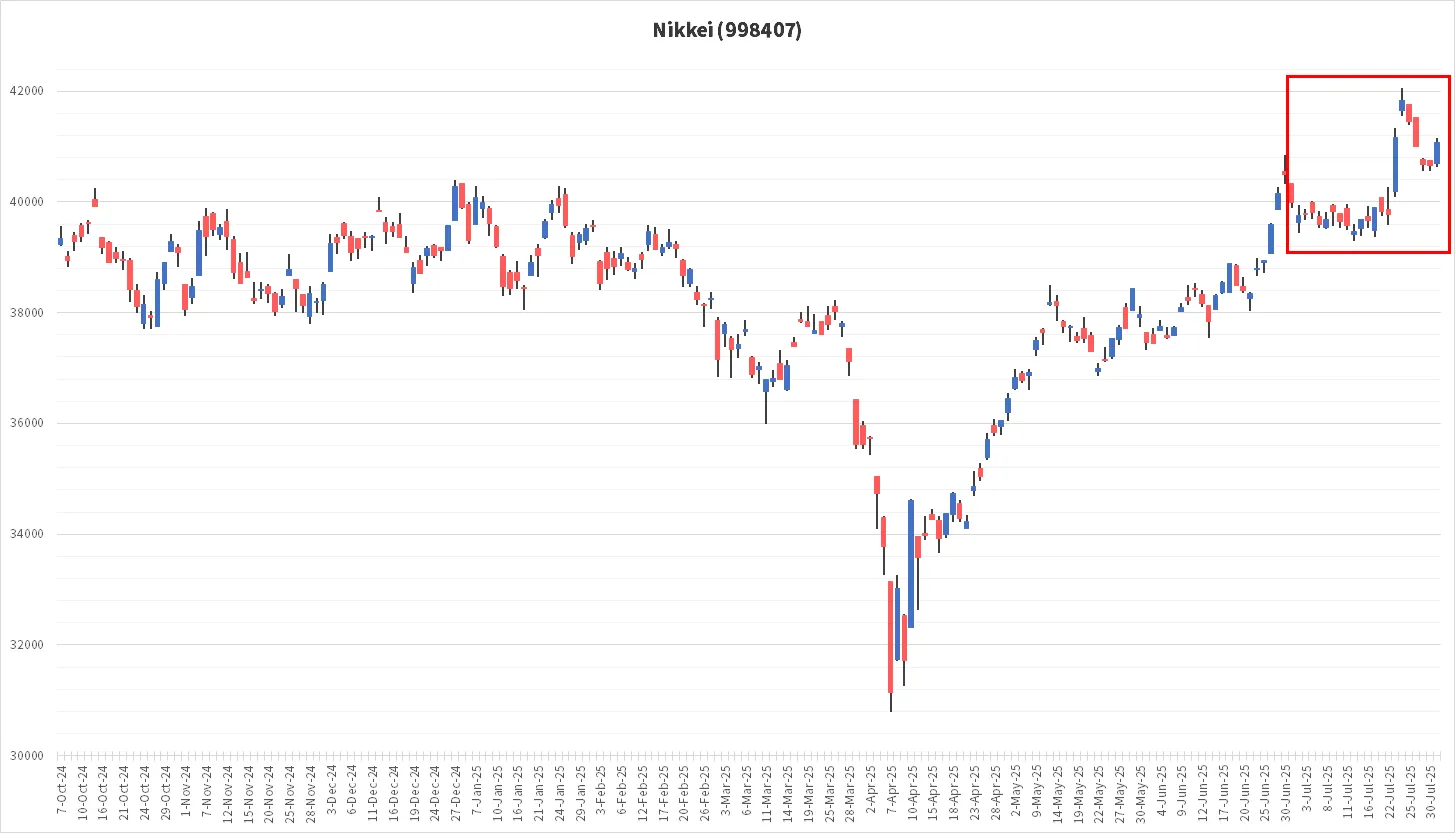

The Nikkei 225 rose significantly at the end of the month.

The Nikkei 225 remained largely unchanged in the first half of July, but rose following the results of the House of Councillors election. In Japan, this is thought to reflect expectations that the incompetent Prime Minister Ishiba will be forced to resign following the Liberal Democratic Party's crushing defeat in the election, and that Ms. Sanae Takaichi will replace him. Ms. Takaichi is a member of the Diet who shares the views of former Prime Minister Shinzo Abe.

It is unclear whether the Nikkei 225 will continue to rise, but I will not sell my current holdings and will continue to hold them.

Finally

In July, my assets exceeded 50 million yen, reaching a new record high.

August is when many Japanese companies announce their quarterly financial results. Depending on the content of the results, some stock prices may decline, but I believe that the outstanding companies I have selected will continue to grow steadily in the long term. Therefore, I plan to remain calm and not be overly affected by the results.

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.

![June 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/06/eyecatch_126-150x150.webp)

![May 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/05/eyecatch_125-150x150.webp)

![January-April 2025 Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/05/eyecatch_124-150x150.webp)

![2024 Final Results [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2025/01/2024_results-150x150.png)