![August 2024 Result [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2024/08/eyecatch_120.webp)

Summary of investment and asset management performance for August 2024.

This article calculates the exchange rate at "$0.00690/yen" (145 yen/$).

The sales and other figures used in this article are current as of the time of writing. Depending on your viewing period, the figures may have changed significantly.

Table of Contents(目次)

August 2024 Result

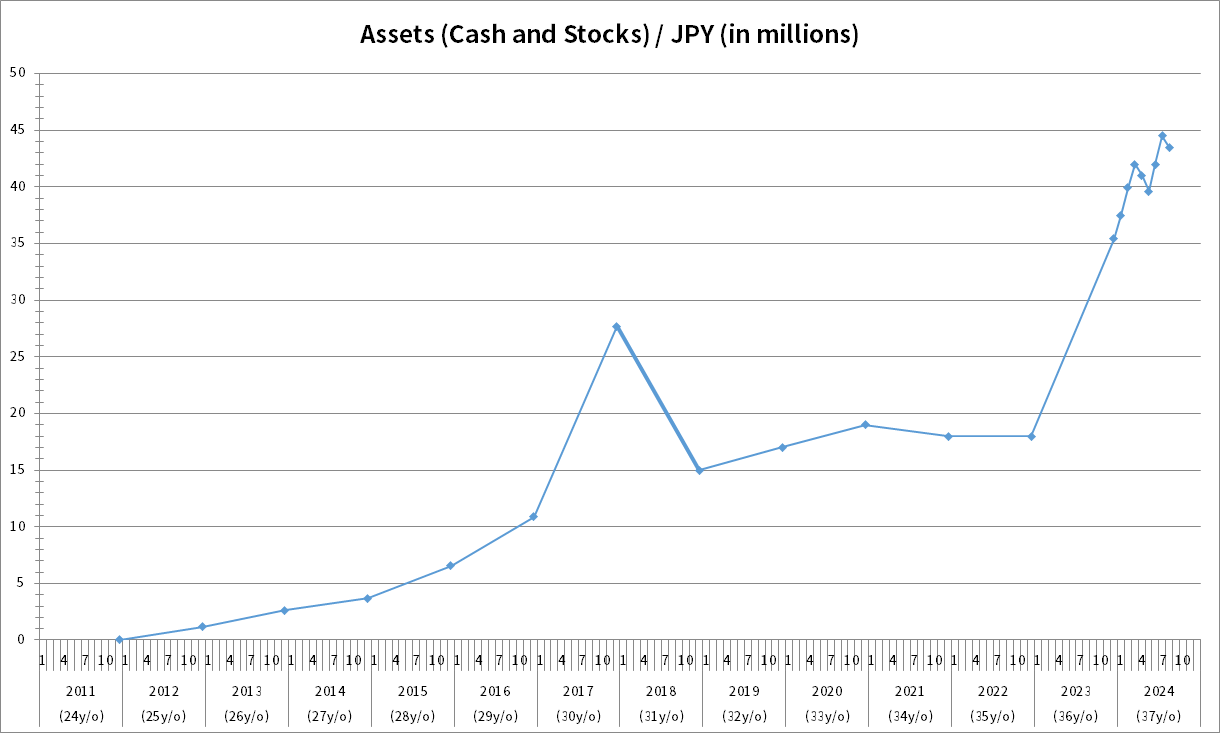

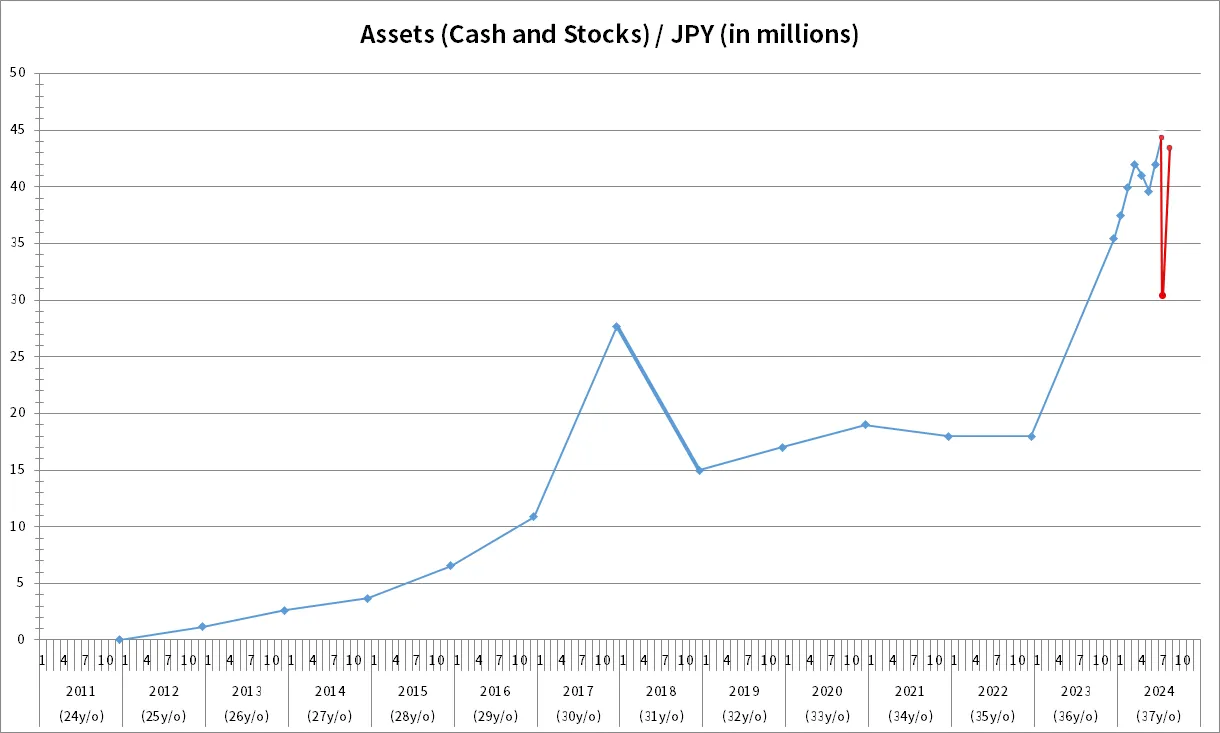

The chart below shows the change in my assets. The rightmost point on the chart is the amount of assets at the end of August 2024, which is 43.5 million yen (about $0.3 million). The month-over-month change in assets was -2.09%.

Looking only at the results of this asset transition, it would appear that the stock price has fallen mildly and slightly. But that is not the case…

Nikkei 225 has crashed.

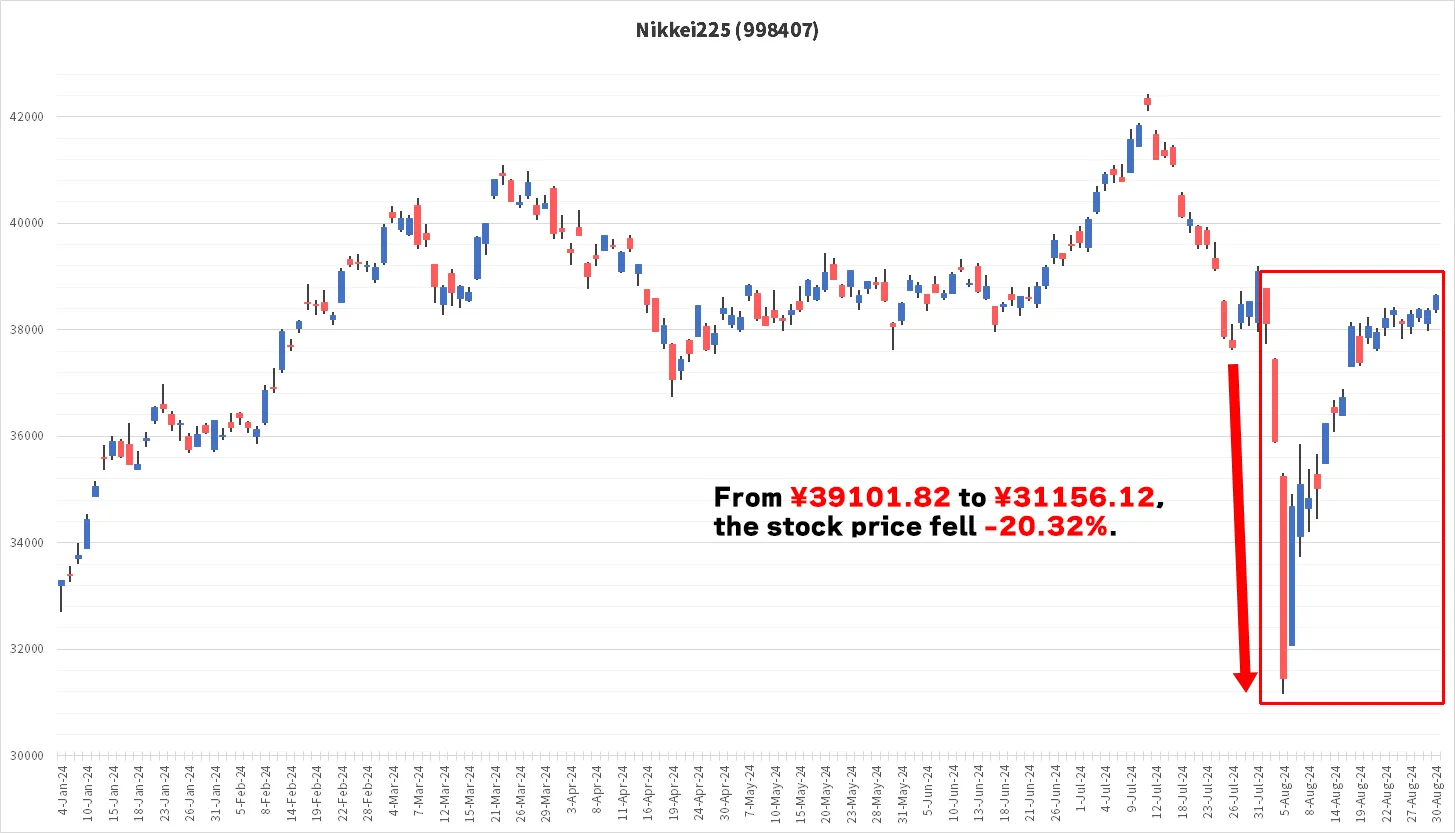

The Nikkei 225 fell sharply from August 1 to August 5 (three business days) following reports that the Bank of Japan would raise interest rates. The Nikkei 225, which had closed at 39101.82 yen at the end of July, crashed to 31156.12 yen (-20.32%) in just three business days.

On Monday, August 5, the Nikkei 225 index set a record, exceeding the Black Monday. On Black Monday, the Nikkei Stock Average was down -3,836 yen, but on Monday, August 5, it was down -4,451 yen.

Following the largest stock price decline on record, some investors sold their shares. However, from the next business day, Tuesday, August 6, the stock price rose sharply. At the end of August, the stock closed at 38647.75 yen, a difference of only -1.16% from the end of July.

Is the unwinding of the yen carry trade the cause?

The crash is said to have been caused by the unwinding of the yen carry trade. Investors who expected the Bank of Japan to raise interest rates would move the yen against the dollar, sell dollars, and buy the Japanese yen, resulting in a significant yen appreciation. The Nikkei 225 fell in line with the appreciation of the yen. However, the BOJ's interest rate this time was about 25 bps (0.25%), and this level was considered to be a limited factor in the appreciation of the yen and not a major negative for Japanese companies, resulting in calmness in the exchange rate and the Nikkei 225.

A brief and easy-to-understand video explaining the yen carry trade was uploaded, so I will share it with you. (This video was not created by me.)

Changes in the valuation of my stock holdings

The most significant drop in my assets was the closing price on Monday, August 5. On that day, my assets fell to 30.15 million yen. Compared to my holdings of 35.4 million yen at the end of 2023, this is -5.24 million yen (-14.8%). Compared to my assets of 44 million yen at one time, this is -13.84 million yen (-31.45%).

I held out without selling my holdings and prayed that the stock price would not fall further. In truth, it would have been in my best interest to purchase additional shares during these crashes. Still, unfortunately, I was unable to do so because the majority of my assets were in equities, and I had no cash.

Finally

Whenever I see a stock market crash, I negatively feel that I may not be suited for stock trading.

However, I still feel that I am becoming more tolerant each time I experience a crash. I can ensure that I do not sell stocks quickly and that even if stocks temporarily crash, I hope they will return to normal over time and not give up.

Still, let me say this one last thing. "If it's going to rise, don't let it drop."

The information on this website is not intended as a solicitation to invest or as investment advice. It is not intended to suggest or guarantee future trends in stock value, nor is it a recommendation to buy or sell. Investment decisions should be made at the user's discretion. While every effort has been made to ensure the accuracy of the information contained in this website, the website administrator assumes no responsibility for any errors in the information, problems caused by downloading data, or any other losses incurred as a result of trading in stocks or other securities.

![July 2024 Result [Asset Trends Disclosure]](https://financial-textbook.com/wp-content/uploads/2024/08/eyecatch_096-150x150.webp)